Form DEF 14A CUMULUS MEDIA INC For: May 04

59 min readGet inside Wall Street with StreetInsider Premium. Claim your 1-week free trial here.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

CUMULUS MEDIA INC.

(Name of Registrant as Specified

in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

CUMULUS MEDIA

INC.

Annual Meeting of Stockholders May

4, 2021

Notice of Meeting and Proxy Statement

3280 Peachtree Road, N.W.

Suite 2200

Atlanta, Georgia 30305

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 4, 2021

To the Stockholders of Cumulus Media Inc.:

The 2021 Annual Meeting of Stockholders of Cumulus Media

Inc., a Delaware corporation (“Cumulus Media,” “we” or the “Company”), will be held virtually

via the Internet at www.meetingcenter.io/205452266, on May 4, 2021 at 12:30 p.m., Eastern Time, for the following purposes:

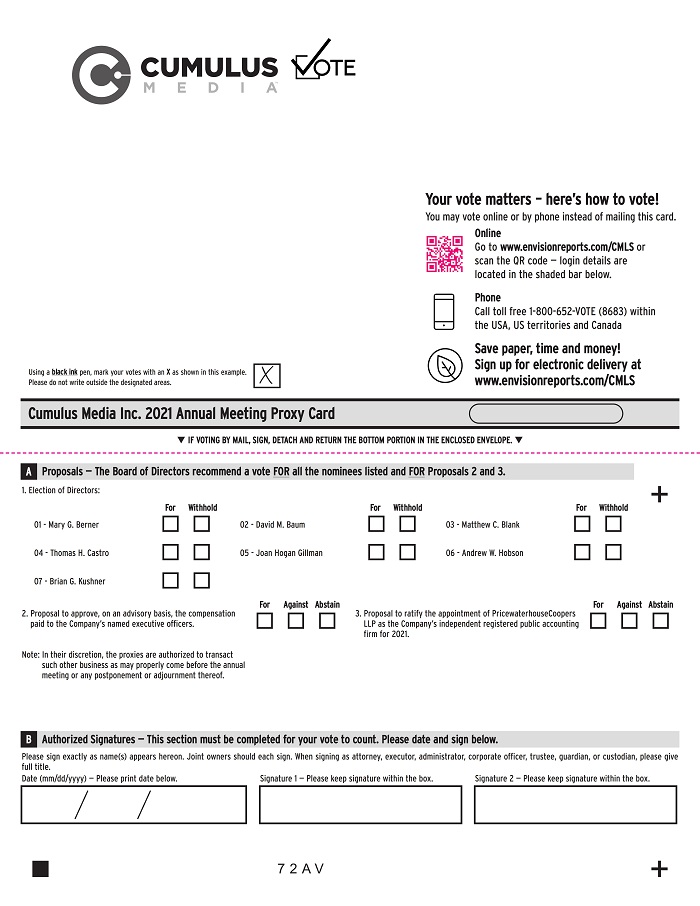

(1) to elect seven directors to serve until the next annual

meeting of stockholders and until their successors are elected and qualified;

(2) to approve, on an advisory basis, the compensation paid

to the Company’s named executive officers;

(3) to ratify the appointment of PricewaterhouseCoopers LLP

as the Company’s independent registered public accounting firm for 2021; and

(4) to transact such other business as may properly come

before the annual meeting or any postponement or adjournment thereof.

The Company’s Board of Directors is committed to the

safety of our stockholders, employees and communities. As a result, due to public health concerns arising from the ongoing presence

of the novel coronavirus (COVID-19), the Company has decided to hold the 2021 Annual Meeting of Stockholders virtually via the

Internet. Details on how to participate are included in the proxy statement, which accompanies this letter.

Only holders of record of shares of the Company’s Class

A common stock at the close of business on March 12, 2021 (the “Record Date”) are entitled to notice of, and to vote

at, the annual meeting or any postponement or adjournment thereof. Guests will not be able to attend the virtual annual meeting.

Beneficial owners as of the Record Date must register in

advance to attend and vote at the annual meeting. To register you must obtain a legally valid proxy from your broker, bank or other

nominee and present it to our transfer agent, Computershare. Once you have received a valid proxy from your broker, bank or other

agent, it should be emailed to Computershare at [email protected] and should be labeled “Legal Proxy” in

the subject line. Please include proof from your broker, bank or other agent of your valid proxy (e.g., a forwarded email from

your broker, bank or other agent with your valid proxy attached, or an image of your valid proxy attached to your email or included

in your mailing). Requests for registration must be received by Computershare no later than 5:00 p.m., Eastern Time, on May 2,

2021. You will then receive a confirmation of your registration, with a control number, by email from Computershare.

Holders of a majority of the outstanding voting power represented

by the shares of the Company’s Class A common stock must be present virtually or by proxy in order for the meeting to be

held. Our Board of Directors recommends that you vote FOR each of the director nominees, FOR the approval, on an

advisory basis, of the compensation paid to the Company’s named executive officers and FOR the ratification of the

appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2021. We urge

you to date, sign and return the accompanying proxy card in the enclosed envelope, or vote your shares by telephone or via the

Internet,

as soon as possible, whether or not you expect to attend the annual meeting virtually. If you attend the annual meeting

and wish to vote your shares virtually, you may do so by validly revoking your proxy at any time prior to the vote.

This notice, the proxy statement and the accompanying proxy

card are being distributed to stockholders and made available on the Internet commencing on or about March 29, 2021.

Important Notice Regarding the Availability of Proxy

Materials for the Annual Meeting of Stockholders to be Held on May 4, 2021.

The proxy statement and the Annual Report on Form 10-K for

the fiscal year ended December 31, 2020 are available at www.envisionreports.com/CMLS.

Mary G. Berner

President and Chief Executive Officer

March 29, 2021

INFORMATION REGARDING THE ANNUAL

MEETING

Proxy Statement; Date, Time and Place of Annual Meeting

We are furnishing this proxy statement in connection with

the solicitation of proxies by our Board of Directors (the “Board of Directors” or the “Board”) for use

at our 2021 annual meeting of stockholders (the “annual meeting”) to be held on May 4, 2021, at 12:30 p.m., Eastern

Time, virtually via the Internet at www.meetingcenter.io/205452266, or at any adjournment or postponement of that meeting. The

Company’s board of directors (the “Board of Directors”) is committed to the safety of our stockholders, employees

and communities. As a result, due to public health concerns arising from the ongoing presence of the novel coronavirus (COVID-19),

the Company has decided to hold the annual meeting virtually via the Internet. At the annual meeting, stockholders will be asked

to consider and vote on the items of business listed and described in this proxy statement. This proxy statement and the accompanying

proxy card are first being distributed to our stockholders and made available on the Internet on or about March 29, 2021.

Record Date; Quorum; Outstanding Common Stock Entitled

to Vote

All holders of record of our Class A common stock as of the

close of business on March 12, 2021 (the “Record Date”) are entitled to receive notice of, and to vote at, the annual

meeting. We will make available, during ordinary business hours at our offices at 3280 Peachtree Road, N.W., Suite 2200, Atlanta,

Georgia 30305, a list of stockholders of record as of the record date for inspection by stockholders for any purpose germane to

the annual meeting during the ten days preceding the annual meeting. To access the stockholder list during this time, please send

your request, and proof of ownership, by email to [email protected].

If your shares are held in “street name” through

a bank, broker or other nominee, you must obtain a proxy card from your bank, broker or other nominee in order to be able to vote

your shares at the annual meeting. As of the Record Date, there were 18,060,517 shares of our Class A common stock outstanding.

Each share of Class A common stock outstanding is entitled to one vote for each of the seven director nominees and one vote on

each other matter to be acted on at the annual meeting. The presence, virtually or by proxy, of holders of a majority of the voting

power represented by our outstanding shares of Class A common stock is required to constitute a quorum for the transaction of business

at the annual meeting.

Abstentions and “broker non-votes” will be treated

as present for purposes of determining a quorum. A “broker non-vote” occurs when a registered holder (such as a bank,

broker or other nominee) holding shares in “street name” for a beneficial owner does not vote on a particular proposal

because the registered holder does not have discretionary voting power for that particular proposal and has not received voting

instructions from the beneficial owner. Banks, brokers or other nominees that have not received voting instructions from their

clients cannot vote on their clients’ behalf on the election of directors, or the approval, on an advisory basis, of the

compensation paid to our named executive officers, which is sometimes referred to as the “advisory vote on executive compensation”

or the “say-on-pay” vote, but may (but are not required to) vote their clients’ shares on the proposal to ratify

the appointment of our independent registered public accounting firm.

If a quorum is not present at the scheduled time of the annual

meeting, the chairman of the meeting may adjourn or postpone the annual meeting until a quorum is present. The time and place of

the adjourned or postponed annual meeting will be announced at the time the adjournment or postponement is taken, and, unless such

adjournment or postponement is for more than 30 days, no other notice will be given. An adjournment or postponement will have no

effect on the business that may be conducted at the annual meeting.

Participation in the Annual Meeting; Questions at the

Meeting

To participate, visit www.meetingcenter.io/205452266 and

login with the control number included in your proxy materials and the password CMLS2021. If you hold your shares through an intermediary,

such as a bank or broker, you must register in advance. To register, you must obtain a legally valid proxy from your broker, bank

or other nominee and present it to our transfer agent, Computershare. Once you have received a valid proxy from your broker, bank

or other agent, it should be emailed to Computershare at [email protected] and should be labeled “Legal Proxy”

in the subject line. Please include proof from your broker, bank or other agent of your valid proxy (e.g., a forwarded email from

your broker, bank or other agent with your valid proxy attached, or an image of your valid proxy attached to your email or included

in your mailing). Requests for registration must be received by Computershare no later than 5:00 p.m., Eastern Time, on May 2,

2021. You will then receive a confirmation of your registration, with a control number, by email from Computershare.

You may log into the annual meeting platform beginning at

12:15 p.m., Eastern Time, on May 4, 2021. The annual meeting will begin promptly at 12:30 p.m., Eastern Time. We encourage you

to access the Annual Meeting prior to the start time.

We have designed the format of the annual meeting to ensure

that our stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting. After

the business portion of the annual meeting concludes and the meeting is adjourned, we will hold a Q&A session during which

we intend to answer questions submitted during the meeting that are pertinent to the Company, as time permits, and in accordance

with our Rules of Conduct of the annual meeting. On the day of and during the annual meeting, you can view our Rules of Conduct

of the annual meeting and submit any questions by accessing www.meetingcenter.io/205452266.

Voting Rights; Vote Required for Approval

Each share of Class A common stock outstanding is entitled

to one vote for each of the seven director nominees and one vote on each other matter to be acted on at the annual meeting. Cumulative

voting for director nominees is not allowed.

The affirmative vote of (1) a plurality of the votes represented

at the annual meeting and entitled to be cast is required to elect each director nominee, and (ii) a majority of the votes represented

at the annual meeting and entitled to be cast is required, (A) to approve, on an advisory basis, the Company’s executive

compensation and (B) to ratify the appointment of our independent registered public accounting firm for 2021. Votes withheld from

the election of directors and abstentions with respect to the approval, on an advisory basis, of the Company’s executive

compensation and the ratification of the appointment of our independent registered public accounting firm for 2021 will have the

same effect as a vote against such director or such proposal, but broker non-votes will not be considered to be votes entitled

to be cast and will have no effect on the outcome of the vote on the election of directors or the approval, on an advisory basis,

of the Company’s executive compensation.

Voting and Revocation of Proxies

A proxy is a legal designation of another person to vote

stock you own. That other person is called a proxy. If you designate someone as your proxy in a written or electronic document,

that document is also called a proxy, a proxy card or a form of proxy. A proxy card for you to use in voting at the annual meeting

accompanies this proxy statement. You may also vote by telephone or by the Internet as follows:

| · | by telephone: call toll free 1-800-652-VOTE (8683) and follow the instructions provided by the recorded message; or |

| · | by the Internet: visit www.envisionreports.com/CMLS and follow the steps outlined on the secure website. |

If your shares are held in “street name” through

a bank, broker or other nominee, you should follow the instructions for voting on the form provided by your bank, broker or other

nominee. You may submit voting instructions by telephone or through the Internet or, if you received your proxy materials by mail,

you may complete and mail a proxy card to your bank, broker or other nominee. If you provide specific voting instructions by telephone,

through the Internet or by mail, your bank, broker or other nominee will vote your shares as you have directed.

All properly executed proxies that are received prior to,

or at, the annual meeting and not revoked (and all shares properly voted by telephone or the Internet) will be voted in the manner

specified. If you execute and return a proxy card, and do not specify otherwise, the shares represented by your proxy will be voted

FOR each of the director nominees, FOR the advisory approval of executive compensation and FOR the ratification

of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2021.

If you have given a proxy or voted by telephone or the Internet

pursuant to this solicitation, you may nonetheless revoke that proxy or vote by attending the annual meeting and voting in person.

In addition, you may revoke any proxy you give before the annual meeting by voting by telephone or the Internet at a later date

(in which case only the last vote will be counted) prior to 1:00 a.m. Eastern Time on May 4, 2021, by delivering a written statement

revoking the proxy or vote or by delivering a duly executed proxy bearing a later date to Richard S. Denning, Corporate Secretary,

at our principal executive offices, 3280 Peachtree Road, N.W., Suite 2200, Atlanta, Georgia 30305, so that it is received prior

to the annual meeting, or by voting at the annual meeting itself prior to the closing of the polls. If you have executed and delivered

a proxy to us or voted by telephone or the Internet, your attendance at the annual meeting will not, by itself, constitute a revocation

of your proxy.

Solicitation of Proxies and Householding

We will bear the cost of the solicitation of proxies. We

will solicit proxies initially by mail. Further solicitation may be made by our directors, officers and employees personally, by

telephone, facsimile, e-mail or otherwise, but they will not be compensated specifically for these services. Upon request, we will

reimburse brokers, dealers, banks or similar entities acting as nominees for their reasonable expenses incurred in forwarding copies

of the proxy materials to the beneficial owners of the shares of common stock they hold of record.

From time to time, we, and if you hold your shares in street

name, your bank, broker or other nominee, may participate in the practice of “householding” proxy soliciting material.

This means that if you reside in the same household as other stockholders of record or beneficial owners of our common stock, you

may not receive your own copy of our proxy materials, even though each stockholder receives his or her own proxy card. If your

household received one set of proxy materials and you are a stockholder of record who would like to receive additional copies of

our proxy materials, you may request a duplicate set by contacting our Corporate Secretary at our principal executive offices,

3280 Peachtree Road, N.W., Suite 2200, Atlanta, Georgia 30305 or at the following telephone number: (404) 949-0700. If you share

an address with other stockholders of record and your household received multiple sets of proxy materials, and you would like for

your household to receive a single copy of our proxy materials, you may make such a request by contacting our Corporate Secretary

at our principal executive offices listed above. If you hold your shares in street name, please contact your bank, broker or other

nominee directly to request a duplicate set of proxy materials or to reduce the number of copies of our proxy materials that are

sent to your household.

Other Matters

Except for the votes on the proposals described in this proxy

statement, no other matter is expected to come before the annual meeting. If any other business properly comes before the annual

meeting, the persons named as proxies will vote in their discretion to the extent permitted by law.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Pursuant to the Amended and Restated Certificate of Incorporation

of the Company (the “Charter”) and the Amended and Restated Bylaws of the Company (the “Bylaws”), members

of the Board of Directors are elected or appointed to a term which expires at the next successive annual meeting of stockholders

and when their successors are duly elected and qualified. Our Board consists of seven members. Each of the director nominees was

elected by our stockholders at our 2020 Annual Meeting of Stockholders.

The director nominees have all been nominated for election

by our Board of Directors, upon the recommendation of the Nominating Committee of the Board. If elected, each of the director nominees

will serve until the 2022 annual meeting of stockholders or until each is succeeded by another qualified director who has been

duly elected or appointed. Our Board of Directors has no reason to believe that any of the individuals nominated will be unable

or unwilling to serve as directors. If for any reason any of these individuals becomes unable or unwilling to serve before the

annual meeting, it is expected that the persons named as proxies will vote for the election of such other persons as our Board

of Directors may recommend.

Below is detailed information about each of our director nominees,

including their principal occupation, business experience, the Board of Directors’ assessment of their individual qualifications

to serve as a director as well as other matters. For certain additional information regarding the director nominees, see the sections

entitled “Security Ownership of Certain Beneficial Owners and Management” and “Information About the Board of

Directors” in this proxy statement.

Mary G. Berner, age 61, has served as our Chief Executive

Officer since October 2015 and as one of our directors since May 2015. She was also appointed as our President in March 2016. Prior

to being appointed as Chief Executive Officer in October 2015, Ms. Berner served as President and Chief Executive Officer

of MPA-The Association of Magazine Media, which is the industry association for multi-platform magazine media companies, since

September 2012. From 2007 to 2011, she served as Chief Executive Officer of Reader’s Digest Association, a global media and

direct marketing company, and a member of the board. While at Reader’s Digest Association, Ms. Berner successfully led

that company through a restructuring of its debt in a voluntary prearranged reorganization under Chapter 11 of the U.S. Bankruptcy

Code in under eight months, emerging from bankruptcy protection in February 2010. Nearly two years after Ms. Berner resigned

from Reader’s Digest Association, that company again filed for bankruptcy protection under Chapter 11 in February 2013. Before

that, from November 1999 until January 2006, she led Fairchild Publications, Inc., first as President and Chief Executive Officer

and then as President of Fairchild and as an officer of Condé Nast. She has also held leadership roles at Glamour, TV Guide,

W, Women’s Wear Daily, Every Day with Rachael Ray and Allrecipes.com. Ms. Berner has served on numerous industry and

not-for-profit boards. Ms. Berner received her Bachelor of Arts degree in History from the College of Holy Cross (Massachusetts).

Ms. Berner, who has gained significant operational and

strategic knowledge of our Company as President and Chief Executive Officer, has over 30 years of senior executive experience in

the media and advertising industry allowing her to add significant strategic perspective to the Board. In addition, her track record

of overseeing revenue growth in the companies she has led, as well as her expertise managing businesses in transition, is important

as we position ourselves for future growth and success.

David M. Baum, age 56, is a private investor in, and

strategic advisor to, a number of companies through Baum Media Group, LLC, an investment and advisory services company, of which

Mr. Baum has served as Managing Member since February 2005. He served as President of Revolution Golf, a digital media company,

from March 2013 until its acquisition by The Golf Channel in July 2017 and he continued to serve as a Special Advisor to The Golf

Channel until February of 2020. Among other endeavors, Mr. Baum served for over seventeen years in various roles at Goldman,

Sachs & Co., an investment bank, retiring in 2003 as a partner and head of the Mergers & Acquisitions department in the

Americas. Mr. Baum serves on the boards of directors of Happify, Inc., Fuze, Inc. and the Marcus Corporation (NYSE: MCS).

Mr. Baum has extensive experience in capital markets,

mergers and acquisitions, and business strategy across a wide range of companies and sectors. His significant professional experience

provides a solid and diverse platform for him to provide a perspective to our Board of Directors on financial, strategic and acquisition-related

matters and to his service on the Compensation and Nominating Committees.

Matthew C. Blank, age 70, currently serves as a Senior

Advisor at The Raine Group. He recently served from January 1, 2018 to December 31, 2018 as an advisor to Showtime Networks Inc.

(“Showtime”), a subsidiary of CBS Corporation (NYSE: CBS). Prior to that in 2016 and 2017, he served as Chairman of

Showtime, and from 1995 through 2015 he served as Chief Executive Officer of Showtime. From 1993-1995 he was President and Chief

Operating Officer of Showtime and from 1988-1992 he served as Executive Vice President of Marketing, Creative Services, and Public

Affairs.

Prior to his service at Showtime, Mr. Blank served for over 12 years in various roles at Home Box Office, Inc., a

premium television network, leaving HBO as its Senior Vice President of Consumer Marketing. Mr. Blank served on the board

of directors of Geeknet, Inc. from 2010 to 2015. Mr. Blank served on the board of the National Cable Television Association

from 1994-2017 and is a member of the board of directors of The Madison Square Garden Company (NYSE: MSG), CuriosityStream Inc.

(NASDAQ: CURI) and is an advisor to D and Z Media Acquisition Corp. (NYSE: DNZ.U). He also currently serves as a member of the

board of directors of The Cable Center and as a trustee of The Harlem Children’s Zone, The Manhattan Theater Club, The Creative

Coalition, and The Museum of the Moving Image.

Mr. Blank has extensive corporate management experience

in the media industry, as evidenced by his senior management positions at Showtime and HBO, which will allow him to offer management

and operational insight to the Board. In addition, this history and experience contributes to the Board through significant insight

into a number of functional areas critical to Cumulus and allows him to bring a unique perspective to his service on the Compensation

and Nominating Committees.

Thomas H. Castro, age 66, has served as the President

and Chief Executive Officer of El Dorado Capital, LLC, a private equity investment firm, since December 2008. Previously, he was

the co-founder and Chief Executive Officer of Border Media Partners, LLC, a radio broadcasting company that primarily targets Hispanic

listeners in Texas, from 2002 to 2007 and its Vice Chairman through 2008. Prior to that, Mr. Castro owned and operated other

radio stations and founded a company that exported oil field equipment to Mexico. Mr. Castro served on the board of directors

of Time Warner Cable, Inc. (“Time Warner”) from 2006 to 2016, where he served on its audit committee. Mr. Castro

currently serves on the board of directors of Nielsen Holdings plc (NYSE: NLSN) and serves on its audit committee. Mr. Castro

also serves as chairman of the board of directors of the Texas Charter Schools Association, and is a board member of the National

Board of Teach for America and a trustee of Spellman College.

Mr. Castro has significant operating and financial experience

as well as an in-depth understanding of the Company’s industry which allows him to bring a valuable perspective to the Board

and his significant financial experience makes him particularly suited to serve on the Audit Committee. In addition, through his

entrepreneurial experience and community work, Mr. Castro brings an important and unique perspective to the Board.

Joan Hogan Gillman, age 57, served as Executive Vice

President of Time Warner, a media, telecom and cable company, and Chief Operating Officer of its Time Warner Cable Media division

($1.1b in revenue), for which she maintained financial and operating responsibility, from September 2006 to June 2016. Prior to

her service at Time Warner Cable, Ms. Gillman served in senior executive roles at OpenTV Corporation, a digital television

software company; British Interactive Broadcasting Holdings Limited, a provider of digital TV and interactive services in the U.K;

Physicians’ Online Inc., an Internet Service Provider and portal for physicians, and served ten years as a staff member to

a United States Senator. Ms. Gillman currently serves on the board of directors of Airgain, Inc. (NASDAQ: AIRG), InterDigital,

Inc. (NASDAQ: ICC) and BAI Communications, and previously served on the board of directors of Centrica PLC (CNA: LN). Ms. Gillman

also serves as the chairman of the board of directors of the Jesuit Volunteer Group and Managing member of the David T. Langrock

Foundation.

Ms. Gillman has substantial corporate management experience

as well as expertise in the digital and traditional media and communications industry through her various senior management positions

at media and communications companies which allow her to provide an in-depth understanding of the opportunities and challenges

associated with our business to the Board, including providing valuable insight in her service on the Compensation and Nominating

Committees.

Andrew W. Hobson, age 59, has served as a Partner

and the Chief Financial Officer of Innovatus Capital Partners, LLC, a private investment firm, since January 2016. From 1994 to

2015, Mr. Hobson served in various roles at Univision Communications Inc., a media company, including Senior Executive Vice

President and Chief Financial Officer from October 2007 through February 2015, during which time he was responsible for all financial

aspects of the company. Prior to his employment at Univision, Mr. Hobson served as a Principal at Chartwell Partners LLC from

1990 to 1994. Mr. Hobson also currently serves on the board of directors of Clear Channel Outdoor Holdings, Inc. (NYSE: CCO).

Mr. Hobson has significant financial and corporate management

experience, including with respect to the media industry. His experience in critical financial analysis and strategic planning

brings essential skills and a unique perspective to the Board. In addition, his significant financial accounting experience makes

him well suited to serve on the Audit Committee.

Brian G. Kushner, age 62, has, since 2009, served

as a Senior Managing Director at FTI Consulting, Inc. (NYSE: FCN) (“FTI”), a global business advisory firm, where he

serves as the leader of the Private Capital Advisory Services practice and

as the co-leader of the Technology practice, the Aerospace,

Defense and Government Contracting practice and the Activism and M&A Solutions practice. Prior to joining FTI, Dr. Kushner

was the co-founder of CXO, L.L.C., a boutique interim and turnaround management consulting firm that was acquired by FTI at the

end of 2008. Dr. Kushner has served the Chief Executive Officer (“CEO”) or interim CEO of over a dozen companies, including

as the Acting Chair, President and CEO of Sage Telecom, a telecommunications company; as Managing Member and CEO of DLN Holdings,

a defense contractor; and, before Sage, as President and CEO of Pacific Crossing Limited, a trans-Pacific telecommunications company.

Dr. Kushner periodically served as Chief Restructuring Officer (or in an analogous position) of companies which elected to utilize

bankruptcy proceedings as a part of their financial restructuring process and, as such, he served as an executive officer of various

companies which filed bankruptcy petitions under federal law, including, among others, Relativity Media LLC in 2015. Dr. Kushner

currently serves on the board of directors of Resideo Technologies, Inc. (NYSE: REZI), Gibson Brands, Inc. and Mudrick Capital

Acquisition Corporation II (NASDAQ: MUDS). He has previously served on the board of directors of Thryv, Inc. (NASDAQ: THRY), DevelopOnBox

Holding, LLC d/b/a Zodiac Systems, Luxfer Holdings PLC (NYSE: LXFR), Pacific Crossing Limited, Damovo Group, Everyware Global,

Inc. (now The Oneida Group), DLN Holdings, LLC and Caribbean Asset Holdings LLC.

Dr. Kushner brings extensive financial and corporate management

experience to our Board of Directors, as evidenced by the variety of CEO and other senior management positions he has held throughout

his career. Dr. Kushner has also served as a member of the board of directors of over a dozen public and private companies, which

allows him to leverage his experience for the further benefit of the Company. In addition, Dr. Kushner’s significant financial

experience brings essential skills and a unique perspective to his services on the Audit Committee.

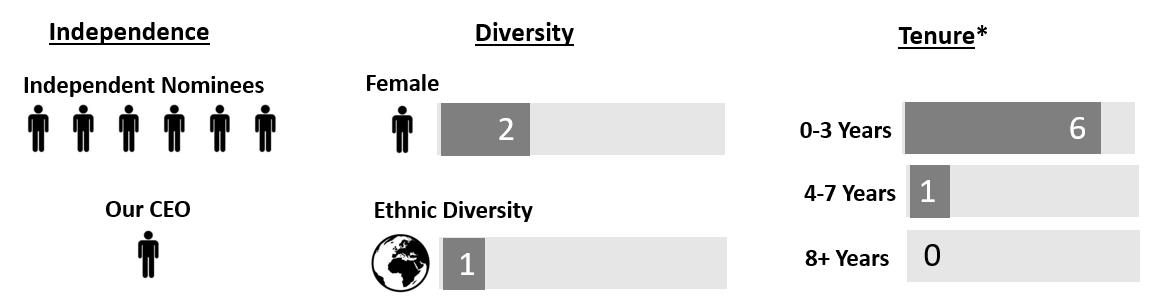

Director-Nominee Composition

Certain highlights of our Board composition include the following:

*Each of the director nominees

was originally appointed to the Board of Directors in connection with our plan of reorganization, which became effective on our

emergence from our Chapter 11 bankruptcy proceedings on June 4, 2018 (the “Emergence”), and was then reelected by our

stockholders at subsequent annual meetings. References to the Company in this proxy statement include its predecessor company for

all periods prior to Emergence.

Recommendation of the Board of Directors

Your Board of Directors recommends a vote FOR each of

the director nominees.

INFORMATION ABOUT THE BOARD OF DIRECTORS

The Board of Directors is elected by our stockholders to

oversee our business and affairs and to assure that the long-term interests of our stockholders are being served. Our business

is conducted by our employees, managers and officers under the direction of the Chief Executive Officer, and with the oversight

of the Board of Directors.

The Board of Directors held 22 meetings during 2020, which

included numerous meetings where the Board was updated on developments related to COVID-19. Each director attended at least 75{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}

of the meetings of the Board of Directors and the committees on which he or she served during the year. During the intervals between

scheduled meetings, the Board periodically is updated by management on business, operational and strategic developments, and engages

in active discussions about such developments. We do not have a formal policy regarding attendance by directors at our annual meetings

of stockholders, but we encourage all incumbent directors, as well as all director nominees, to attend our annual meeting of stockholders.

All director nominees who were then serving as directors of the Company attended last year’s annual meeting of stockholders.

Director Independence

Our Board of Directors has reviewed the standards of independence

for directors established by applicable laws and regulations, including the current listing standards of the NASDAQ Marketplace

Rules, and has reviewed and evaluated the relationships of the directors with the Company and our management. Based upon this review

and evaluation, our Board of Directors has determined that none of the current non-employee members of the Board of Directors or

director nominees has a relationship with the Company or our management that would interfere with such director’s exercise

of independent judgment, and that each non-employee member of the Board of Directors is “independent” as such term

is defined under the NASDAQ Marketplace Rules. The independent directors meet periodically in executive sessions.

Board of Directors Leadership Structure

Andrew W. Hobson serves as Chairman of the Board of Directors.

As Chairman of the Board of Directors, Mr. Hobson’s

responsibilities include, among others:

| · | providing oversight of corporate governance matters; |

| · | developing Board of Directors meeting agendas; |

| · | overseeing and managing any potential conflict of interest issues; |

| · | coordinating communication and integration across committees; and |

| · | presiding over Board meetings and executive sessions of the independent directors. |

In light of the ongoing challenging general economic, business

and competitive environment, the Board of Directors believes the separation of the Chairman and Chief Executive Officer roles remains

appropriate as it enhances oversight of management by the Board of Directors, Board independence, and accountability to our stockholders.

In addition, it allows Ms. Berner, our President and Chief Executive Officer, to dedicate substantially all of her professional

time and attention to the significant operational demands facing the Company.

We believe that the foregoing structure and responsibilities,

when combined with the Company’s other governance policies and procedures, provide appropriate opportunities for oversight,

discussion and evaluation of decisions and direction from the Board of Directors.

Committees of the Board of Directors

The Board of Directors has an Audit Committee, a Compensation

Committee and a Nominating Committee. Each committee operates pursuant to a written charter in compliance with the applicable provisions

of the Sarbanes-Oxley Act of 2002, the related rules of the Securities and Exchange Commission (the “SEC”) and the

NASDAQ Marketplace Rules. Copies of these charters are available on our corporate website, at www.cumulusmedia.com.

The Audit Committee. The purpose of the Audit Committee

is to assist our Board of Directors in fulfilling its oversight responsibilities with respect to:

| · | our accounting, reporting and financial practices, including the integrity of our financial statements; |

| · | our compliance with legal and regulatory requirements; |

| · | the independent auditors’ qualifications and independence; and |

| · | the performance of the independent auditors. |

The Audit Committee is responsible for overseeing our accounting

and financial reporting processes and the audits of our financial statements on behalf of our Board of Directors. The Audit Committee

is directly responsible for the appointment, compensation, retention and oversight of the work of our independent registered public

accounting firm (including resolution of any disagreements between our management and our independent registered public accounting

firm regarding financial reporting), and our independent registered public accounting firm reports directly to the Audit Committee.

The Audit Committee met four times in 2020. The current members

of the Audit Committee are Brian G. Kushner (Chairman), Thomas H. Castro and Andrew W. Hobson. Our Board of Directors has determined

that each Audit Committee member is “independent,” as such term is defined under the rules of the SEC and the NASDAQ

Marketplace Rules applicable to audit committee members, and meets the financial literacy requirements of the NASDAQ Marketplace

Rules. No member of the Audit Committee participated in the preparation of our, or our subsidiaries’, financial statements

at any time during the past three years. In addition, our Board of Directors has determined that Dr. Kushner (1) is an “audit

committee financial expert,” as such term is defined under the rules of the SEC, and (2) meets the NASDAQ Marketplace Rules’

professional experience requirements. In making such determination, the Board of Directors took into consideration, among other

things, the express provision in Item 407(d) of SEC Regulation S-K that the determination that a person has the attributes of an

audit committee financial expert shall not impose any greater responsibility or liability on that person than the responsibility

and liability imposed on such person as a member of the Audit Committee and the Board of Directors, nor shall it affect the duties

and obligations of other Audit Committee members or the Board of Directors.

The Compensation Committee. The Compensation Committee

oversees the determination of all matters relating to employee compensation and benefits and specifically reviews and approves

salaries, bonuses and equity-based compensation for our executive officers.

Our Board of Directors has delegated specifically to the

Compensation Committee the following areas of responsibilities:

| · | performance evaluation, compensation and development of our executive officers; |

| · | establishment of performance objectives under the Company’s short- and long-term incentive compensation arrangements and determination of the attainment of such performance objectives; and |

| · | oversight and administration of benefit plans. |

The Compensation Committee generally consults with management

in addressing executive compensation matters. Subject to applicable parameters in various employment agreements entered into with

our executive officers, our Chief Executive Officer, based on the performance evaluations of the other executive officers, recommends

to the Compensation Committee compensation for those executive officers. The executive officers, including our Chief Financial

Officer, also provide recommendations to the Compensation Committee from time to time regarding key business drivers included in

compensation program design, especially incentive programs, which may include defining related measures and explaining the mutual

influence on or by other business drivers and the accounting and tax treatment relating to certain awards. Our Chief Executive

Officer also provides regular updates to the Compensation Committee regarding current and anticipated performance outcomes, including

the impact on executive compensation. The Compensation Committee has the authority to retain compensation consultants from time

to time as it deems appropriate.

The Compensation Committee met three times in 2020. In between

scheduled meetings, the members of the Compensation Committee receive periodic updates and are active in ensuring that the Company’s

compensation programs remain consistent with marketplace developments and Company performance. The members of the Compensation

Committee during 2020 were David M. Baum (Chairman), Matthew C. Blank and Joan Hogan Gillman. Each of the members of the Compensation

Committee is “independent,” as such term is defined under the NASDAQ Marketplace Rules.

The Nominating Committee. The Nominating Committee

is responsible for:

| · | identifying individuals qualified to become Board members, consistent with criteria approved from time to time by the Board; |

| · | selecting, or recommending that the Board select, the director nominees to election at each annual meeting of stockholders; and |

| · | recommending Board members to serve on the standing committees of the Board. |

The Nominating Committee met two times in 2020. The members

of the Nominating Committee during 2020 were Joan Hogan Gillman (Chairman), Matthew C. Blank and David M. Baum. Each of the members

of the Nominating Committee is “independent,” as such term is defined under the NASDAQ Marketplace Rules.

Risk Oversight

Our Board of Directors as a whole has responsibility for

risk oversight, with reviews of certain areas being conducted by the relevant Board committee, which reports on its deliberations

to the full Board of Directors (except for those risks that require risk oversight solely by independent directors) as further

described below. The Board of Directors believes that this structure for risk oversight is appropriate and, as only independent

directors serve on the Board of Directors’ standing committees, the independent directors have full access to all available

information for risks that may affect us.

The Audit Committee is specifically charged with reviewing

and discussing risk management (primarily financial and internal control risk), and receives regular reports from management (including

legal and financial representatives), independent auditors, internal audit and outside legal counsel on risks related to, among

other things, our financial controls and reporting, covenant compliance under our various financing and other agreements and cost

of capital. The Compensation Committee considers risks related to the Company’s compensation policies and programs, and makes

recommendations to the Board of Directors with respect to whether those compensation policies and programs are properly implemented

to discourage inappropriate risk-taking, and is regularly advised by management (including legal and financial representatives),

outside legal counsel and compensation consultants. In addition, the Company’s management, including the Company’s

General Counsel, regularly communicates with the Board of Directors regarding important risks that merit its review and oversight,

including regulatory risk and risks stemming from periodic litigation or other legal matters in which we are involved. Further,

we believe that our structure separating the Chairman and Chief Executive Officer roles more efficiently and appropriately allows

for identification and assessment of issues that should be brought to the Board of Directors’ attention.

Director Nomination Process

The purposes of the Nominating Committee include, among other

things, identifying individuals qualified to become Board members and recommending candidates to the Board to fill new or vacant

positions. In recommending candidates, the Nominating Committee considers such factors as it deems appropriate, consistent with

criteria approved by the Board and as described in more detail below.

The Nominating Committee does not maintain a formal process

for identifying and evaluating nominees for director. Historically, director candidates had been first identified by evaluating

the current members of our Board of Directors. If a member whose term is expiring at the next succeeding annual meeting of stockholders

no longer wished to continue in service, if the Board of Directors determined to increase the overall size of the Board, or if

our Board of Directors decided not to re-nominate such member, the Nominating Committee would then determine whether to commence

a search for qualified individuals meeting the criteria discussed below.

The Nominating Committee evaluates all candidates based upon,

among other factors, a candidate’s financial literacy, knowledge of our industry and other organizations of comparable size,

other relevant background experience, judgment, skill, integrity, the interplay of a candidate’s experience with the experience

of other Board members, status as a stakeholder, “independence” (for purposes of compliance with the rules of the SEC

and the NASDAQ Marketplace Rules), and willingness, ability and availability for service. There are no stated minimum criteria

for director nominees, although the Nominating Committee may also consider such other factors as it may deem are in the best interests

of us and our stockholders.

The Board of Directors and the Nominating Committee believe

that having a Board of Directors diverse in experience and expertise enables the Board of Directors, as a body, to have the broad

range of requisite expertise and experience to guide the Company and management and to fulfill its role of oversight and stewardship.

Currently, approximately 43{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the Board consists of women or ethnically diverse members, in addition to the diverse skills and

experience represented among all of the directors. Although neither the Board of Directors nor the Nominating Committee has developed

a formal policy with respect to diversity in identifying nominees for director, when evaluating potential nominees, the Nominating

Committee does specifically consider individual characteristics that may bring diversity to the Board of Directors, including gender,

race, national origin, age, professional background, unique skill sets and areas of expertise, among other relevant factors.

Our Bylaws provide for stockholder nominations to our Board

of Directors, subject to certain procedural requirements. To nominate a director to our Board of Directors, a stockholder must

give timely notice of the nomination in writing to our Corporate Secretary not later than 90 days nor earlier than 120 days prior

to the anniversary date of the annual meeting of stockholders in the preceding year. All such notices must include (i) the stockholder’s

name and address, (ii) a representation that the stockholder is one of our stockholders, and will remain so through the record

date for the upcoming annual meeting of stockholders, (iii) the class and number of shares of our common stock that the stockholder

holds (beneficially and of record), and (iv) a representation that the stockholder intends to appear in person or by proxy at the

upcoming annual meeting of stockholders to make the nomination. The stockholder must also provide information on his or her prospective

nominee, including such person’s name, address and principal occupation or employment, a description of all arrangements

or understandings between the stockholder, his or her prospective nominee and any other persons (to be named), the written consent

of the prospective nominee and such other information as would be required to be included in a proxy statement soliciting proxies

for the election of director nominees.

Historically, we have not had a formal policy with regard

to the consideration of director candidates recommended by our stockholders. To date, our Board of Directors has not received any

recommendations from stockholders requesting that it consider a candidate for inclusion among our Board of Directors’ slate

of nominees in our proxy statement. The absence of such a policy does not mean, however, that a recommendation would not have been

considered had one been received, or will not be considered if one is received in the future. Our Board of Directors from time

to time may give consideration to the circumstances in which the adoption of a formal policy would be appropriate.

STOCKHOLDER COMMUNICATION WITH THE

BOARD OF DIRECTORS

Any matter intended for our Board of Directors, or for any

individual member or members of our Board of Directors, should be directed to Richard S. Denning, Corporate Secretary, at our principal

executive offices, 3280 Peachtree Road, N.W., Suite 2200, Atlanta, Georgia 30305, with a request to forward the same to the intended

recipient. In the alternative, stockholders may direct correspondence to our Board of Directors to the attention of the chairman

of the Audit Committee of the Board of Directors, in care of Richard S. Denning, Corporate Secretary, at our principal executive

offices. All such communications will be forwarded unopened.

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Delinquent Section 16(a) Reports

Pursuant to Section 16(a) of the Securities Exchange Act

of 1934 (“Section 16(a)”), our directors and executive officers, and any persons who beneficially own more than 10{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}

of our common stock, are required to file initial reports of ownership and reports of changes in ownership with the SEC. Based

upon our review of copies of such reports for our 2020 fiscal year and written representations from our directors and executive

officers, we believe that our directors and executive officers, and beneficial owners of more than 10{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of our common stock, timely

complied with all applicable filing requirements for our 2020 fiscal year, except that Messrs. Denning, Milner and Walker and Mss. Berner

and Grimes each did not timely file a change in ownership on Form 4 relating to three transactions, each of which was filed late

due to inadvertent administrative error.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table lists information concerning the

beneficial ownership of our common stock as of March 12, 2021 (unless otherwise noted) by (1) each person known to us to beneficially

own more than 5{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of any class of our voting common stock, (2) each of our directors and director nominees, and each of our named

executive officers (as defined below), and (3) all of our current directors and executive officers as a group.

|

Class |

||

|

Name |

Number |

Percentage |

| David M. Baum | 31,837(2) | * |

| Matthew C. Blank | 31,837(2) | * |

| Thomas H. Castro | 31,837(2) | * |

| Joan Hogan Gillman | 31,837(2) | * |

| Andrew Hobson | 59,044(3) | * |

| Brian G. Kushner | 31,837(2) | * |

| Mary G. Berner | 198,308 (4) | 1.1{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

| Richard S. Denning | 35,973(5) | * |

| Francisco J. Lopez-Balboa | 22,500(6) | * |

| All current directors and executive officers as a group (12 persons) | 577,123(7) | 3.2{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

| Eaton Vance Management(8) | 2,722,321 | 15.1{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

| SP Signal Manager, LLC(9) | 1,792,000 | 9.9{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

| Zazove Associates, LLC (10) | 1,457,909 | 8.1{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

*Indicates less than one percent

| (1) | Each share of Class A common stock entitles its holder to one vote on each matter to be voted upon by stockholders. |

| (2) | Includes 2,701 shares of Class A common stock underlying options that are either presently exercisable or will become exercisable within 60 days after March 12, 2021 and 4,554 shares of unvested restricted stock that will vest within 60 days after March 12, 2021. |

| (3) | Includes 5,402 shares of Class A common stock underlying options that are either presently exercisable or will become exercisable within 60 days after March 12, 2021 and 8,220 shares of unvested restricted stock that will vest within 60 days after March 12, 2021. |

| (4) | Includes 124,249 shares of Class A common stock underlying options that are either presently exercisable or will become exercisable within 60 days after March 12, 2021. |

| (5) | Includes 19,940 shares of Class A common stock underlying options that are either presently exercisable or will become exercisable within 60 days after March 12, 2021. |

| (6) | Includes 15,000 shares of Class A common stock underlying options that are either presently exercisable or will become exercisable within 60 days after March 12, 2021 and 7,500 shares of unvested restricted stock that will vest within 60 days after March 12, 2021. |

| (7) | Includes 238,425 shares of Class A common stock underlying options that are either presently exercisable or will become exercisable within 60 days after March 12, 2021 and 38,490 shares of unvested restricted stock that will vest within 60 days after March 12, 2021. |

| (8) | This information is based in part on a Schedule 13G/A filed with the SEC on February 12, 2021, by Eaton Vance Management, which stated that Eaton Vance Management has sole voting power and sole dispositive power over 2,722,321 shares. The address of Eaton Vance Management is 2 International Place, Boston, Massachusetts 02110. |

| (9) | This information is based in part on a Schedule 13G/A filed with the SEC on February 14, 2020, by SP Signal Manager, SP Signal and Edward A. Mulé, which stated that SP Signal Manager has sole voting power and sole |

| dispositive power, and SP Signal and Edward A. Mulé have shared voting power and shared dispositive power, over 1,792,000 shares. The address of SP Signal Manager, SP Signal and Edward A. Mulé is Two Greenwich Plaza, Greenwich, Connecticut 06830. |

| (10) | This information is based in part on a Schedule 13G filed with the SEC on January 20, 2021, by Zazove Associates, LLC (“Zazove”) and Gene T. Pretti, which stated that Zazove and Mr. Pretti have sole voting power and sole dispositive power over 1,457,909 shares. The address of Zazove and Mr. Pretti is 1001 Tahoe Blvd., Incline Village, NV 89451. |

For the year ended December 31, 2020, our Chief Executive

Officer and our two other most highly compensated executive officers, who we refer to as our named executive officers, were:

| · | Mary G. Berner, our President and Chief Executive Officer; |

| · | Francisco J. Lopez-Balboa, our Executive Vice President and Chief Financial Officer; and |

| · | Richard S. Denning, our Executive Vice President, Secretary and General Counsel. |

Smaller Reporting Company

The Company is a Smaller Reporting Company,

as defined in Rule 12b-2 of the Securities Exchange Act of 1934 and, accordingly, has conformed certain information required in

this Proxy Statement to the applicable scaled disclosure obligations. Under the scaled disclosure obligations, the Company is not

required to provide, among other things, a Compensation Discussion and Analysis and certain other tabular and narrative disclosures

relating to executive compensation.

Summary Compensation Table

The following table summarizes the total compensation paid

to or earned by each of the named executive officers for the fiscal years ended December 31, 2020 and December 31, 2019.

|

Year |

Salary |

Bonus |

Stock |

Options |

Non-Equity |

All |

Total |

|

| Mary G. Berner | 2020 | 1,341,250 | — | 1,317,600 | 486,000 | — | 7,313 | 3,152,163 |

| President and Chief Executive Officer | 2019 | 1,450,000 | — | 834,120 | — | 1,690,291 | 5,566 | 3,979,977 |

| Francisco J. Lopez-Balboa | 2020 | 569,445 | — | 270,000 | 136,200 | — | 100 | 975,745 |

| Executive Vice President, Chief Financial Officer | 2019 | — | — | — | — | — | — | — |

| Richard S. Denning | 2020 | 562,502 | — | 234,240 | 86,400 | — | 3,756 | 886,898 |

| Executive Vice President, Secretary and General Counsel | 2019 | 600,000 | — | 132,400 | — | 349,715 | 3,656 | 1,085,772 |

| (1) | See “Employment Agreements with Named Executive Officers– Temporary Reductions in Base Salary” below. |

| (2) | Reflects the grant date fair value of awards calculated in accordance with FASB ASC Topic 718. Performance stock awards assume all grants were made in the initial year. See note 11 of the consolidated financial statements in the Company’s annual report on Form 10-K for the year ended December 31, 2020 for certain assumptions underlying the fair value of awards. |

| (3) | See “Non-Equity Incentive Plan Compensation” below. |

Employment Agreements with Named Executive Officers

Berner Employment Agreement

On September 29, 2015, we entered into an employment agreement

with Ms. Berner, pursuant to which she agreed to serve as our President and Chief Executive Officer, and which remained in

effect following Emergence with an initial term through September 29, 2019 and contained a provision for automatic extensions of

one-year periods thereafter, unless terminated in advance by either party in accordance with the terms of the agreement. On March

19, 2020, we entered into a new employment agreement with Ms. Berner (the “Berner Employment Agreement”), which

extended the term of her existing agreement through December, 31, 2022, and contains a provision for automatic extensions of one-year

periods thereafter, unless terminated in advance by either party in accordance with the terms of the agreement. Pursuant to the

Berner Employment Agreement, Ms. Berner is entitled to receive an annual base salary of $1,450,000 million, subject to increase.

The Berner Employment Agreement also provides that Ms. Berner

is eligible for an annual cash bonus based upon achievement of annual performance goals for Ms. Berner and/or the Company

determined by the Compensation Committee each year. The annual cash bonus is calculated as a percentage of Ms. Berner’s

base salary, with a target award opportunity of 100{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of Ms. Berner’s base salary and a maximum award opportunity of

150{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of Ms. Berner’s base salary. Notwithstanding these target and maximum award opportunities, the Berner Employment

Agreement provides that the Compensation Committee may adjust upward the target and maximum award opportunities for Ms. Berner

for each year.

Lopez-Balboa Employment Agreement

On March 19, 2020, we entered into an employment agreement

with Mr. Lopez-Balboa (the “Lopez-Balboa Employment Agreement”). The Lopez-Balboa Employment Agreement has an initial

term through March 23, 2023 and contains a provision for automatic extensions of one-year periods thereafter, unless terminated

in advance by either party in accordance with the terms of the agreement. Pursuant to the agreement, Mr. Lopez-Balboa is entitled

to receive an annual base salary of $800,000, subject to further increase.

The Lopez-Balboa Employment Agreement also provides that

Mr. Lopez-Balboa is eligible for an annual cash bonus based upon achievement of annual performance goals for Mr. Lopez-Balboa and/or

the Company determined by the Compensation Committee each year. The annual cash bonus is calculated as a percentage of Mr. Lopez-Balboa’s

base salary, with a target award opportunity of 100{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of Mr. Lopez-Balboa’s base salary and a maximum award opportunity of

150{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of Mr. Lopez-Balboa’s base salary. Notwithstanding these target and maximum award opportunities, the Lopez-Balboa Employment

Agreement provides that the Compensation Committee may adjust upward the target and maximum award opportunities for Mr. Lopez-Balboa

for each year.

Denning Employment Agreement

On November 29, 2011, we entered into an employment agreement

with Mr. Denning (as amended, the “Denning Employment Agreement”). The Denning Employment Agreement, which remained

in effect following Emergence, currently has a term through November 29, 2021, and contains a provision for automatic extensions

of one-year periods thereafter, unless terminated in advance by either party in accordance with the terms of the agreement. Pursuant

to the agreement, Mr. Denning is entitled to receive an annual base salary of $600,000, subject to further increase.

The Denning Employment Agreement also provides that Mr. Denning

is eligible for an annual cash bonus based upon achievement of performance criteria or goals set forth in an executive incentive

plan. The annual cash bonus is calculated as a percentage of Mr. Denning’s base salary, with a current target award

opportunity of 50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}, or a higher amount as determined by the Chief Executive Officer. If in any given year the Compensation Committee

does not approve an executive incentive plan proposed by the Chief Executive Officer, or the Chief Executive Officer elects not

to propose an executive incentive plan, the basis for annual cash bonuses to Mr. Denning will be governed by the bonus provisions

in his employment agreement that were in effect immediately prior to January 1, 2016, pursuant to which Mr. Denning is entitled

to receive an annual cash bonus based upon the achievement of Company and/or individual annual performance goals determined by

the Compensation Committee, with a target award opportunity of 40{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} and a maximum award opportunity of 60{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of base salary. In any

year in which the Compensation Committee approves an executive incentive plan, it may adjust, only in respect of that year, the

target bonus applicable for Mr. Denning.

Temporary Reductions in Base Salary

As a result of the COVID-19 global pandemic and related measures

and guidelines, the Company experienced a sudden and significant decline in revenues in the spring of 2020 along with a negative

impact on our business including our results of operations, financial condition and liquidity. During this challenging time, our

named executive officers agreed to a temporary reduction in pay from April 1, 2020 to June 30, 2020. The reductions agreed upon

by each of the named executive officers were as follows: Ms. Berner (30{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}), Mr. Lopez-Balboa (25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}) and Mr. Denning (25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}).

Non-Equity Incentive Plan Compensation

In February 2020, the Board of Directors adopted the Company’s

annual quarterly incentive plan, in which named executive officers participate (the “2020 QIP”).

Award opportunities to the named executive officers under

the 2020 QIP were based on the Company achieving budgeted adjusted earnings before interest, taxes, depreciation and amortization

(“EBITDA”) levels. The table below sets out the threshold, target and maximum EBITDA performance goals established

for 2020 by the Compensation Committee in February 2020:

|

2020 EBITDA |

||

|

Threshold |

Target |

Maximum |

| $194,700,000 | $216,300,000 | $237,900,000 |

The target cash incentive award opportunity available to

each named executive officer under the 2020 QIP was calculated as a percentage of each named executive officer’s base salary,

all in accordance with the terms of each such officer’s employment agreement. The table below sets out the target cash incentive

award opportunity for each named executive officer as a percentage of base salary, as further described in “Employment Agreements

with Named Executive Officers” above:

|

Name |

Target |

| Mary G. Berner | 100{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

| Francisco J. Lopez-Balboa | 100{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

| Richard S. Denning | 50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} |

Under the 2020 QIP, performance was measured at the end of

each quarter, beginning with the quarter ended March 31, 2020, based on year-to-date performance at the end of the respective quarter.

If target performance levels for the year-to-date period were met or exceeded, 12.5{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the total annual target bonus would be

awarded following the applicable quarter end. If, at the completion of any quarter, target performance levels for the year-to-date

period (other than the full year period) were not met, no payment was made for that period.

Following the end of the year, actual annual performance

would be compared to the threshold, target and maximum performance goals. If the Company achieved the full-year 2020 threshold

EBITDA goal, each named executive officer would be entitled under the 2020 QIP to a total payout for the full year equal to 50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}

of his or her respective 2020 QIP target award opportunity. If the Company met or exceeded the full-year 2020 maximum EBITDA goal,

each named executive officer was entitled under the 2020 QIP to a total payout for the full year equal to 150{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of his or her respective

2020 QIP target award opportunity. Actual performance between threshold and target or target and maximum would result in payout

amounts determined by linear interpolation.

For 2020, no payouts were made under the 2020 QIP based on

an assessment of year-to-date performance at the end of each respective quarter of 2020, and based on the full-year 2020 threshold

EBITDA goal at the end of the year.

Long-Term Incentive Plan

Upon Emergence, the Company’s predecessor supplemental

incentive plan was terminated and replaced by the Company’s long-term incentive plan (the “Long-Term Incentive Plan”).

The Long-Term Incentive Plan was intended to, among other things, help attract, motivate and retain key employees and directors

and to reward them for making major contributions to the success of the Company. The Long-Term Incentive Plan generally provides

for the following types of awards: stock options (including incentive options and nonstatutory options); restricted stock; stock

appreciation rights; dividend equivalents; other stock based awards; performance awards; and cash awards. The Long-Term Incentive

Plan was succeeded by the Cumulus Media Inc. 2020 Equity Incentive Compensation Plan, which the Company’s stockholders approved

on April 30, 2020.

In February 2020, the Board of Directors approved long-term

incentive awards pursuant to, and in accordance with, the Long-Term Incentive Plan.

The value of the awards that were granted in 2020 to each

of the named executive officers under the Long-Term Incentive Plan were as follows:

| Name |

Stock Awards(1) |

|||

| Mary G. Berner | $ | 1,803,600 | ||

| Francisco J. Lopez-Balboa | $ | 406,200 | ||

| Richard S. Denning | $ | 320,640 | ||

| (1) | Reflects the grant date fair value of awards calculated in accordance with FASB ASC Topic 718. Performance stock awards assume all grants were made in the initial year. See note 11 of the consolidated financial statements in the Company’s annual report on Form 10-K for the year ended December 31, 2020 for certain assumptions underlying the fair value of awards. |

In order to provide a balance between retention and performance

for the executive officers, and to further incentivize them toward the creation of long-term value, 25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the award consisted

of time-based restricted stock units with a four-year vesting schedule beginning one year from the date of grant in equal installments,

50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the award consisted of stock options with a four-year vesting schedule beginning one year from the date of grant in equal

installments and 25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the award consisted of performance-based restricted stock units with a four-year vesting schedule beginning

one year from the date of grant in equal installments.

The performance-based restricted stock units vesting in any

year may be earned in a range of 0{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} to 100{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the initial shares awarded. The performance-based restricted stock units are earned

based on Company performance under the Board of Directors approved annual EBITDA performance goals for each of 2020, 2021, 2022

and 2023, respectively, which the Board of Directors establishes at the beginning of each respective year. For more information

on the annual EBITDA performance goals for 2020, see “Non-Equity Incentive Plan Compensation” above.

Each of the awards under the Long-Term Incentive Plan are

subject to clawback provisions that require that such awards be forfeited or repaid to the Company in the event of certain acts

of fraud or misconduct that result in a material restatement of the Company’s financial results.

Outstanding Equity Awards at 2020 Fiscal Year-End

The following table sets forth the number and value of shares

of restricted stock and stock options held by each named executive officer that were outstanding as of December 31, 2020. All awards

relate to shares of Class A common stock. The value of restricted stock awards was calculated based on a price of $8.72 per share,

the closing price of the Company’s Class A common stock on December 31, 2020.

|

Options |

Stock |

||||||||

|

Number |

Number |

Equity |

Option |

Option |

Number |

Market |

Equity |

Equity |

|

| Mary G. Berner |

— | 169,583 (1) | — | 25.70 | 6/5/2023 | — | — | 33,917 (4) | 295,756 |

| — | 90,000 (2) | — | 14.64 | 2/13/2025 | — | — | 36,400 (5) | 317,408 | |

| — | — | — | — | — | — | — | 78,750 (6) | 686,700 | |

| Francisco J. Lopez- Balboa |

— | 60,000 (3) | — | 4.50 | 3/23/2025 | — | — | 52,500 (7) | 457,800 |

| Richard S. Denning |

— | 26,568 (1) | — | 25.70 | 6/5/2023 | — | — | 5,314 (4) | 46,338 |

| — | 16,000 (2) | — | 14.64 | 2/13/2025 | — | — | 5,778 (5) | 50,383 | |

| — | — | — | — | — | — | — | 14,000 (6) | 122,080 |

| (1) | 60{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the award of this option has currently vested, the remaining 40{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} will vest in equal amounts on June 5, 2021 and June 5, 2022. |

| (2) | 25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the award of this option has currently vested, the remaining 75{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} will vest in equal amounts on February 13, 2022, February 13, 2023 and February 13, 2024. |

| (3) | 25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the award of this option has currently vested, the remaining 75{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} will vest in equal amounts on March 23, 2022, March 23, 2023 and March 23, 2024. |

| (4) | 100{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents time-based RSUs vesting in equal parts on June 5, 2021 and June 5, 2022. |

| (5) | (i) 19{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents performance-based RSUs, which will vest on December 31, 2021 subject to certain performance criteria that may decrease the ultimate amount earned; and (ii) the remaining 81{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents time-based RSUs, 43{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the time-based RSUs has currently vested, the remaining 57{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} will vest in equal amounts on February 1, 2022 and February 1, 2023. |

| (6) | (i) 43{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents performance-based RSUs, which will vest in equal amounts on December 31, 2021, December 31, 2022 and December 31, 2023, subject to certain performance criteria that may decrease the ultimate amount earned; and (ii) the remaining 57{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents time-based RSUs, 25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the time-based RSUs has currently vested, the remaining 75{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} will vest in equal amounts on February 1, 2022, February 1, 2023, and February 1, 2024. |

| (7) | (i) 43{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents performance-based RSUs, which will vest in equal parts on December 31, 2021, December 31, 2022 and December 31, 2023, subject to certain performance criteria that may decrease the ultimate amount earned; and (ii) the remaining 57{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of this amount represents time-based RSUs, 25{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the time-based RSUs has currently vested, the remaining 75{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} will vest in equal amounts on March 23, 2022, March 23, 2023 and March 23, 2024. |

Securities Authorized for Issuance Under Equity Incentive

Plans

The following table sets forth, as of December 31, 2020,

the number of securities outstanding under our equity compensation plans, the weighted average exercise price of such securities,

if applicable, and the number of securities available for grant under these plans:

|

Plan |

To |

Weighted-Average |

Number |

| Equity Compensation Plans Approved by Stockholders | 771,114 | 20.00 | 2,504,315 |

| Equity Compensation Plans Not Approved by Stockholders |

— |

— |

— |

| Total |

771,114 |

20.00 |

2,504,315 |

Director Compensation

We use a combination of cash and stock-based incentive compensation

to attract and retain qualified candidates to serve on our Board. In setting director compensation, we consider the significant

amount of time that directors expend in fulfilling their duties as directors as well as the expertise and knowledge required.

In response to the COVID-19 pandemic, the Company announced