Forensic Accounting in Cross-border Investigations

14 min readColum Bancroft, Edward Boyle and Takahiro Yamada, AlixPartners

This is an extract from the 2021 edition of GIR’s The Asia-Pacific Investigations Review. The full publication is available below.

Introduction

The recent economic climate is exceptionally demanding throughout almost all geographies and a huge variety of industries. In accordance to Earth Bank forecasts, the coronavirus will result in the global financial system contracting by 5.2 for every cent in 2020, the deepest worldwide economic downturn in decades. Progress in the Asia-Pacific region is forecast to gradual to .5 for each cent.

At present, economic stimulus is mitigating some of the financial effect of the virus. In spite of this, we have presently observed a amount of high-profile corporate failures. In this environment, accounting problems are likely to be a important compliance hazard for the foreseeable long run.

The financial environment produces added pressure on companies to hit overall performance targets and fulfill the necessities of their traders and creditors. Force to strike figures in struggling providers with weak cultures of compliance will almost inevitably final result in accounting irregularities, which, remaining unchecked, could escalate into product misstatements. Lessons from previous economic crises explain to us that, in periods of significant economic pressure, fraud is each far more common and a lot more most likely to be uncovered.

Fraud in a downturn

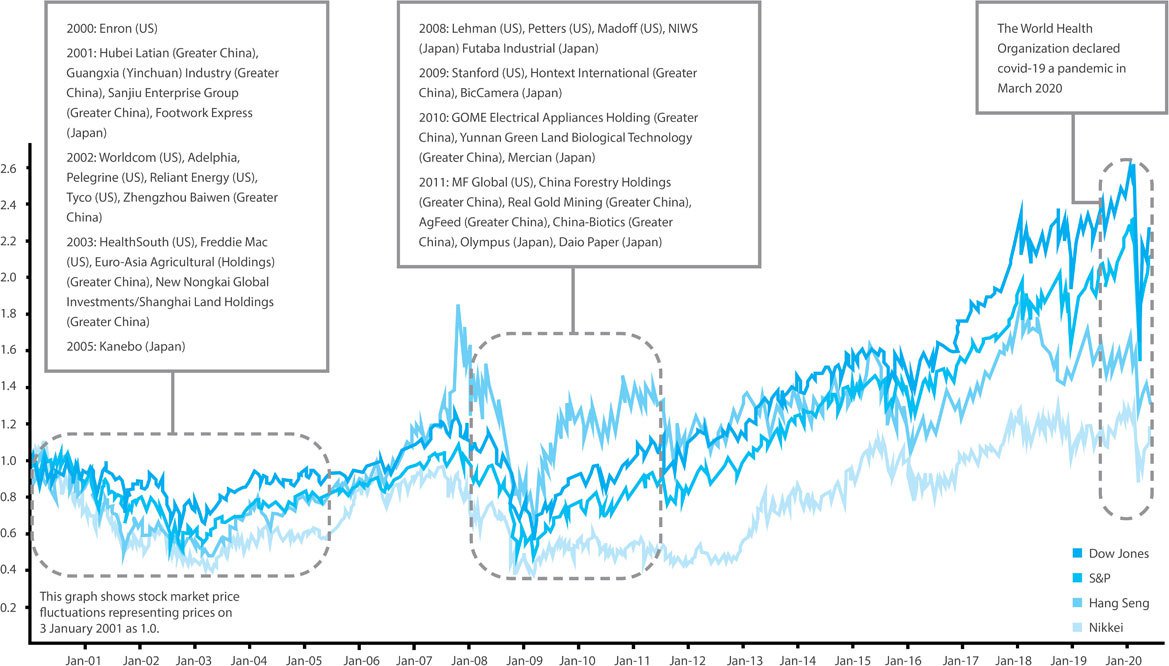

Searching at previous economic slowdowns all over the world, big fraudulent pursuits have regularly been exposed shortly following stock marketplace lows have been arrived at. As depicted in Figure 1 below, a number of major fraudulent issues were unveiled for the duration of financial downturns in the United States, Greater China and Japan.

Figure 1: Uncovering Fraud Amid Stock Marketplace Drops

Resource: AlixPartners

In specified noteworthy occasions, the price of the inventory sector or asset values more commonly can be identified as the essential factor in uncovering fraudulent things to do or accounting irregularities. The Madoff situation came to gentle immediately after investors commenced withdrawing their funds next the stock marketplace correction in 2008 in the wake of the worldwide monetary disaster. Much more just lately, the remarkable dip in oil charges in early 2020 placed unsustainable tension on Hin Leong with huge ramifications. Hin Leong’s founder Lim Oon Kuin admitted in a courtroom doc to directing the enterprise not to disclose hundreds of millions of dollars in losses. The investigation determined that the organization experienced concealed about US$800 million of losses in derivatives buying and selling around a interval of 10 decades. If oil experienced been investing at US$100 a barrel, it is doable the fraud would not have been uncovered.

In other situations, the inventory industry drop is a bellwether for financial contraction and the fraud is uncovered as companies that have been struggling are tipped in excess of the edge by decreased liquidity. Accounting fraud normally begins small to plug a gap in an underperforming organization with some ‘creative’ accounting. This can occur in a lot of kinds, but most typically requires ‘borrowing’ some revenue from the upcoming quarter. Evaluation of general public businesses in the United States shows that improper earnings recognition is deemed as the most frequently utilised fraud approach, followed by the overstatement of assets or capitalisation of expenditures. If business enterprise functionality improves and the gaps can be loaded then this may hardly ever come to mild. On the other hand, if the enterprise continues to struggle and the holes in the accounts get greater, the strain to meet up with targets and conceal previous indiscretions implies the plan escalates to the level where a company is materially misstating its economical scenario. In a downturn, extra firms are uncovered as liquidity dries up and the fraud usually will come to mild.

In this regard, as financial tension mounts, we are by now looking at accounting troubles as a important location of target and we can assume to see even more substantial-profile conditions. Managed earnings as effectively as intense and fraudulent accounting methods are most likely to be an growing reality.

How is it finished and how does it surface?

Accounting fraud consists of the manipulation of revenues and gains. Intense profits recognition procedures, though incredibly significant and might result in the prerequisite to restate prior benefits, can be thought of the slim conclude of the wedge. In the most egregious cases, revenues and revenue are completely fictitious. Such ‘profits’ build corresponding property that final result in the secondary fraud to address up the effects of the falsified earnings. This can manifest in a amount of strategies, these kinds of as falsification of money balances, inflation of asset values or falsified acquisitions.

A often applied tactic of short sellers to concern the monetary statements of goal providers is to contrast levels of financial debt with the amount of money of described funds. Inflated dollars balances can be disguised with additional concerned strategies, such as round-tripping involving undisclosed connected get-togethers. In this way, a little pool of money can be utilised to assistance the a lot higher falsified balances.

Inflation or falsification of other asset balances can be far more tough to detect if well disguised. This is intricate by the actuality that selected asset balances might be a issue of subjective accounting judgment. The valuation of house, an obtained organization, collectability of receivables are all spots that can be manipulated or falsified. These pitfalls are also heightened in times of financial uncertainty.

Asset valuations in a pandemic

Regulators’ and accounting bodies’ current publications deliver perception into most likely locations of problem relating to accounting fraud and connected difficulties.

On 3 March 2020, the Hong Kong Institute of Accredited General public Accountant issued a advice in relation to the economical reporting implications of coronavirus. In specific, the assistance asks entities to pay back very careful focus to any parts wherever estimates will need to be manufactured, which include accounting for the measurement of internet realisable benefit of inventories, the remaining valuable lifetime and residual price of assets and assessing whether or not an sign of impairment exists for non-financial belongings.

In the same way, the SEC’s Workplace of the Main Accountant issued a assertion on financial reporting in mild of covid-19, which lists accounting troubles involving significant discretion and estimation because of to the virus. The checklist of accounting challenges contains truthful price and impairment factors, income recognition, likely problem and subsequent activities. The timing of the pandemic is notably difficult when assessing asset values the World Well being Business declared a pandemic in March 2020, which is specifically the time a huge number of providers would be likely through yr-close audits.

A ideal storm for corruption

The Asia-Pacific location continues to see higher levels of activity relating to common troubles involving anti-corruption compliance. A prolonged slowdown and ongoing target on China by global regulators imply this is probable to proceed for the foreseeable future.

China has long been the concentration of investigations and enforcement activity. There are various crucial aspects that have combined to make the perfect storm for corruption in China: the significance of China for global organization, China’s long-standing corruption challenges, improved enforcement by regulatory authorities and, in current a long time, China’s slowing expansion. While China proceeds to see a huge variety of circumstances, the quantity of investigations somewhere else in the Asia-Pacific is also considerable. Increasingly, functions in South East Asia and India are attracting awareness. It is no magic formula that China has been a priority current market for multinationals and global personal equity corporations for a lot of yrs. With the sheer volume of overseas financial investment, China’s serious corruption complications have resulted in continual and significant publicity as multinationals have entered and tried out to navigate the Chinese market place.

As corruption instances turned far more frequent and noticeable, multinationals began to need anti-corruption because of diligence as element of any potential offer. Concurrently, compliance programmes progressed from a simple ethics statement to a fully fledged package of in depth guidelines and supporting procedures. This evolution resulted in a developing recognition of anti-corruption problems among the staff members. As recognition of bribery and corruption difficulties amplified, the approaches for generating and disguising corrupt payments developed as well.

There has been a standard change in corruption-relevant schemes from reasonably larger-quantity and lower-greenback worth techniques (too much foods, items and vacation), to reasonably decrease-volume and increased-dollar benefit strategies involving much more artistic, opaque methods (this kind of as enhanced use of third functions and schemes identical to individuals seen in embezzlement scenarios). A person example of this will involve the imaginative use of third-party consultants in response to bigger scrutiny of fictitious supporting documentation, whereby a sequence of distinct third-social gathering consultants are utilised around shorter periods for the same scope of do the job. A usual scenario may possibly include a marketing consultant staying hired by a company for a higher-danger scope of perform, these kinds of as interfacing with govt officers. The expert would difficulty legitimate, officially registered invoices, so an original assessment of the company’s publications and documents would current no red flags. On the other hand, the advisor would then depart following a temporary period (considerably less than a year) and be replaced by a different specialist with the exact same functionality and scope. In addition, these consultants would primarily be start-ups with no background, keep track of document or recognisable existence in the market place, highlighting the need to have for substantive owing diligence on intermediaries and 3rd functions. In these scenarios, corporations have properly tried to outsource their bribery. As a consequence, investigations and compliance programmes have had to grow in scope to ensure 3rd-party danger is currently being sufficiently dealt with.

International providers in China have place substantial work and expense into setting up compliance and fraud-avoidance programmes, but as the external pressures raise, additional will need to have to be carried out to remain ahead of a fast evolving risk and danger natural environment. Companies require to reassess the usefulness of their programmes to weather conditions the coming storm. As political tensions among the United States and China carry on to mount, a lot of the media protection has targeted on world wide provide chains and multinationals seeking to relocate functions outside the house China or accelerating the adoption of a ‘China as well as one strategy’ exactly where firms established up a new location in reduced expense countries, to diversify their source chain and production functions. In new years there has been a marked enhance in the will need for investigations in fewer made jurisdictions, in which financial problems and compliance programmes lag at the rear of China. This has led to an raise of investigative functions in India and Indonesia, in specific.

Heightened regulatory risks because of to political rigidity

In recent several years, Chinese firms in the technological innovation sector have been subject matter to large profile regulatory actions in the United States. This craze is very likely to go on for the foreseeable upcoming. A single exciting observation is the use of diverse levers. In the circumstance of ZTE, the Division of Commerce place in place a keep track of for an unparalleled time period of 10 years in response to the firm allegedly providing phony data relating to disciplinary steps taken against staff as portion of its unique settlement settlement for sanctions violations. In contrast, Huawei is issue to the US Commerce Department’s Entity Listing, which prohibits suppliers from providing selected technologies or program to Huawei. In July 2020, the United kingdom government declared that it would ban Huawei’s machines from the country’s large-pace wi-fi community.

With the passing of the Hong Kong Autonomy Act in July 2020 and sanctions versus political leaders in Hong Kong, it is crystal clear that the United States is eager to use sanctions as and when relations among the United States and China deteriorate. The scale and scope of the sanctions against company entities stays to be viewed but companies working in the region will want to perform a comprehensive threat evaluation of their prospective exposure.

Distant knowledge collections and investigations

At a time when monetary and regulatory hazard is at its most acute, investigations have been forced on the web as lockdowns, social distancing, quarantine guidelines and teleworking have become the new standard. Investigators have to have to adapt to the modifying natural environment and adopt modern techniques for data collection. It is now probable to conduct investigations solely remotely, such as attaining obtain to accounting and other company units, imaging of laptops and mobile units and conducting witness interviews by movie contact.

Details imaging of laptops and desktops can be coordinated logistically whereby investigators ship an encrypted difficult push made up of the imaging instruments to the custodian or clients’ IT office and set up for an on the internet online video assembly to ask for remote access and command over that procedure for imaging. Similarly, the custodian can also ship the Personal computer immediately to the investigators for imaging with consent from the customer and counsel.

In advance of undertaking any assortment effort and hard work, it is essential to have an understanding of how the e mail system platform is deployed. Emails can be immediately downloaded from cloud-primarily based e mail devices this kind of as Microsoft O365 that remove transfer time and bodily media shipment. Email methods deployed on premises typically will require support from client IT experts as remote accessibility is difficult for investigators.

As for cell products, the course of action of details collection is additional difficult, so distant cellular machine collections are not proposed. Under particular circumstances, these types of as social distancing and border closures, the help of custodians may well be requested to have distant management of the laptop or computer that is linked to the cell machine. In the worst circumstance circumstance, these kinds of as failure on remote imaging, the device could be delivered to the investigators for imaging beneath the advice of the lawful counsel and with the consent of the custodian.

Know-how-assisted review

With functional restrictions on the potential of for investigators to conduct on-web-site perform, the worth of utilizing technological know-how to the successful conduct of an investigation is a lot more important than ever.

Technological know-how-assisted critique (TAR) – utilizing device learning as element of the document evaluate process – has been acknowledged by courts in the United States and Europe for some time. The just take-up in Asia-Pacific countries has been slower but has been attaining level of popularity owing to will increase in facts volumes and broader acceptance of the technological know-how by forward-wondering regulation corporations.

The newest TAR software package has a amount of various features that can assist the overview process. Ordinarily, the process consists of taking a set of reviewed seed documents from which the software program will look for common components and implement predictive coding to the remaining overview populace. This is then refined and validated through an iterative procedure till the program determines that the remaining files do not will need to be reviewed or, technically talking, that the likelihood that the relevance of any doc that has not been reviewed (by a human) is outside the house predetermined statistical parameters.

Critically, for investigations, in the Asia-Pacific area, the technological innovation has demonstrated its efficacy when dealing with Asian languages. But, the issue all over this technological know-how is the perception that equipment finding out is a black box process. Investigators who are not familiar with the know-how can be unwilling to go absent from tried using and dependable methodologies, as the technological know-how used for traditional linear critique has been in use for some time and is broadly understood. A established of search terms can be agreed at the outset centered on identified troubles and a evaluate population is discovered. From that position the progress of the assessment is reasonably predictable. The evaluation plan is clear-cut and uncomplicated to converse to stakeholders, such as regulators.

Due to the fact of the troubles outlined above, a hybrid technique can be an helpful way to defensibly speed up the progress of an investigation. First of all, the TAR software package can be made use of as section of an early scenario assessment. The info visualisation functions swiftly help investigators get an in general being familiar with of the knowledge set and determine if there are any gaps in the data. For the evaluate stage, the research conditions can then be used to the critique population as in a linear evaluation. TAR is then utilised not to predictively code, but to prioritise the overview dependent on the outcomes of an original critique of the seed established of documents. The edge of this technique is that the equipment mastering will support to establish probably pertinent documents and drive them up the review queue, that means previously identification of critical files. When compared with a linear assessment there is no downside, as the prioritisation can be managed at minimum incremental charge and is probable to direct to efficiency price savings total. This is specially handy when there are parallel workstreams such as witness interviews and examination of structured knowledge. Early identification can let the investigation to promptly house in on the vital troubles.

Combining insights from multiple sources of info

Just one of the most time-consuming and, therefore, pricey features of an investigation is figuring out hyperlinks and evaluation amongst distinct details sets, particularly in between unstructured data (eg, invoices, lender statements, emails, chat messages, and so forth) and structured details (generally transactional information). An email may possibly refer to the payment of an bill, and the investigator then has to discover the payment in the structured info in a distinct technique (or systems) by reference to the day or the bill quantity. This can be specifically time-consuming, especially in the context of investigations the place the list of suspect transactions could be voluminous, these as AML, corruption or accounting fraud investigations.

New instruments are now available that can not only home structured and unstructured info in the identical review system, but also mechanically make links between the two facts sets. In apply, this usually means a reviewer can look at the contents of an email discussing a transaction and the precise linked transaction information with a handful of clicks. This can support to quickly validate results as nicely as root out untrue positives, specifically by filtering out emails that on 1st evaluate may well look to incorporate challenges, but are in fact benign. The expanding complexity and sophistication of the troubles confronted by forensic investigators implies investigators have to equip them selves with the ideal accessible tools to uncover the problems in an efficient and price-helpful fashion.

Capturing communications

The evolution of channels of conversation and blurring of the traces concerning organization and private communications implies relevant facts can sit on numerous equipment with many applications on each individual unit. Capturing, processing and internet hosting e-mail and other electronic facts has been common practice for a amount of decades but is no lengthier enough. The use of messaging programs for company as nicely as social conversation is now commonplace. For occasion, the once-a-year WeChat report issued by Tencent described that 87.7 for each cent of surveyed respondents use WeChat for function in 2017 and the energetic accounts of WeChat amounted to 1.2 billion as of 2020 Q1, all of which equates to a major volume of organization discussions going on off electronic mail. Crucially these get the job done-linked conversations manifest no matter of whether or not the machine is issued by the company or is owned by the worker.

Conversations on messaging purposes can be incredibly worthwhile evidence precisely for the reason that negative actors are usually now nicely aware that their company e-mail can be very easily accessed and reviewed. In most situations, custodians are likely to be significantly less careful when communicating over messaging purposes, and this sort of communications can be critical to corroborating results and insights from investigation into the fiscal data.

Conclusion

Covid-19 is initially and foremost a humanitarian disaster. We are now starting up to see some of the financial impression of the measures put in spot to command the distribute of the virus. On the lookout at previous downturns, fraudulent activity was uncovered soon right after the stock market’s very low details. We can be expecting to see extra main situations surface as economic and regulatory strain create and frauds and corruption schemes are uncovered.

Investigations are far more tough in a remote functioning surroundings with vacation at this time mostly impractical. With these restrictions, owning the appropriate engineering to access and derive insights from ever expanding volumes of information is extra essential than at any time to the prosperous and productive resolution of the investigation.

Subscribe listed here for associated written content, breaking information and current market examination from World wide Investigations Evaluate.

International Investigations Evaluation provides unique news and evaluation and other thought-provoking information for those who specialise in investigating and resolving suspected company wrongdoing.