Financial instability: the hunt for the next market fracture

8 min read

Right after a decade of slipping curiosity rates and central financial institution largesse, global financial markets are experiencing a reckoning.

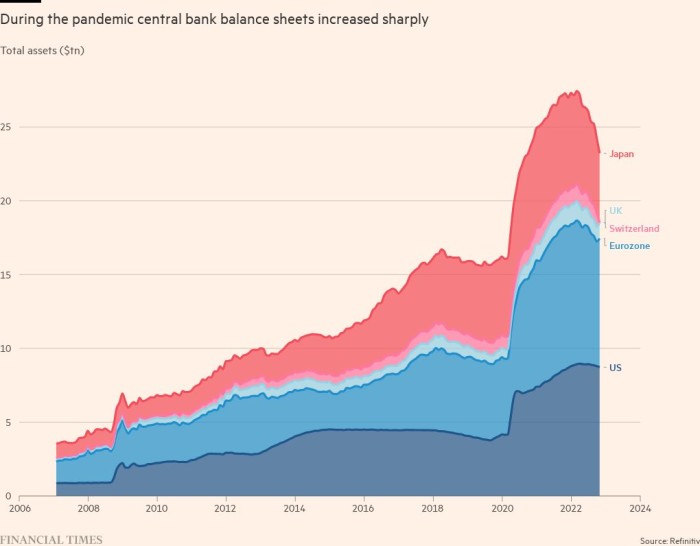

Soaring inflation is staying fulfilled by increasing desire charges, the slowing of central financial institution asset purchases and fiscal shocks, all of which are sucking liquidity, the capability to transact with no substantially relocating prices, out of markets.

Violent, sudden cost moves in one sector can provoke a vicious loop of margin phone calls and forced gross sales of other belongings, with unpredictable results.

“The sector is so illiquid and so erratic and so risky,” Elaine Stokes, a portfolio supervisor at Loomis Sayles, claimed. “It’s trading on each individual impulse and we just cannot hold undertaking that.”

Policymakers are having to pay close focus to current market plumbing and fiscal stability challenges, with the vice-chair of the Federal Reserve past thirty day period warning a “shock could direct to the amplification of vulnerabilities”.

Disparate shocks — like the closure of the nickel sector in London, structured item blow-ups, the bailout of European electrical power vendors or the speedy pensions disaster in the British isles sparked by turmoil in the country’s government credit card debt prices — are becoming scrutinised as oracles of broader dislocations to arrive.

With challenges rising, buyers are seeing some bits of the market place more closely than many others. Eric Platt

European repo marketplaces

A swift change to larger interest fees is fuelling dysfunction in Europe’s cash marketplaces, threatening to undermine attempts to tighten monetary policy.

The legacy of big-scale asset purchases, known as quantitative easing, in the eurozone and the British isles is a flood of liquidity in the variety of central financial institution reserves that have been made to get federal government bonds. These bonds had been hoovered up by the European Central Lender and Financial institution of England, leaving somewhat number of accessible to buyers.

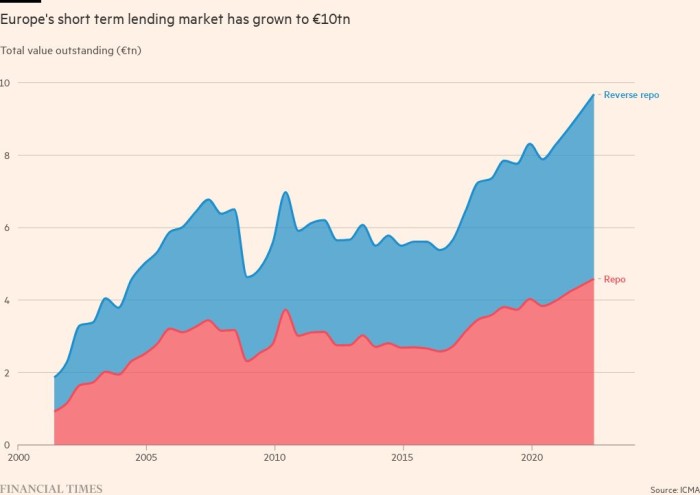

That scarcity of secure quick-time period debt could be hurting the euro area’s €10tn repo market place, the Intercontinental Cash Marketplace Association, which signifies the most important gamers in international bond marketplaces, warned previously this calendar year.

The little-followed repo sector serves as a very important lubricant in every day trading, as it permits investors to just take out a short-term cash mortgage against the assets they hold.

ICMA argued the shortage was distorting curiosity costs for prized collateral like brief-time period governing administration credit card debt, and pushing it nicely under the ECB’s deposit level, which rose to 1.5 for each cent very last thirty day period getting risen previously mentioned zero in September for the initially time in far more than a ten years.

A equivalent dynamic has gripped United kingdom markets, in which, at the get started of November, an index of right away repo markets fell beneath the Financial institution of England’s policy charge by a record total, in accordance to analysts at ING. These distortions commonly worsen at quarter and yr-close.

ICMA urged the European Central Lender to set up a reverse repo facility very similar to the just one introduced by the US Federal Reserve in 2013. That would permit the central financial institution to ease the collateral squeeze by loaning out some of the bonds it holds from its extensive asset buying programmes.

“Central financial institutions are successfully conducting a bit of an unparalleled experiment by hiking fees when liquidity in the system is at these higher stages,” said Antoine Bouvet, an desire prices strategist at ING. Tommy Stubbington

US Treasury industry illiquidity

Liquidity has long been the hallmark of the US Treasury market place. But it has dried up as the Federal Reserve has ratcheted curiosity rates greater, and as important holders of Treasury financial debt these as the Fed and the Financial institution of Japan have stepped back again.

The disruption in liquidity has led some investors to dilemma the total wellbeing of the sector. Any crisis in the Treasury marketplace would have far-reaching penalties, because Treasury yields ascertain everything from mortgage prices to the cost for the US authorities to borrow. It is the spine of the world wide financial system and the benchmark for all other US belongings, so huge swings in selling price would ricochet across markets.

On top rated of the uncertainty and volatility in the market this year that has created Treasuries more durable to trade, cautious investors also argue that the liquidity difficulties are the result of longstanding structural issues. Some have often existed, but have been accentuated as the Treasury market has developed in dimension. And some have emerged as rules pursuing the 2007-09 monetary disaster — which compelled banking institutions to have more substantial cash cushions — have built it a lot more costly for them to maintain Treasury credit card debt. Because then, these banking companies, regular suppliers of liquidity, have retreated from the sector.

This usually means that in the event of a disaster, structural complications may exacerbate any sell-off, as was observed in March 2020. But the current liquidity issues in the Treasury market place also imply it might not choose an function as disruptive as the onset of a global pandemic to spark a significant offer-off. If some mis-stage prompted a sprint for hard cash, investors could have issues promoting Treasuries, main to massive swings in selling prices, generating significant adequate gaps in price ranges to guide to forced selling. Kate Duguid

Dysfunction in Japanese govt personal debt

For many months now, as the Bank of Japan has been forced to do the job ever tougher to maintain interest rates on the benchmark 10-12 months bond shut to zero underneath its “yield curve control” plan, speculation has mounted on regardless of whether markets would ultimately drive the central bank’s governor, Haruhiko Kuroda, to again down and loosen the coverage.

Japanese fees analysts and BoJ watchers have a tendency to consider he will not foreign cash and traders imagine that he might.

Logically, say analysts, the BoJ will be exceptionally cautious about an exit from generate curve command, for the reason that of the probable for a disorderly exit to send shockwaves all around the earth.

Significant in the memory of Japanese central bankers is the 2015 experience of the Swiss Nationwide Lender, which out of the blue lifted its ceiling on the franc, ensuing in a huge impact on global markets.

Switzerland, as opposed to Japan, is smaller and the disruption that would be caused by a very similar capitulation would be massive. Domestic shares would plunge, with the ripple result from a Japanese equity crash turning worldwide funds into pressured sellers.

Deutsche Financial institution economist Kentaro Koyama pointed out that in the minutes of the BoJ’s September financial plan assembly, 1 board member experienced spoken up about the increasing dysfunction of the bond markets.

“We take into account it an vital stage to a recognition among board users of the flailing operation of the markets,” said Koyama. Leo Lewis

Trapped in credit rating

For many years, corporate bond and financial loan traders warned about the dangers of exchange traded funds in a disaster, elevating concerns around how the well-known automobiles would cope with significant redemptions in a sell-off.

But now, as the sizing of both the non-public credit history and leveraged bank loan marketplaces have exploded more than the past number of years, ETFs are witnessed a fewer of a menace. Instead, concentrate has shifted to mutual funds and other cars that have been hoovering up the latest surge of risky personal debt.

The Fed and IMF have both wrung the alarm bell above the problem. In a worst-scenario state of affairs, a fund suffering substantial outflows as bond or personal loan price ranges drop will have to halt redemptions, trapping capital and perhaps leading to an unwinding of the fund. Buyers nervous about a potential issue will most likely head for the exit early, building issues even worse for these who hold out behind.

The actuality that spillovers were being viewed in significant-quality areas of the US credit score sector when pension resources in the British isles ended up hit with margin calls has intensified worries, given so a lot of traders have piled into illiquid bonds and financial loans.

The increase of personal credit rating has also opened the doorway to new troubles, with policymakers and regulators warning they have minor insight into the cottage market. These debts are traded significantly less commonly — if at all — and are not marked continuously by lenders. Even with the personal debt sitting in cash that involve more time money commitments, it is unclear how endowments and pensions could possibly attempt to promote their stakes in a disaster. The secondary market place is however nascent, albeit escalating.

“We will see a breakdown in private marketplaces,” Stokes at Loomis Sayles included. “Every pension and endowment has shifted into [them].” Eric Platt

Emerging industry defaults

Two hazards threaten fiscal balance for emerging market traders.

The quick anxiety is of various defaults among the reduced and middle-revenue international locations as significant fascination prices and the strong dollar make it tougher to provider greenback debts.

Credit score score agencies say 26 building nations around the world, about a third of those people with sovereign eurobonds, are at substantial danger of default, exceptionally speculative, or in default.

Even so, the publicity of traders is considerably less concerning. The 15 countries with bonds investing at distressed degrees in October built up just 6.7 for each cent of the benchmark JPMorgan EMBI sovereign eurobond index.

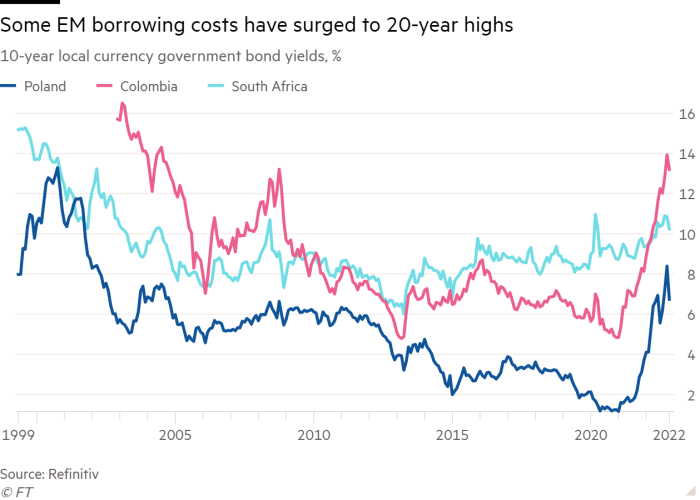

But buyers have turn out to be unwilling to fund governments of some larger emerging economies. Yields on the domestic 10-year bonds of Poland, Colombia and South Africa lately strike 20-calendar year highs. They and other issuers are being hit by soaring inflation or massive fiscal imbalances, or each. Traders worry that economies will not expand promptly plenty of for governments to halt personal debt ratios mounting out of command.

Poland’s yields peaked at 9 for each cent in October. Its ratio of govt credit card debt to gross domestic products is about 55 per cent. That looks unproblematic up coming to Brazil, exactly where equivalent yields are 12 for every cent and governing administration personal debt to GDP is close to 90 for each cent. But Brazil’s yields have been broadly stable for the previous 15 several years.

Investors are shunning Poland due to the fact its credit card debt is of quick maturity, about four decades on ordinary. But nerves about the landing level of inflation and desire premiums, assuming they fall from their present highs, could rapidly distribute.

“There is no magic threshold at which [such debts] grow to be problematic,” reported Manik Narain, rising market place strategist at UBS. “But they pressure austerity on governments and can guide to capital flight.” Jonathan Wheatley