Form 10-K TEMIR CORP. For: Aug 31

140 min readGet instant alerts when news breaks on your stocks. Claim your 1-week free trial to StreetInsider Premium here.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended AUGUST 31, 2020

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________

to ___________

COMMISSION

FILE NO. 333-213996

TEMIR CORP.

(Exact name of registrant as specified in

its charter)

Nevada

(State or Other Jurisdiction of Incorporation

or Organization)

| 98-1321204 | 7999 | |

| IRS Employer Identification Number | Primary Standard Industrial Classification Code Number |

Temir Corp.

Suite 1802-03, 18th Floor,

Strand 50, 50 Bonham Strand, Sheung Wan, Hong Kong

Tel. 852-28527388

(Address and telephone number of registrant’s

executive office)

Securities registered pursuant to Section

12(b) of the Act: None

Securities registered pursuant to Section

12(g) of the Act: None

Indicate by check mark whether the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

No ☒

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark if disclosure of

delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K. Yes ☐ No ☒

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the

Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act) Yes ☐

No ☒

As of December 12, 2020, the registrant

had 6,692,182 shares of common stock issued and outstanding. No market value has been computed based upon the fact that no active

trading market has been established as of December 12, 2020.

Table Of Contents

PART I

ITEM 1. DESCRIPTION OF BUSINESS

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking

statements. These statements relate to future events or our future financial performance. These statements often can be identified

by the use of terms such as “may,” “will,” “expect,” “believe,” “anticipate,”

“estimate,” “approximate” or “continue,” or the negative thereof. We intend that such forward-looking

statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such

forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best

judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important

factors beyond our control that could cause actual results and events to differ materially from historical results of operations

and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking

statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated

events.

As used in this annual report, the terms “we”, “us”,

“our”, “Temir”, “the Company”, mean TEMIR CORP., unless otherwise indicated.

All dollar amounts refer to US dollars unless otherwise indicated.

DESCRIPTION OF BUSINESS

Our Corporate History and Background

Our Temir Business

The Company was a travel agency that organized

individual and group tours in Kyrgyzstan, such as cultural, recreational, sport, business ecotours and other travel tours. Services

and products provided by our Company included custom packages according to the client’s specifications. We developed and

offered our own tours in Kyrgyzstan as well as third-party suppliers.

While we are retaining our Temir business,

our primary business has changed, with the acquisition of JTI Financial Services Group Limited (“JTI”) on April 2,

2020.

Reverse Acquisition of JTI

On

April 2, 2020, the Company as purchaser and the Vendor entered into the Agreement with respect to the acquisition of the entire

issued share capital of JTI for a consideration of $4,686,272, which will be satisfied by the allotment and issue of the shares

of the Company. Mr. Roy Chan, an executive director and president of the Company, was holding 50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} shareholding in the Vendor prior

to the Transaction. The remaining 50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} equity interest in the Vendor is held by the father of Mr. Roy Chan.

Under the terms and conditions of the Agreement,

the Company offered, sold and issued 1,874,508 shares of common stock of the Company as Consideration Shares at the issue

price of $2.5 per Consideration Share for the acquisition of all the issued share capital of JTI (the “Transaction”).

On

April 29, 2020, the Company as purchaser and the Vendor entered into the Amendment to the Agreement. Pursuant to the Amendment,

the parties have agreed to extend the Long Stop Date (as defined in the Agreement) to June 30, 2020 or such later date as may be

agreed between the Vendor and the Company.

On

June 30, 2020, the Company as purchaser and the Vendor entered into the Second Amendment to the Agreement and the Amendment. Pursuant

to the Second Amendment, the parties have agreed to further extend the Long Stop Date (as defined in the Agreement) to July 31,

2020 or such later date as may be agreed between the Vendor and the Company.

On

June 30, 2020, the Company as purchaser and the Vendor entered into the Third Amendment to the Agreement, the Amendment and the

Second Amendment. Pursuant to the Third Amendment, the parties have agreed to adjust (i) the consideration of the Transaction

from US$4,686,272 to US$10,295,455; and (ii) the number of Consideration Shares from 1,874,508 shares to 4,118,182 Consideration

Shares. Save as disclosed above, all the other terms in the Agreement remain unchanged and in full force and effect. The effect

of the issuance is that the Vendor will hold approximately 61.54{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the issued and outstanding shares of common stock of the Company.

The revised consideration has been determined

and agreed between the parties on an arm’s length basis based on the potential growth of JTI and after taking into account

the market conditions, and the Board considers that the entering into of the Third Amendment is fair and reasonable and is in the

interest of the Company and its shareholders as a whole.

Mr. Roy Chan, the founder of JTI, an executive

director and president of the Company, is the holder of 629,350 shares of common stock of the Company prior to the Transaction.

The Company’s officers and directors, Mr. Roy Chan, Mr. Mark Yip and Mr. Brian Wong, control an aggregate of 4,993,412 or

74.62{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}, of the outstanding common stock of the Company, on a fully diluted basis, after the Transaction.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Common Stock |

||||||

| Roy Kong Hoi Chan | 629,350 | 9.40 | {14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} | |||||

| Brian Hung Ngok Wong | 244,630 | 3.66 | {14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} | |||||

| Mark Ko Chiu Yip | 1,250 | 0.02 | {14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} | |||||

| Ace Vantage Investments Limited | 4,118,182 | 61.54 | {14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} | |||||

| Total | 4,993,412 | 74.62 | {14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} | |||||

Upon completion, Temir is interested in

the entire equity interest in JTI, and as such, JTI became a wholly-owned subsidiary of Temir. JTI was incorporated in Hong Kong,

China on February 8, 2019.

The principal activities of JTI are provision

of diversified financial services through its wholly owned subsidiaries incorporated in Hong Kong.

JTI Finance Limited (“JF”)

is a licensed money lender in Hong Kong, holding a money lender license no. 0991/2019 granted by the licensing court of Hong Kong.

JF offers various types of loans including but not limited to personal loan, business loan, credit card consolidation loan and

equity pledge loan to its customers. Its target customers are small and medium size corporation and retail customers with a principal

place of business in Hong Kong. Hong Kong’s lending market is dominant by the banks and money lenders which are wholly owned

by the banks. The borrowers are normally required to provide highly secured collaterals such as property for obtaining credit facility

from the banks and money lenders which are wholly owned by the banks. JF targets to provide credit facility to the borrowers who

needs operating cash flows funding but are not able to provide highly secured collaterals. Higher interest rates will be applied

to these loans and could generate higher profit margin for JF.

Concept We Mortgage Broker Limited (“CW”)

is one of the active mortgage brokers in Hong Kong. CW provides up-to-date mortgage plans of numerous banks and financial institutions.

CW provides analysis and comparison on different mortgage plans offered by banks and financial institutions, assisting its customers

to choose the most suitable mortgage plan and borrowing terms based on each customer’s financial background. Its revenue

is mainly derived from the referral fee from the banks and financial institutions for the mortgage referral.

JTI Property Agency Limited (“JP”)

is a licensed property agent in Hong Kong, holding an estate agent’s license granted by Estate Agents Authority of Hong Kong.

JP maintains good business connections and reputation with the landlords of commercial properties. JP mainly provides commercial

property agency services in Hong Kong. Its revenue is mainly derived from the commission provided by the landlord for facilitating

the sales or lease of commercial properties.

JTI Asset Management Limited (“JA”)

is a consultancy services company. After the completion of the Agreement, JA is planning to apply for fund management licenses

in Hong Kong or in other jurisdiction, aiming to provide fund management services globally.

Listing Status

Temir Corp. has been approved to upgrade

its common shares from the Pink® Open Market to the OTCQB® Venture Market under the trading system

“TMRR”, effective September 8, 2020.

Revenue and Business Model

JTI’s revenue is mainly derived from

interest income, commission, referral fee and advisory services fee. JTI only charges fees to clients on a successfully basis.

| 1. | Property agency fee is from 2.5{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} to 3{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} on the gross value of the transactions; |

| 2. | Mortgage referral fee is from 0.1{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} to 4{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} on the gross value of the transactions; |

| 3. | Consultancy advisory services fee is determined on case by case basis with a minimum fee of US$10,000 per contract: and |

| 4. | The interest rate of the money lending business from 0.001{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} to 2.2{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} monthly flat rate, depending on the loan type and borrowers’ credibility. |

Government Regulation and Approvals

JTI is subject to a number of local laws

and regulations that involve matters such as money lending, estate agency, privacy, rights of publicity, data protection, content

regulation, intellectual property, competition, protection of minors, consumer protection, taxation or other subjects. Many of

these laws and regulations are still evolving and being tested in courts and could be interpreted in ways that could harm our business.

In addition, the application and interpretation of these laws and regulations often are uncertain, particularly in the new and

rapidly evolving industry in which we operate.

Intellectual Property

JF owns a trademark which is registered

under the intellectual property department of the government of Hong Kong SAR. The trademark number is 302036853 and the expiry

date is September 20, 2021. The details of trademark shown as below:

It is believed to be of material importance

in the operation of JF’s operation. JTI believes that no single patent, license, or trademark is material in relation to

JTI’s business as a whole.

Employees

We have 5 full-time employees as of August 31, 2020.

DESCRIPTION OF PROPERTIES

Our principal office is located at Suite

1802-03, 18/F, Strand 50, 50 Bonham Strand, Sheung Wan, Hong Kong.

We do not own any real estate or other physical properties.

Item 1A. Risk Factors

The Company operates in an environment

that involves a number of risks and uncertainties. The risks and uncertainties described in this Annual Report on Form 10-K are

not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material

or are not known to us, and therefore are not mentioned herein, may impair our business operations. If any of the risks described

in this Annual Report on Form 10-K actually occur, our business, operating results and financial position could be adversely affected.

RISKS RELATING TO OUR COMPANY

Financial service industry is highly competitive in Hong

Kong.

We operate in the financial services industry

in Hong Kong, which has a large number of existing participants, making the industry highly competitive. Our results of operations

and business development are dependent on our ability to complete equity or debt financings or generate profitable return. Such

financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustment

that is able to reflect the outcome of this uncertainty.

If our estimates related to future expenditures

are erroneous or inaccurate, our business will fail and you could lose your entire investment.

Our success is dependent in part upon the

accuracy of our management’s estimates of our future cost expenditures for legal and accounting services (including those

we expect to incur as a publicly reporting company) and for administrative expenses. If such estimates are erroneous or inaccurate,

or if we encounter unforeseen costs, we may not be able to carry out our business plan, which could result in the failure of our

business and the loss of your entire investment.

If we are not able to develop our business

as anticipated, we may not be able to generate revenue or achieve profitability and you may lose your investment.

Our business prospects are difficult to

predict because of the financial service industry is highly competitive. Our primary business activities will be focused on the

relative high risk operating cash flows funding. Although we believe that our business plan has significant profit potential, we

may not attain profitable operations and our management may not succeed in realizing our business objectives. If we are not able

to develop our business as anticipated, we may not be able to generate revenue or achieve profitability and you may lose your entire

investment.

We may not be able to execute our business plan or stay in

business without additional funding.

Our ability to generate future operating

revenue depends in part on whether we can obtain necessary financing to implement our business plan. We may require additional

financing through the issuance of debt and/or equity to fund our future operation plans, and such financing may not be forthcoming.

As widely reported, the global and domestic financial markets have been extremely volatile in recent months. If such conditions

and constraints continue or if there is no investor appetite to finance our specific business, we may not be able to acquire additional

financing through credit markets or equity markets. Even if additional financing is available, it may not be available on terms

favorable to us. At this time, we have not identified or secured sources of additional financing. Our failure to secure additional

financing when it becomes required will have an adverse effect on our ability to remain in business.

Our operating subsidiaries may fail

to renew their licenses.

Our money lending business is subject to

licensing requirements under the provisions of the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong). JF, our operating

subsidiary, is a licensed money lender in Hong Kong, holding a money lender license. Money lenders licenses are granted by the

licensing court of Hong Kong and are renewable annually subject to satisfaction of all licensing conditions. The licensing court

has the discretion to suspend or revoke a license if a licensee is in breach of any licensing condition. We cannot guarantee that

the conditions or requirements which JF may be required to satisfy or meet will not change from time to time.

Our property agency business is subject

to licensing requirements under the provisions of the Estate Agents Ordinance (Chapter 511 of the Laws of Hong Kong). JP is a licensed

property agent in Hong Kong, holding an estate agent’s license granted by Estate Agents Authority of Hong Kong. The Estate

Agents Authority of Hong Kong has the discretion to suspend or revoke a license if a licensee is in breach of any licensing condition.

We cannot guarantee that the conditions or requirements which JP may be required to satisfy or meet will not change from time to

time.

In the event that our operating subsidiaries

are unable to renew their licenses in a timely manner or if the relevant authorities do not approve the application for a renewal

of their licenses, our subsidiaries may not be able to operate their business until such time as they receive new licenses, which

may have a material adverse effect on our financial condition and results of operation.

Our property agency business and mortgage

referral business are sensitive to downturns in the economy, economic uncertainty and particularly the performance of the real

estate market in Hong Kong.

CW and JP are our operating subsidiaries

that mainly provide mortgage referral services and commercial property agency services in Hong Kong. Their business and financial

performance are sensitive to the real estate market in Hong Kong. Demand for property is sensitive to downturns and uncertainty

in the global and regional economy and corresponding changes in the appetite for real estate investments and purchases. Changes

in the appetite for real estate investments and purchases are driven by various factors including, amongst others, perceived or

actual general economic conditions, employment and job market conditions, actual or perceived levels of disposable consumer income

and wealth and consumer confidence in the economy. These and other factors have, in the past, affected consumer demand for real

estate and any negative sentiment or downturn in the economy could materially and adversely affect our business, financial condition

and results of operations and also our liquidity position.

Our money lending business is exposed

to the credit risks of our customers.

The financial position and profitability

of our money lending business depends in part on our customers’ creditworthiness. Thus, we are exposed to our customers’

credit risks. There is no assurance that we will not encounter doubtful or bad debts in the future. If we experience slower payments

from our customers, it may increase our accounts receivable aging and/or our bad debts. Further, our cash flows and financial results

will be adversely affected if we experience any unexpected delay or difficulty in collections from our customers.

Our money lending business is affected

by fluctuations in interest rates and our credit position.

The interest rate risks faced by JF arise

from both the interest-bearing lending and borrowings of our money lending business. In particular, our profitability is highly

correlated with the net interest margin, being the difference between the interest rate charged to our customers and the costs

of our funding. The interest rate chargeable by JF to its customers is determined by, amongst other factors, the market demand

for loans and the prevailing competition in the industry, and is ultimately capped by the relevant provisions of the Money Lenders

Ordinance (Chapter 163 of the Laws of Hong Kong). The borrowing cost of JF is determined with reference to the overall local money

lending market conditions and our credit positions. An increase in general interest rates or a deterioration of our credit positions

will lead to increases in our funding costs.

Our money lending business may be affected

by changes in the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong).

The business operation of JF is regulated

under the Money Lenders Ordinance (Chapter 163 of the Laws of Hong Kong) and full compliance with such regulation is essential

for us to carry on our business. Notwithstanding this, the relevant regulatory authorities may from time to time amend the Money

Lenders Ordinance (Chapter 163 of the Laws of Hong Kong) or adopt new laws and regulations applicable to licensed money lenders

in Hong Kong. Our operation, financial performance and business prospects may be materially and adversely affected if we are not

able to comply with any changes and/or new requirements in applicable laws and regulations related to the money lending industry

in Hong Kong. Notably, for the mortgage loans granted by us to our customers, the interest rate for such loans shall not exceed

the maximum effective interest rate of 60{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} per annum as stipulated under the Money Lenders Ordinance (Chapter 163 of the Laws of

Hong Kong). In the event that such maximum limit for interest rate is lowered as a result of any change to the Money Lenders Ordinance

(Chapter 163 of the Laws of Hong Kong) and/or any relevant laws and regulations, thus limiting and lowering the interest rate we

can offer to our customers, our financial performance, operational results and profitability may be materially and adversely affected.

Unfavorable financial market and economic

conditions in Hong Kong, China, and elsewhere in the world could materially and adversely affect our asset management business.

JA is planning to apply for fund management

licenses in Hong Kong or in other jurisdiction, aiming to provide fund management services globally. During a market or general

economic downturn, we may derive lower revenue from our asset management business due to lower mark-to-market or fair value of

the assets that we manage. In addition, due to uncertainty or volatility in the market or in response to difficult market conditions,

our customers or prospective customers may withdraw funds from, or hesitate to allocate assets to, our asset management business

in favor of investments they perceive as offering greater opportunity or lower risk. Difficult market conditions can also materially

and adversely affect our ability to launch new products or offer new services in our asset management business, which could negatively

affect our financial performance, operational results and profitability.

The loss of the services of any key

member of management team, our Chief Executive Officer and Chairman of the Board of Directors, or our failure to timely identify

and retain competent personnel could negatively impact our ability to develop our business and sell our services.

The decision making is based on a team

of management, which consists of at least 5 directors and/or managers. The board of directors consists of 6 members. We are not

highly dependent on any manager or director for any business decisions. Our future success depends upon the continued services

of our executive officers who are developing our business, and on our ability to identify and retain competent consultants and

employees with the skills required to execute our business objectives. The loss of the services of any executive officer or director

or our failure to timely identify and retain competent personnel would have small impact our ability to develop our business and

license our brand, and have minimal effect on our financial results and impair our growth.

Our success depends on good business

relationship with clients and banks and other financial institutions.

Our success depends

on good business relationship with clients and banks and other financial institutions. Our business would be adversely affected

if:

| ● | the major banks in Hong Kong such as HSBC, Bank of China, Hang Seng Bank, suspend or terminate their mortgage business, our revenue generated from mortgage referral business will be substantially impacted; |

| ● | our major business partner, Savills (Hong Kong), has any negative impact on their business or their reputation, our revenue generated from property agency business will be affected; |

| ● | we fail to raise capital for the development of initial customer base and reputation; |

| ● | we fail to implement our business model and strategy; and |

| ● | we are not able to retain our management team who have extensive working experience in the banking and finance sectors. |

We incur costs associated with SEC reporting

compliance, which may significantly affect our financial condition.

The Company made the decision to become

an SEC “reporting company” in order to comply with applicable laws and regulations. We incur certain costs of compliance

with applicable SEC reporting rules and regulations including, but not limited to attorneys’ fees, accounting and auditing

fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately

US$100,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company

being in a position where it had very limited access to additional capital funding.

We have identified material weaknesses

in our internal control over financial reporting. If we fail to remediate the material weaknesses or maintain an effective system

of internal control over financial reporting, we may be unable to accurately report our financial results or prevent fraud, and

investor confidence and the market price of our shares may be adversely affected.

To implement Section 404 of the Sarbanes-Oxley

Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on the company’s

internal control over financial reporting in their annual reports on Form 10-K. Under current law, we are subject to the requirement

that we maintain internal controls and that management perform periodic evaluation of the effectiveness of the internal controls,

assuming our filing status remains as a smaller reporting company. A report of our management is included under Item 9A of this

Annual Report on Form 10-K. Our management has identified the following material weaknesses in our internal control over financial

reporting:

| (1) | We do not have an audit committee – While we are not obligated to have an audit committee, it is management’s view that such a committee, including a financial expert member, is an utmost important entity level control over the Company’s financial reporting. Currently, our Chief Executive Officer and directors act in the capacity of the audit committee, and do not include a member that is considered to be independent of management to provide the necessary oversight over management’s activities. | |

| (2) | We do not have adequate written policies and procedures – Due to lack of adequate written policies and procedures for accounting and financial reporting, we did not establish a formal process to close our books monthly and account for all transactions in a timely manner. | |

| (3) | We did not implement appropriate information technology controls – As at August 31, 2019, we retained copies of all financial data and material agreements; however, there is no formal procedure or evidence of normal backup of our data or off-site storage of the data in the event of theft, misplacement, or loss due to unmitigated factors. | |

| (4) | We do not have sufficient and skilled accounting personnel with an appropriate level of technical accounting knowledge and experience in the application of accounting principles generally accepted in the United States commensurate with our financial reporting requirements. |

A “material weakness” is a

deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility

that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on

a timely basis. We have taken measures and plan to continue to take measures to remedy this material weakness. However, the implementation

of these measures may not fully address the material weakness in our internal control over financial reporting. Our failure to

address any control deficiency could result in inaccuracies in our financial statements and could also impair our ability to comply

with applicable financial reporting requirements and related regulatory filings on a timely basis. Moreover, effective internal

control over financial reporting is important to prevent fraud. As a result, our business, financial condition, results of operations

and prospects, as well as the trading price of our shares, may be materially and adversely affected.

Our independent registered auditors

have expressed substantial doubt about our ability to continue as a going concern.

Our audited financial statements included

in this report include an explanatory paragraph that indicates that they were prepared assuming that we would continue as a going

concern. As of August 31, 2020, we have suffered recurring losses from operations, and records an accumulated deficit and

a working capital deficit of $695,468 and $244,186, respectively. These factors raise substantial doubts about our ability to continue

as a going concern. Our continuation as a going concern is dependent upon improving our profitability and the continuing financial

support from our shareholders or other debt or capital sources. Management believes the existing shareholders or external financing

will provide the additional cash to meet our obligations as they become due. There can be no assurance that we will be successful

in our plans described above or in attracting equity or alternative financing on acceptable terms, or if at all. These financial

statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets

and liabilities that may result in our inability to continue as a going concern.

The audit report included in this report

have been prepared by auditors whose work may not be inspected fully by the Public Company Accounting Oversight Board and, as such,

you may be deprived of the benefits of such inspection.

Our independent registered public accounting

firm that issue the audit report included in our reports filed with the SEC as auditors of companies that are traded publicly in

the United States and firms registered with the Public Company Accounting Oversight Board (United States), or the PCAOB, are required

by the laws of the United States to undergo regular inspections by the PCAOB to assess their respective compliance with the laws

of the United States and professional standards.

Many other clients of our auditors have

substantial operations within mainland China, and the PCAOB has been unable to complete inspections of the work of our auditors

without the approval of the Chinese authorities. Thus, our auditors and their audit work are not currently inspected fully by the

PCAOB. On December 7, 2018, the SEC and the PCAOB issued a joint statement highlighting continued challenges faced by the U.S.

regulation in their oversight of financial statement audits of U.S.-listed companies with significant operation in China. However,

it remains unclear what further actions the SEC and PCAOB will take to address the problem.

Inspections of other firms that the PCAOB

has conducted outside mainland China have identified deficiencies in those firms’ audit procedures and quality control procedures,

which can be addressed as part of the inspection process to improve future audit quality. The lack of PCAOB inspections in mainland

China prevents the PCAOB from regularly evaluating our auditors’ audit procedures and quality control procedures as they

relate to their work in mainland China. As a result, investors may be deprived of the benefits of such regular inspections.

The inability of the PCAOB to conduct full

inspections of auditors in mainland China makes it more difficult to evaluate the effectiveness of our auditors’ audit procedures

and quality control procedures as compared to auditors who primarily work in jurisdictions where the PCAOB has full inspection

access. Investors may lose confidence in our reported financial information and the quality of our financial statements.

Proceedings instituted by the SEC against

five PRC-based accounting firms could result in financial statements being determined to be not in compliance with the requirements

of the Securities Exchange Act of 1934.

The SEC previously instituted proceedings

against mainland Chinese affiliates of the “big four” accounting firms, including the affiliate of our auditor, for

failing to produce audit work papers under Section 106 of the Sarbanes-Oxley Act because of restrictions under PRC law. Each of

the “big four” accounting firms in mainland China agreed to a censure and to pay a fine to the SEC to settle the dispute

and stay the proceedings for four years, until the proceedings were deemed dismissed with prejudice on February 6, 2019. It remains

unclear whether the SEC will commence a new administrative proceeding against the four mainland China-based accounting firms. Any

such new proceedings or similar action against our audit firm for failure to provide access to audit work papers could result in

the imposition of penalties, such as suspension of our auditor’s ability to practice before the SEC. If our independent registered

public accounting firm, or its affiliate, was denied, even temporarily, the ability to practice before the SEC, and it was determined

that our financial statements or audit reports were not in compliance with the requirements of the U.S. Exchange Act, we could

be at risk of delisting or become subject to other penalties that would adversely affect our ability to remain listed on the Nasdaq.

In recent years, U.S. regulators have continued

to express their concerns about challenges in their oversight of financial statement audits of U.S.-listed companies with significant

operations in China. More recently, as part of increased regulatory focus in the U.S. on access to audit information, on May 20,

2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act, or the HFCA Act, which includes requirements for the

SEC to identify issuers whose audit reports are prepared by auditors that the PCAOB is unable to inspect or investigate completely

because of a restriction imposed by a non-U.S. authority in the auditor’s local jurisdiction. If the HFCA Act or any similar

legislation were enacted into law, our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if

our auditor is not inspected by the PCAOB for three consecutive years, and this ultimately could result in our ordinary shares

being delisted. Delisting of our ordinary shares would force our U.S.-based shareholders to sell their shares. The market prices

of our ordinary shares could be adversely affected as a result of anticipated negative impacts of the HFCA Act upon, as well as

negative investor sentiment towards, China-based companies listed in the United States, regardless of whether the HFCA Act is enacted

and regardless of our actual operating performance.

Furthermore, on June 4, 2020, the U.S.

President issued a memorandum ordering the President’s Working Group on Financial Markets (“PWG”) to submit a

report to the President within 60 days of the memorandum that includes recommendations for actions that can be taken by the executive

branch, the SEC, the PCAOB or other federal agencies and departments with respect to Chinese companies listed on U.S. stock exchanges

and their audit firms, in an effort to protect investors in the United States. On August 6, 2020, PWG released its Report on Protecting

United States Investors from Significant Risks from Chinese Companies (“PWG Report”). The PWG Report includes five

recommendations for the Securities and Exchange Commission. In particular, to address companies from jurisdictions, such as China,

that do not provide the PCAOB with sufficient access to fulfill its statutory mandate, the PWG recommends enhanced listing standards

on U.S. exchanges. This would require, as a condition to initial and continued exchange listing, PCAOB access to work papers of

the principal audit firm for the audit of the listed company. Companies unable to satisfy this standard as a result of governmental

restrictions on access to audit work papers and practices in these countries may satisfy this requirement by providing a co-audit

from an audit firm with comparable resources and experience where the PCAOB determines it has sufficient access to audit work papers

and practices to conduct an appropriate inspection of the co-audit firm. The PWG Report permits the new listing standards to provide

for a transition period until January 1, 2022 for listed companies. The recommendations are to include actions that could be taken

under current laws and rules as well as possible new rulemaking recommendations. Any resulting actions, proceedings or new rules

could adversely affect the listing and compliance status of China-based issuers listed in the United States, such as our company,

and may have a material and adverse impact on the trading prices of the securities of such issuers, including our ordinary shares,

and substantially reduce or effectively terminate the trading of our ordinary shares in the United States.

We, our customers, our suppliers and

other partners may be adversely affected by disaster or health epidemics, including the recent COVID-19 outbreak.

In general, our

business could be adversely affected by the effects of epidemics, including, but not limited to, the COVID-19, avian influenza,

severe acute respiratory syndrome (SARS), the influenza A virus, Ebola virus, severe weather conditions such as storm, flood or

hazardous air pollution, or other outbreaks. In recent years, there have been outbreaks of epidemics in various countries. Recently,

there was an outbreak of a novel strain of coronavirus (COVID-19) in the PRC, which has spread rapidly across the world. In March

2020, the World Health Organization declared the COVID-19 a pandemic.

As all of our revenues are generated in

Hong Kong, our results of operations will likely be adversely, and may be materially, affected, to the extent that the COVID-19

or any other epidemic harms the Hong Kong’s and global economy. Any potential impact to our results of operations will depend

on, to a large extent, future developments and new information that may emerge regarding the duration and severity of the COVID-19.

The actions taken by government authorities and other organizations to contain the spread of COVID-19 are beyond our control. Potential

impacts include, but are not limited to, the following:

| ● | temporary closure of offices and the implement of temporary travel restrictions; |

| ● | our customers that are negatively impacted by the outbreak of COVID-19 may reduce their budgets to purchase our services, which may materially adversely impact our revenue. We may have to provide significant sales incentives to our customers in response to boost our sales, which may in turn materially adversely affect our financial condition and operating results; | |

| ● | our customers may delay the payment or fail to pay us at all, which could significantly increase the amount of accounts receivable and require us to record additional allowances for doubtful accounts; | |

| ● | the business operations of our customers have been and could continue to be negatively impacted by the outbreak of COVID-19, which may result in loss of customers or disruption of our business or services, which may in turn materially adversely affect our financial condition and operating results; and | |

| ● | some of our customers, suppliers and other partners are small and medium-sized enterprises (SMEs), which may not have strong cash flows or be well capitalized, and may be vulnerable to an epidemic outbreak and slowing macroeconomic conditions. Our results of operations and financial results may be materially and adversely affected if the SMEs that we work with fail to resume normal business operations as a result of economic impact or the outbreak of COVID-19. |

In response to the outbreak of COVID-19,

government and other organizations may adopt regulations and policies that could lead to severe disruption to our daily operations,

including but not limited to:

| ● | the reduction of economic activity and close our office for all our employees to work from home has resulted in a significant reduction in productivity. As a result of these effects, our cumulative revenues for the year ended August 31, 2020 was lower than our revenues for the same period in 2019 with the major negative impact identified in May 2020. Due to the decline of the Group’s operating results in 2020, our liquidity is likely to be negatively impacted and additional funding may be needed in the future; | |

| ● | for the period since December 31, 2019, the Group has furthermore incurred losses. Depending on the duration of the COVID-19 crisis and continued negative impact on economic activity, the Group may experience further negative results, liquidity restraints and incur additional impairments on its assets in 2020, which may result in material adverse impact to our financial condition and results of operations. |

RISKS ASSOCIATED WITH OUR SECURITIES

Our shares of common stock do not presently

trade, and the price may not reflect our value and there can be no assurance that there will be an active market for our shares

of common stock either now or in the future.

Although our common stock is quoted on

the OTC Markets, our shares of common stock do not trade and the price of our common stock, if traded, may not reflect our value.

There can be no assurance that there will be an active market for our shares of common stock either now or in the future. Market

liquidity will depend on the perception of our operating business and any steps that our management might take to bring us to the

awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may

not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. As a result holders

of our securities may not find purchasers our securities should they to sell securities held by them. Consequently, our securities

should be purchased only by investors having no need for liquidity in their investment and who can hold our securities for an indefinite

period of time.

If a more active market should develop,

the price of our shares of common stock may be highly volatile. Because there may be a low price for our shares of common stock,

many brokerage firms may not be willing to effect transactions in our securities. Even if an investor finds a broker willing to

effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any,

and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares

of common stock as collateral for any loans.

We may, in the future, issue additional

common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize

the issuance of 75,000,000 shares of common stock. As of August 31, 2020, the Company had 6,692,182 shares of common stock

issued and outstanding. Accordingly, we may issue up to an additional 68,307,818 shares of common stock. The future issuance of

common stock and/or preferred stock will result in substantial dilution in the percentage of our common stock held by our then

existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for

future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our

investors, and might have an adverse effect on any trading market for our common stock.

Our officers and directors collectively

beneficially own a majority of our stock, and accordingly, collectively have control over stockholder matters, our business and

management.

Mr. Roy Chan, the Company’s President

is holder of 4,747,532 shares, Mr. Mark Yip, the director, is holder of 1,250 shares and Mr. Brian Wong, Chief Executive officer,

is holder of 244,630 shares of common stock of the Company. Therefore, our officers and directors collectively hold approximately

74.62{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of our issued and outstanding shares of common stock. As a result, our officers and directors will collectively have the

discretion to:

| ● | Elect or defeat the election of our directors; |

| ● | Amend or prevent amendment of our Articles of Incorporation or Bylaws; |

| ● | Effect or prevent a merger, sale of assets or other corporate transaction; and |

| ● | Affect the outcome of any other matter submitted to the stockholders for vote. |

Moreover, because of the significant ownership

position held by our insiders, new investors may not be able to effect a change in our business or management, and therefore, shareholders

would have no recourse as a result of decisions made by management.

In addition, sales of significant amounts

of shares held by our officers and directors, or the prospect of these sales, could adversely affect the market price of our common

stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting

to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our

stock price.

State securities laws may limit secondary

trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold

in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities

laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available

for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading

of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of

that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity

for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

The Company does not intend to seek registration

or qualification of its shares of common stock the subject of this offering in any State or territory of the United States. Aside

from a “secondary trading” exemption, other exemptions under state law and the laws of US territories may be available

to purchasers of the shares of common stock sold in this offering,

Anti-takeover effects of certain provisions

of Nevada state law hinder a potential takeover of us.

Though not now, we may be or in the future

we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has

more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada

or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the

ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the

following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third,

(ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be

direct or indirect, as well as individual or in association with others.

The effect of the control share law is

that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are

conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The

control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority

to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders

do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting

shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling

interest, their shares do not become governed by the control share law.

If control shares are accorded full voting

rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record,

other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such

stockholder’s shares.

Nevada’s control share law may have

the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada

has a business combination law which prohibits certain business combinations between Nevada corporations and “interested

stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,”

unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested

stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting

power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time

within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of

the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad

to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation’s assets to finance

the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination

law is to potentially discourage parties interested in taking control of us from doing so if it cannot obtain the approval of our

board of directors.

Because we do not intend to pay any

cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings

to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in

the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they

sell them. Stockholders may never be able to sell shares when desired. Before you invest in our securities, you should be aware

that there are various risks. You should consider carefully these risk factors, together with all of the other information included

in this annual report before you decide to purchase our securities. If any of the following risks and uncertainties develop into

actual events, our business, financial condition or results of operations could be materially adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

We do not own any property.

We are not currently involved in any legal proceedings and we

are not aware of any pending or potential legal actions.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE

OF SECURITY HOLDERS

No report required.

ITEM 5. MARKET FOR COMMON EQUITY AND RELATED

STOCKHOLDER MATTERS

MARKET INFORMATION

As of August 31, 2020 the 6,692,182 issued

and outstanding shares of common stock were held by a total of 61 shareholders of record.

DIVIDENDS

We have never paid or declared any dividends on our common stock

and do not anticipate paying cash dividends in the foreseeable future.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION

PLANS

We currently do not have any equity compensation plans.

ITEM 6. SELECTED FINANCIAL DATA

As a smaller reporting company, we are not required to provide

the information called for by Item 6 of Form 10-K.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULT OF OPERATIONS

The following discussion should be read

in conjunction with our financial statements, including the notes thereto, appearing elsewhere in this annual report. The following

discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could

differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such

differences include, but are not limited to those discussed below and elsewhere in this Annual Report. Our audited financial

statements are stated in United States Dollars and are prepared in accordance with United States Generally

Accepted Accounting Principles.

Overview

We were incorporated in the State of Nevada

on May 19, 2016. We commenced operations in tourism. We were a travel agency that organized individual and group tours in Kyrgyzstan,

such as cultural, recreational, sport, business, ecotours and other travel tours. Services and products provided by our company

included custom packages according to the client’s specifications. We developed and offered our own tours in Kyrgyzstan as

well as third-party suppliers.

On July 15, 2019, the Company’s principal

office relocated to Room 1204-06, 12/F, 69 Jervois Street, Sheung Wan, Hong Kong. On January 15, 2020, our principal office relocated

to Suite 1802-03, 18/F, Strand 50, 50 Bonham Strand, Sheung Wan, Hong Kong. Our management is planning to restructure our business

from a travel agency to a Fintech Company with major business focusing on financials services and using the internet, mobile devices,

software technology or cloud services to perform or connect with financial services.

Reverse Acquisition of JTI

On April 2, 2020, the Company entered into

a Sale and Purchase Agreement, by and among the Company, JTI, a Hong Kong corporation, and the Vendor.

Under the terms and conditions of the Agreement

(and supplemented by the Amendment, the Second Amendment and the Third Amendment), the Company offered, sold and will issue

4,118,182 shares of common stock in consideration for all the issued and outstanding shares in JTI. The effect of the issuance

is that the Vendor now hold approximately 61.54{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the issued and outstanding shares of common stock of the Company.

Mr. Roy Chan, the founder of JTI, and Chairman

of the board of directors is the holder of 629,350 shares of common stock of the Company prior to the Transaction. The Company’s

officers and directors, Mr. Roy Chan, Mr. Mark Yip and Mr. Brian Wong therefore, control an aggregate of 4,993,412 or 74.62{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of

the outstanding common stock of the Company, on a fully diluted basis, after the Transaction.

As a result of the agreement, JTI is now

a wholly-owned subsidiary of the Company.

The transaction with JTI was treated as

a reverse acquisition, with JTI as the acquirer and the Company as the acquired party. As a result of the controlling financial

interest of the former stockholders of JTI, for financial statement reporting purposes, the merger between the Company and JTI

was treated as a reverse acquisition, with JTI deemed the accounting acquirer and the Company deemed the accounting acquiree under

the acquisition method of accounting in accordance with the Section 805-10-55 of the FASB Accounting Standards Codification. The

reverse acquisition is deemed a capital transaction in substance whereas the assets and liabilities of JTI. (the accounting acquirer)

are carried forward to the Company (the legal acquirer and the reporting entity) at their carrying value before the combination

and the equity structure (the number and type of equity interests issued) of JTI is being retroactively restated using the exchange

ratio established in the Share Purchase Agreement to reflect the number of shares of the Company issued to effect the acquisition.

The number of common shares issued and outstanding and the amount recognized as issued equity interests in the consolidated financial

statements is determined by adding the number of common shares deemed issued and the issued equity interests of JTI immediately

prior to the business combination to the unredeemed shares and the fair value of the Company determined in accordance with the

guidance in ASC Section 805-40-55 applicable to business combinations, i.e. the equity structure (the number and type of equity

interests issued) in the consolidated financial statements immediately post combination reflects the equity structure of the Company,

including the equity interests the legal acquirer issued to effect the combination.

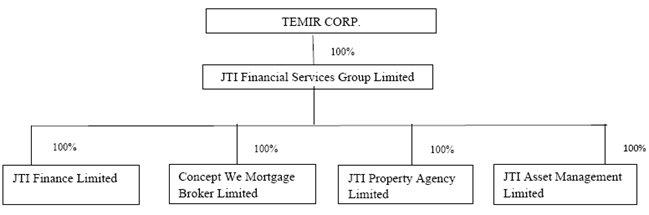

JTI has four wholly owned operating subsidiaries,

namely, JTI Finance Limited, Concept We Mortgage Broker Limited, JTI Property Agency Limited and JTI Asset Management Limited.

The principal activities of JTI are provision of diversified financial services through its wholly owned subsidiaries incorporated

in Hong Kong.

JF is a licensed money lender in Hong Kong,

holding a money lender license no. 0991/2019 granted by the licensing court of Hong Kong. JF offers various types of loans including

but not limited to personal loan, business loan, credit card consolidation loan and equity pledge loan to its customers in Hong

Kong.

CW is one of the active mortgage brokers

in Hong Kong. Its revenue is mainly derived from the referral fee from the banks and financial institutions for the mortgage referral.

JP is a licensed property agent in Hong

Kong, holding an estate agent’s license granted by Estate Agents Authority of Hong Kong. Its revenue is mainly derived from

the commission provided by the landlord for facilitating the sales or lease of commercial properties.

JA is a consultancy services company. After

the completion of the Agreement, JA is planning to apply for fund management licenses in Hong Kong or in other jurisdiction, aiming

to provide fund management services globally.

Impact of COVID-19

The spread of the coronavirus (“COVID-19”)

around the world has caused significant business disruption in year 2020. In March 2020, the World Health Organization declared

the outbreak of COVID-19 as a global pandemic, which continues to spread around the world. There is significant uncertainty around

the breadth and duration of business disruptions related to COVID-19, as well as its impact on the Hong Kong’s and global

economy. While it is difficult to estimate the financial impact of COVID-19 on the Company’s operations, management believes

that COVID-19 could have a material impact on its financial results in year 2021.

Results of operations

The following table sets forth key components of our results

of operations for the years ended August 31, 2020 and 2019:

| Year ended | ||||||||

| August 31, 2020 |

August 31, 2019 |

|||||||

| REVENUE | $ | 26,631 | $ | 44,392 | ||||

| Cost of revenue | (2,371 | ) | (15,966 | ) | ||||

| GROSS PROFIT | 24,260 | 28,426 | ||||||

| General and administrative expenses | (299,474 | ) | (193,981 | ) | ||||

| LOSS FROM OPERATIONS | (275,214 | ) | (165,555 | ) | ||||

| Other Income | 9,487 | 29,127 | ||||||

| Loss before income tax | (265,727 | ) | (136,428 | ) | ||||

| Income tax credit (expense) | 634 | (643 | ) | |||||

| NET LOSS | (265,093 | ) | (137,071 | ) | ||||

As of August 31, 2020, our accumulated

deficit was $695,468.

Year ended August 31, 2020 compared

to the year ended August 31, 2019

Revenue and cost of revenue

During the year ended August 31, 2020,

the Company generated revenue of $26,631 compared to $44,392 for the year ended August 31, 2019. Cost of revenue was $2,371 for

the year ended August 31, 2020 compared to $15,966 for the year ended August 31, 2019. Our agency revenues were $1,218 the year

ended August 31, 2020 while such revenue was $33,097 in 2019. On the other hand, mortgage referral fee income was $25,413 in the

year ended August 31, 2020. We earned $10,993 mortgage referral fee in last year. Included in cost of revenue were referral fees

of nil and $15,966 incurred in relation to our property agency business in 2020 and 2019, respectively.

General and administrative expenses

During the year ended August 31, 2020,

we incurred $299,474 general and administrative expenses compared to $193,981 for the year ended August 31, 2019. General and administrative

expenses incurred generally related to corporate overhead, director fee, financial and administrative contracted services, such

as legal and accounting and developmental costs.

Net loss

As a result of the cumulative effect of

the factors described above, our net loss for the year ended August 31, 2020 was $265,093 compared to net loss of $137,071 for

the year ended August 31, 2019.

Going concern

Our consolidated financial statements have

been prepared using the going concern basis of accounting, which contemplates the realization of assets and the satisfaction of

liabilities in the normal course of business.

As of August 31, 2020, we have suffered

recurring losses from operations, and record an accumulated deficit and a working capital deficit of $695,468 and $244,186,

respectively. These conditions raise substantial doubt about our ability to continue as a going concern. The continuation of our

company as a going concern is dependent upon improving our profitability and the continuing financial support from our shareholders

or other debt or capital sources. Management believes the existing shareholders or external financing will provide the additional

cash to meet our obligations as they become due.

The continuation of our company as a going

concern is dependent upon improving its profitability and the continuing financial support from our shareholders or other debt

or capital sources. Management believes the existing shareholders or external financing will provide the additional cash to meet

our obligations as they become due. No assurance can be given that any future financing, if needed, will be available or, if available,

that it will be on terms that are satisfactory to us. Even if we are able to obtain additional financing, if needed, it may contain

undue restrictions on our operations, in the case of debt financing, or cause substantial dilution for our stock holders, in the

case of equity financing.

In March 2020, the World Health Organization

declared the outbreak of COVID-19 as a global pandemic, which continues to spread around the world. There is significant uncertainty

around the breadth and duration of business disruptions related to COVID-19, as well as its impact on the Hong Kong’s and

global economy. While it is difficult to estimate the financial impact of COVID-19 on our operations, management believes that

COVID-19 could have a material impact on our financial results at this time.

Our consolidated financial statements do

not include any adjustments to reflect the possible future effects on the recoverability and classification of assets and liabilities

that may result in our company not being able to continue as a going concern.

Segment Information

The following table set forth our results

of operations by segments:

| For the year ended August 31, 2020 | Money lending | Property agency services | Mortgage referral services | Corporate unallocated | Consolidated | |||||||||||||||

| Revenue | $ | – | $ | 1,218 | $ | 25,413 | $ | – | $ | 26,631 | ||||||||||

| Cost of revenue | – | – | (2,371 | ) | – | (2,371 | ) | |||||||||||||

| Gross profit | – | 1,218 | 23,042 | – | 24,260 | |||||||||||||||

| General and administrative expenses | (133,368 | ) | (283 | ) | (4,230 | ) | (161,593 | ) | (299,474 | ) | ||||||||||

| Profit (loss) from operations | (133,368 | ) | 935 | 18,812 | (161,593 | ) | (275,214 | ) | ||||||||||||

| Other income | 1,282 | – | – | 8,205 | 9,487 | |||||||||||||||

| Profit (loss) before income tax | (132,086 | ) | 935 | 18,812 | (153,388 | ) | (265,727 | ) | ||||||||||||

| Income tax | – | 634 | – | – | 634 | |||||||||||||||

| Net profit (loss) | (132,086 | ) | 1,569 | 18,812 | (153,388 | ) | (265,093 | ) | ||||||||||||

| For the year ended August 31, 2019 | Money lending | Property agency services | Mortgage referral services | Corporate unallocated | Consolidated | |||||||||||||||

| Revenue | $ | 302 | $ | 33,097 | $ | 10,993 | $ | – | $ | 44,392 | ||||||||||

| Cost of revenue | – | (15,966 | ) | – | – | (15,966 | ) | |||||||||||||

| Gross profit | 302 | 17,131 | 10,993 | – | 28,426 | |||||||||||||||

| General and administrative expenses | (130,431 | ) | (1,531 | ) | (5,702 | ) | (56,317 | ) | (193,981 | ) | ||||||||||

| Profit (loss) from operations | (130,129 | ) | 15,600 | 5,291 | (56,317 | ) | (165,555 | ) | ||||||||||||

| Other income | 4,512 | – | – | 24,615 | 29,127 | |||||||||||||||

| Profit (loss) before income tax | (125,617 | ) | 15,600 | 5,291 | (31,702 | ) | (136,428 | ) | ||||||||||||

| Income tax | – | (643 | ) | – | – | (643 | ) | |||||||||||||

| Net profit (loss) | (125,617 | ) | 14,957 | 5,291 | (31,702 | ) | (137,071 | ) | ||||||||||||

We do not allocate our assets located and

expenses incurred outside Hong Kong to our reportable segments because these assets and activities are managed at a corporate level.

We primarily operate in Hong Kong. Substantially

all our long-lived assets are located in Hong Kong.

Liquidity and capital resources

Working Capital

| August 31, | ||||||||

| 2020 | 2019 | |||||||

| Cash and cash equivalents | $ | 2,580 | $ | 10,252 | ||||

| Total current assets | 2,882 | 85,612 | ||||||

| Total assets | 2,882 | 85,804 | ||||||

| Total liabilities | 247,068 | 64,897 | ||||||

| Accumulated deficit | 695,468 | 430,375 | ||||||

| Total equity (deficit) | (244,186 | ) | 20,907 | |||||

The following table provides detailed information

about our net cash flow for all financial statement periods presented in this report:

| Year ended | ||||||||

| August 31, 2020 |

August 31, 2019 |

|||||||

| Net cash used in operating activities | $ | (234,137 | ) | $ | (141,221 | ) | ||

| Net cash from investing activities | – | – | ||||||

| Net cash provided by financing activities | 226,465 | 149,928 | ||||||

| Net increase (decrease) in cash and cash equivalents | (7,672 | ) | 8,707 | |||||

| Cash and cash equivalents, beginning of year | 10,252 | 1,545 | ||||||

| CASH AND CASH EQUIVALENTS, END OF YEAR | $ | 2,580 | $ | 10,252 | ||||

Cash Flows from Operating Activities

For the year ended August 31, 2020, net

cash flows used in operating activities was $234,137consisting primarily of net loss of $265,093 offset by the decrease of accounts

receivable of $3,298, decrease of prepaid expenses, deposits and other current assets of $16,410 and increase of accrued liabilities

of $9,008. For the year ended August 31, 2019, net cash flows used inoperating activities was $141,221, consisting primarily of

net loss of $137,071 and an increase of prepaid expenses, deposits and other current assets of $16,410.

Cash Flows from Investing Activities

Cash flows used in investing activities

was nil during years ended August 31, 2020 and August 31, 2019.

Cash Flows from Financing Activities

Cash flows provided by financing activities

during the year ended August 31, 2020 were $226,465, consisting of $661,643 advances from a shareholder and offset by $435,178

repayment to a shareholder. Cash flows provided by financing activities during the year ended August 31, 2019 were $149,928, consisting

of $185,269 advances from a shareholder and $35,341 repayment to a shareholder.

Contractual Obligations and Commercial

Commitments

We had the following contractual obligations

and commercial commitments as of August 31, 2020: .

| Payment Due by Period | ||||||||||||||||||||

| Total | Less than 1 Year | 1-3 Years | 3-5 Years | More than 5 Years | ||||||||||||||||

| Amount due to a shareholder | $ | 173,796 | $ | 173,796 | $ | – | $ | – | $ | – | ||||||||||

| Amount due to a related company | 56,317 | 56,317 | – | – | – | |||||||||||||||

| Total | $ | 230,113 | $ | 230,113 | $ | – | $ | – | $ | – | ||||||||||

We believe that our current cash and financing from our existing

stockholders are adequate to support operations for at least the next 12 months. We may, however, in the future, require additional

cash resources due to changed business conditions, implementation of our strategy to expand our business or other investments or

acquisitions we may decide to pursue. If our own financial resources are insufficient to satisfy our capital requirements, we may

seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities

could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations

and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available

in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at

all, could limit our ability to expand our business operations and could harm our overall business prospects.

Capital Expenditures

We did not incur any capital expenditures in the periods presented.

Inflation

Inflation and changing prices have not

had a material effect on our business and we do not expect that inflation or changing prices will materially affect our business

in the foreseeable future. However, our management will closely monitor price changes in our industry and continually maintain

effective cost control in operations.

Off Balance Sheet Arrangements

We do not have any off balance sheet arrangements

that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition,

revenues or expenses, results of operations, liquidity or capital expenditures or capital resources that is material to an investor

in our securities.

Seasonality

Our operating results and operating cash

flows historically have not been subject to significant seasonal variations. This pattern may change, however, as a result of new

market opportunities or new product introductions.

Critical Accounting Policies and Estimates

We regularly evaluate the accounting policies

and estimates that we use to make budgetary and financial statement assumptions. A complete summary of these policies is included

in the notes to our financial statements. In general, management’s estimates are based on historical experience, on information

from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances.

Actual results could differ from those estimates made by management. The discussion of our critical accounting policies contained

in Note 2 to our consolidated financial statements, “Summary of Significant Accounting Policies,” is incorporated herein

by reference.

Recent Accounting Pronouncements

For further information on recently issued

accounting pronouncements, see Note 2—Summary of Significant Accounting Policies in the accompanying notes to consolidated

financial statements included in Part II, Item 8, “Financial Statements and Supplementary Data” of this Annual Report

on Form 10-K.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

Not applicable.

ITEM 8. FINANCIAL STATEMENTS

AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Temir Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated

balance sheets of Temir Corp. and its subsidiaries (the “Company”) as of August 31, 2020 and 2019, and the related

consolidated statements of operations and comprehensive loss, changes in stockholders’ equity (deficit) and cash flows for