Built by IIT graduates, this free business accounting application and software has about 5.5M MSME end users

4 min readIf the COVID-19 pandemic and the lockdown has taught Indian MSMEs anything, it is that electronic, contactless payments are below to keep. And this is followed by the have to have to document and account financial transactions digitally.

Bengaluru-based startup OkCredit’s founders might not have predicted the pandemic back in 2017, but they had been inclined to spot their religion in constructing cellular-dependent digital accounting options for MSMEs.

Routinely interacting with local grocery retailers, IIT Kanpur graduates Harsh Pokharna, Gaurav Kumar, and Aditya Prasad seen shopkeepers would do most of their accounting on paper. Tallying took lengthy, the system was vulnerable to human error, and the modest slips of paper could be quickly misplaced.

This led them to start OkCredit — a absolutely free, electronic-centered credit history stability recording resolution for little small business entrepreneurs — in 2017.

Harsh Pokharna, Co-founder and CEO, OkCredit, says:

“We provide a uncomplicated and secured digital accounting app for small enterprise proprietors in 13 regional languages. We also included a new voice note attribute for the advantage of end users to document their transactions.”

Severe Pokharna, Cofounder and CEO, OkCredit

Product choices

OkCredit not long ago released OkShop — an on the net retail outlet for little merchants — who can display screen their merchandise and offers and get to out to customers. It has also constructed OkStaff — a workers and payroll management application for larger sized firms that hire a workforce.

Harsh claims OkCredit’s USP is that its merchandise are basic, safe, and technologically innovative. They run on a basic smartphone and aid automate enterprise transactions of merchants with clients and wholesalers.

“Currently, we are at a pre-profits phase. Our target proper now is to make MSMEs educated on the simplicity of digital accounting and making them comfortable with the technology and aid them expand their company,” he suggests.

OkCredit, which has elevated just about $84 million, statements to witness in excess of three million every day transactions on the system. It has 5.5 million active users and saw transactions truly worth $7.5 billion recorded in Oct 2020.

“By offering a self-serving onboarding experience, we obtain and activate end users digitally. The product is very simple to use, and the new options that aid them to improve their money flows and income assistance us to retain and interact them,” claims Severe.

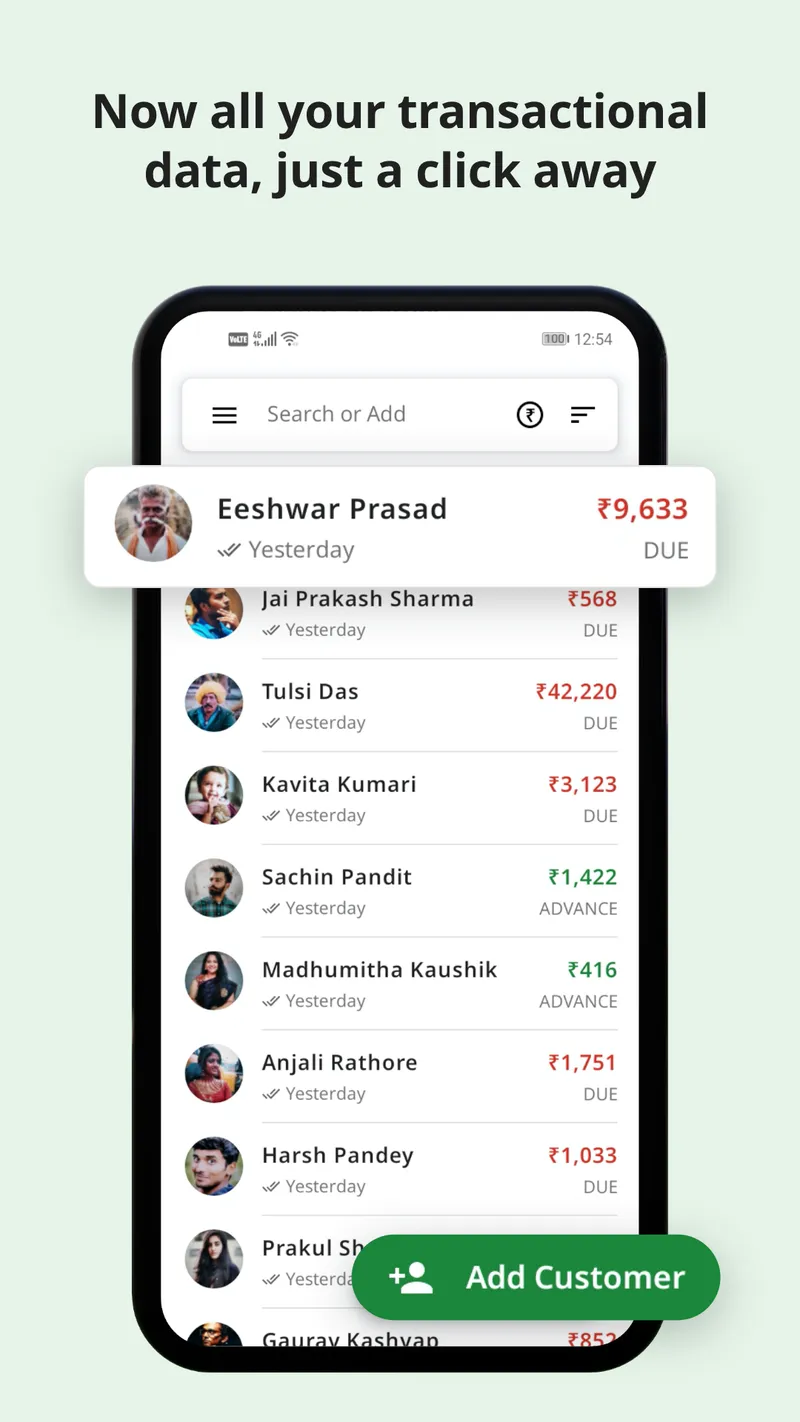

A snapshot of the OkCredit app

Difficulties of fixing for MSMEs

Operating with MSME shoppers is an uphill battle, and problems are prevalent, specifically in the electronic bookkeeping sector.

Corporations like OkCredit deal with the job of switching customers’ mindsets from standard e book-trying to keep behaviors to adopt technology and digital platforms.

“There is a lower engineering literacy amount, which helps make it complicated for MSMEs to understand the benefits of these kinds of an app, and most of them have not made use of any these types of apps for small business prior to,” claims Harsh. “There is also diversity in the consumer foundation throughout categories, and merchants, as very well as wholesalers, use OkCredit,” he provides.

He clarifies his team is surmounting these challenges by making the electronic bookkeeping working experience as user-pleasant and productive as feasible.

It is an open mystery that the key to obtaining MSME customers at scale lies in the simplicity of the merchandise, and OkCredit is not by yourself in this sport.

Startups these kinds of as Vyapar and KhataBook have manufactured substantial in-roads in creating basic accounting computer software for small businesses. Established gamers such as Tally, Intuit, and Zoho have also been in the activity for some time now, and are all vying for an $85 billion over-all option for digitising Indian MSMEs.

Harsh maintains OkCredit is distinguishing alone by means of its intuitive and secure platform, and credit score-monitoring and payment reminder characteristics.

COVID-19 influence

The well timed payment reminder is specifically useful for MSMEs in the present circumstance, wherever lenders may well be fewer keen or are unable to pay. More, through the lockdown earlier this calendar year, OkCredit noticed retailers stopping and promoting their products and solutions on credit as they knowledgeable a dip in small business and revenues.

But, as the lockdown was lifted in stages, the business saw merchants throng WhatsApp to create catalogues and interact with and promote to their consumers.

“This quickly became aspect of the new usual and promoted contactless transactions. Our retention and revival have now grown and surpassed pre-COVID amounts,” states Severe.

OkCredit now programs to increase its companies and arrive at out to MSMEs throughout India that may well not be knowledgeable of these solutions and solutions. Harsh suggests this prepare is in line with OkCredit’s corporate policy to enable the “real India” profit from digitisation. He urges far more founders and entrepreneurs to address for the electronic bookkeeping and payments phase.

“I suggest merchandise builders to concentration on a distinct segment of a organization category in solving a challenge. They ought to start out with a solitary user, and from there, operate on strategies to solve the problem in the most efficient way. They really should focus on finding to know the user’s persona and get in-depth details about a user’s everyday living,” he suggests, incorporating:

“It is crucial to understand that this market place is just opening up, and there will be a large amount of players who resolve problems and go away. The vital is to have a prolonged time period aim and fix complications sustainably.”