Gibson Dunn | 2020 Year-End Update on Corporate Non-Prosecution Agreements and Deferred Prosecution Agreements

60 min readJanuary 19, 2021

Click for PDF

The world changed significantly in 2020. Amid the uncertainty wrought by COVID-19, however, the use of corporate non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”) by the U.S. Department of Justice (“DOJ”) proved to be a constant.[1] The year 2020 proved to be a record-breaking year in terms of the sums recovered through corporate resolutions, and the busiest full year under this Administration’s Justice Department when measured by the number of agreements concluded.

In this client alert, the 23rd in our series on NPAs and DPAs, we: (1) report key statistics regarding NPAs and DPAs from 2000 through 2020; (2) analyze the possible effect of the upcoming change in presidential administrations on corporate enforcement; (3) discuss recent commentary from DOJ suggesting a possible increase in focus on compliance programs; (4) take an in-depth look at the increased use of DPAs by DOJ’s Antitrust Division; (5) summarize 2020’s publicly available federal corporate NPAs and DPAs; and (6) survey recent developments in DPA regimes abroad.

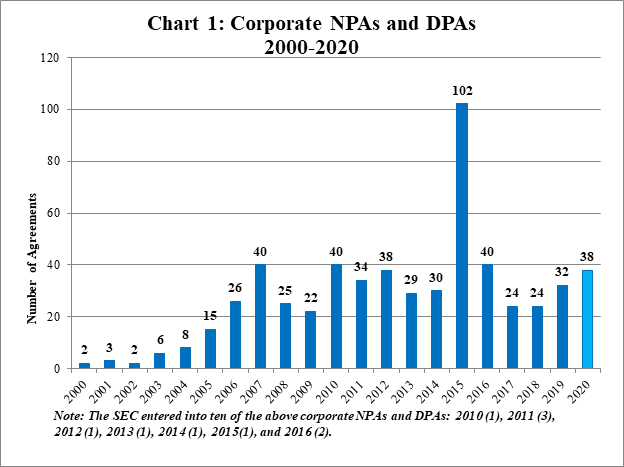

Chart 1 below shows all known corporate NPAs and DPAs from 2000 through 2020. Of 2020’s 38 total NPAs and DPAs, 9 are NPAs and 29 are DPAs. DOJ also entered into one public NPA addendum. The SEC, consistent with its trend since 2016, did not enter into any NPAs or DPAs in 2020.

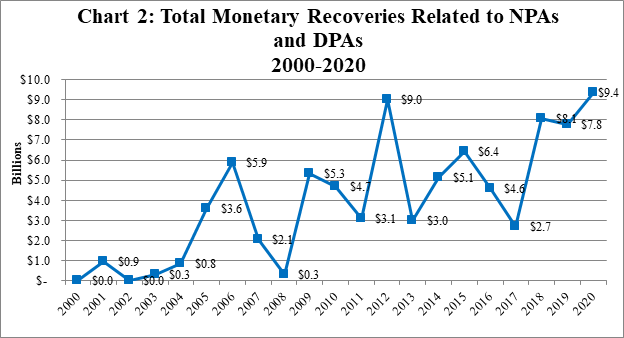

Chart 2 reflects total monetary recoveries related to NPAs and DPAs from 2000 through 2020. At nearly $9.4 billion, recoveries associated with NPAs and DPAs in 2020 are the highest for any year since 2000, surpassing even the prior record-high recoveries in the year 2012. As in 2012, the large recovery amount in 2020 was driven by a small number of settlements of over $1 billion apiece. In fact, in 2020, approximately 53{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of the total monetary recoveries were attributable to the two largest resolutions. And enforcement in the financial sector was particularly active in 2020, with financial institutions accounting for the four largest resolutions. At the same time, 2020 witnessed a record-breaking 13 resolutions each with total recoveries of $100 million or more—more agreements over the $100 million threshold than in any other year in the last two decades. Together, these top 13 resolutions (which included the two largest ones discussed above) accounted for approximately 94{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of total recoveries in 2020. With recoveries in 2020 totaling nearly twice the average yearly recoveries from 2005 through 2020, it remains to be seen whether 2020 proves an outlier, or whether the overall trend towards more resolutions above the $100 million and $1 billion thresholds continues.

2020 in Context

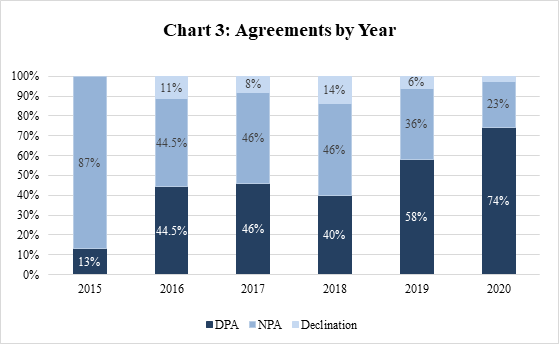

Twenty-nine of the 39 resolutions concluded in 2020 (including one declination and excluding an NPA addendum) have been DPAs. As illustrated in Chart 3 below and discussed in our Mid-Year Update, a larger number of DPAs compared to NPAs signals a notable decline in the percentage of NPAs on an annual basis. As we discussed in the mid-year update, this could signal a shift toward requiring self-disclosure to achieve an NPA, and reserving NPAs only for those cases that otherwise present unusual mitigating circumstances.[2]

Only nine companies received NPAs in 2020. One, Patterson Companies Inc., appears to have received credit for voluntarily disclosing conduct “beyond [its subsidiary’s] conduct set forth in the [related] Information and Plea Agreement.”[3] None of the remaining eight companies appear to have received voluntary self-disclosure credit, but many of the resolutions referenced unusual mitigating circumstances. For example, the potential for significant collateral consequences likely factored into at least two of the NPAs. Specifically, the NPA entered with Alutiiq International Solutions, LLC (“AIS”) cited the fact that AIS’s profits went directly to support Alaskan Native shareholders, who are residents of, or descendants of residents of, two Alaska Native villages that are severely economically disadvantaged.[4] The NPA with Progenity, Inc. (“Progenity”) explicitly noted the “significant collateral consequences to health care beneficiaries and the public from further criminal prosecution of Progenity.”[5] One NPA, for Bank Hapoalim B.M. (“BHBM”) and Bank Hapoalim (Switzerland) Ltd. (“BHS”), expressly involved extraordinary remedial measures or redress of the misconduct through other means. In that agreement, BHBM substantially exited the private banking business outside of Israel and represented that it would close BHS.[6] Conditions leading to concern that a company would go out of business may have weighed in favor of unusual leniency in the context of 2020’s agreements. Power Solutions (“PSI”) entered an NPA after already settling a civil class action lawsuit related to the misconduct and paying the SEC a civil monetary fine.[7] The resolution noted that PSI would not be able to pay a criminal penalty “without seriously jeopardizing the Company’s continued viability.”[8] The successful prosecution of six individuals and their subsequent guilty pleas for conspiring to impede the lawful functions of the EPA and Department of Transportation and to violate the Clean Air Act was likely a factor in the government’s decision to enter an NPA with Select Energy Services, Inc. (“SES”)—DOJ has noted that the adequacy of prosecution of individuals is one consideration when making charging decisions. Finally, substantial cooperation likely contributed to the government’s decision to not prosecute Jia Yuan USA Co., Inc. Jia Yuan proactively provided the government with records located in China and also made the chairman available for an interview “while he was located outside the reach of U.S. law enforcement.”[9]

2015 calculated including the 80 Swiss Bank Program NPAs. With the Swiss Bank NPAs removed, the 2015 percentages are 59{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} DPAs and 41{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} NPAs.

Corporate Enforcement in the Biden Administration

Any changes to the DOJ enforcement landscape following the inauguration of Joseph R. Biden Jr. on January 20, 2021 are difficult to predict. Historically, the overall level of corporate enforcement has remained largely steady with each change in administration and typically is not politicized in one direction or another—as evidenced most recently by the large recoveries under both the Obama and Trump Administrations. Specific policies and priorities, however, including around corporate enforcement, do tend to shift when administrations change. Corporate enforcement priorities under the Biden Administration will largely be driven by Attorney General nominee Merrick Garland, as well as by other officials such as Lisa Monaco, President-elect Biden’s nominee for Deputy Attorney General (“DAG”), the second highest ranking position in the Justice Department. We have discussed in our prior updates instances in which then-current DAGs have articulated their corporate enforcement priorities in written guidance to DOJ prosecutors. In the two most recent examples, then-DAG Rod Rosenstein in 2018 issued a memorandum (the “Rosenstein Memorandum”) promoting coordination of corporate resolution penalties among DOJ components and between DOJ and other agencies,[10] and then-DAG Sally Yates penned a memorandum (the “Yates Memorandum”) encouraging individual accountability in corporate enforcement.[11] Typically, DAG memoranda have served to develop or emphasize particular aspects of corporate enforcement that DOJ leadership sees as priorities, rather than to effect top-to-bottom overhauls of DOJ’s approach to enforcement. While Ms. Monaco, who was Homeland Security and Counterterrorism Advisor to President Obama and has served in a number of senior roles at DOJ,[12] may continue this trend, it remains to be seen what her precise priorities will be in the area of corporate enforcement.

What we can glean from public statements by President-elect Biden regarding corporate misconduct suggests that enforcement efforts by DOJ will remain robust. After 1985, when Mr. Biden asked, “[H]ow long can a democratic society dependent upon the confidence of its people afford to tolerate legal and corporate standards that deviate significantly from traditional expectations for honesty and accountability among power-holders?,”[13] Mr. Biden authored a number of “tough on crime” provisions throughout his time in the Senate, including the 1994 Crime Bill, and a provision of the Sarbanes-Oxley Act that increased penalties on individual corporate officers for misleading their companies’ pension funds about the value of the companies’ stocks and for failing to sign off on financial reports to the SEC.[14] History suggests that DOJ’s approach to corporate resolutions is unlikely to change significantly with a new administration, but President-elect Biden’s consistently strong stance on corporate accountability is a reminder of the perspective he will bring to what are already deeply ingrained approaches to investigating and prosecuting white-collar crime.

Judge Garland, a sitting judge on the U.S. Court of Appeals for the D.C. Circuit, became a household name as the president’s choice to replace the late Associate Justice Antonin Scalia on the U.S. Supreme Court prior to the 2016 election. Earlier in his career, Judge Garland served as Deputy Assistant Attorney General for the Criminal Division and as Principal Associate Deputy Attorney General in the Clinton Administration.[15] Given his background, Judge Garland is likely to continue DOJ’s sharp focus on white-collar enforcement. And, given the central role NPAs and DPAs have come to play both in securing large recoveries for the government and in influencing companies’ approach to compliance, we can expect that these resolution vehicles will continue to feature prominently in the new administration.

In the coming year, we may also expect to see increased involvement by Congress in overseeing DOJ’s use of NPAs and DPAs, at least in certain areas of corporate enforcement. The bipartisan National Defense Authorization Act,[16] which became law despite President Trump’s veto,[17] contains (among other provisions regarding the Bank Secrecy Act (“BSA”)) a provision specific to corporate resolutions concerning violations of the BSA. The provision requires DOJ to submit to Congress an annual report of all “deferred prosecution agreements and non-prosecution agreements that [DOJ] has entered into, amended, or terminated during the year covered by the report with any person [or corporate entity] with respect to a violation or suspected violation of the [BSA],” including the justifications for the decision and a list of factors considered in making that determination.[18] Although this provision is specific to one area of corporate enforcement and as such may represent at most an incremental step towards increased congressional oversight, it may show a willingness by both sides of the aisle to wade into aspects of the enforcement process over which DOJ has historically had significant discretion.

Focus on Corporate Compliance Programs

Since DOJ’s June 2020 updates to the Criminal Division’s guidance on the “Evaluation of Corporate Compliance Programs”—which Gibson Dunn addressed in a prior client alert—the defense bar and DOJ alike have increasingly focused on corporate compliance program health in resolving investigations. In September 2020, the then-Acting Assistant Attorney General emphasized the importance of this focus, stressing the importance of “corporate rehabilitation” through compliance program improvements.[19] He further explained that the Criminal Division had “moved away from simply seeking ever-larger fine payments from corporations, and [was] in every case taking great care to achieve the maximum public benefit available using all of the tools at [DOJ’s] disposal, be they fines, other monetary payments, improvements to internal processes such as compliance or reporting functions, or any number of oversight and assurance mechanisms.”[20] Though the Acting Assistant Attorney General did not specifically discuss DPAs or NPAs, his remarks indicated that DOJ will continue to scrutinize compliance programs—and improvements to them or lack thereof—when negotiating DPAs and NPAs. DOJ’s DPA with JPMorgan Chase reflected DOJ’s focus on compliance program improvements by highlighting, over more than two pages, the company’s compliance program enhancements implemented since the time of the alleged conduct.[21] The DPA noted a “systematic effort to reassess and enhance [JPMorgan Chase’s] market conduct compliance program and internal controls,” listing seven specific improvements such as: adding hundreds of compliance officers and internal audit personnel, with significant increases in compliance and internal audit spending; improving the company’s anti-fraud and manipulation training and policies; and increasing its electronic communications surveillance program, with ongoing updates to the list of monitored employees and regular updates to the terminology used.[22]

Developments in Antitrust Division Attitudes

In the last 18 months we have seen significant developments in DOJ Antitrust Division’s attitudes toward DPAs, including a new stated policy and a subsequent string of novel agreements entered into by the Antitrust Division. Entering 2021, the availability of DPAs to resolve Antitrust investigations represents a potentially exciting opportunity for practitioners, but many questions remain as to how the Antitrust Division will navigate its various programs going forward.

Under long-standing DOJ Antitrust Division policy, the first company or individual to self-report an antitrust violation can qualify for leniency. The Antitrust Division has historically required others involved in an alleged conspiracy to plead guilty or face indictment. To further incentivize self-reporting, the Division has historically expressed that it disfavors the use of NPAs and DPAs to resolve antitrust investigations for companies that do not qualify for leniency. Consistent with that stance, the Division has entered into NPAs associated with only two investigations since 2006, and, prior to 2019, had entered into only three DPAs.

Then, in July 2019, the Antitrust Division announced a policy shift to allow prosecutors to more actively consider resolving antitrust investigations with Deferred Prosecution Agreements, as we covered in our client alert here. According to the policy announcement by Assistant Attorney General Makan Delrahim, the Antitrust Division would begin to consider the “four hallmarks” of “good corporate citizenship” in evaluating a potential DPA, specifically whether the company has: (i) implemented an effective compliance program, (ii) self-reported wrongdoing, (iii) cooperated with investigations, and (iv) remedied past misconduct.[23] Delrahim noted that the Antitrust Division would continue to disfavor NPAs.[24]

With the announcement of this significant departure from traditional policy still fresh, we entered 2020 with open questions as to how the program would operate in practice. Specifically, the announcement caused some to ask what incentives remain for companies to be first-movers for leniency purposes. Because self-reporting was indicated as a potential factor to be considered in negotiating a DPA, seemingly for any company facing Antitrust charges, there was uncertainty whether the leniency program, which strongly incentivized self-reporting first, remained as attractive. So, in February 2020, Deputy Assistant Attorney General Richard Powers addressed the question, remarking that the Antitrust Division had heard that “companies uncovering cartel conduct may no longer feel the need to seek leniency as quickly as possible, but may instead sit tight and later advocate for a DPA if leniency is no longer available.”[25] Powers explained that such a wait-and-see approach could be a “costly mistake,” noting that “[l]eniency’s exclusive benefits include complete immunity from criminal prosecution for the company and its covered cooperating employees,” in addition to other benefits.[26]

Open questions remain, however, including how and to what extent the “four hallmarks” of good corporate citizenship will be considered in negotiating potential DPAs without intruding on the incentives of leniency. Although the Antitrust Division has entered into seven DPAs since June 2019, including four in 2020, none of those agreements explicitly references the new policy, and it is not clear to what extent consideration of the “four hallmarks” influenced the Antitrust Division to enter into the agreements.

Five of these DPAs have been with companies connected to a common conspiracy investigation into anticompetitive conduct in the generic drug industry, with two more companies currently facing unresolved charges in the same investigation.[27] Multiple of these agreements referenced potential collateral consequences, such as mandatory exclusion from federal healthcare programs resulting from a conviction, as primary factors motivating pre-trial resolution, rather than any of the “four hallmarks” of corporate citizenship. The Antitrust Division has also entered into a DPA with private oncology practice Florida Cancer Specialists to resolve allegations of anticompetitive conduct in the oncology industry, an agreement which also noted potential exclusion from Federal healthcare programs as the Antitrust Division’s foremost consideration.[28] Then, most recently, in early 2021 the Antitrust Division announced an agreement with concrete company Argos USA LLC to resolve Antitrust conspiracy charges.[29] This agreement did not implicate either (1) potential disbarment or exclusion from Federal programs, or (2) robust consideration of the “four hallmarks” such as self-reporting or existing compliance efforts. Thus, the Argos agreement could signal the Antitrust Division’s widespread openness to DPAs going forward, or be an outlier as we approach a change in administration.

Collectively, these seven DPAs represent the first examples of the Antitrust Division using these agreements to resolve purely antitrust-based charges, as opposed to charges brought in conjunction with other enforcement divisions or agencies. So, while the contours of the Antitrust Division’s approach to DPA negotiations is still being developed, especially as they relate to self-reporting and leniency, what is clear is that DPAs are now on the menu for practitioners navigating Antitrust investigations.

We will continue to monitor if and how the Antitrust Division develops its use of DPAs.

Year-End 2020 Agreements

The following summarizes agreements concluded in 2020 that were not otherwise summarized in our Mid-Year Update.

5D Holdings Ltd. (“5Dimes”)

On September 25, 2020, 5D Holdings Ltd. (operating under the brand name “5Dimes”), an offshore internet sports betting company, and Laura Varela, the wife of former 5Dimes owner, operator, and founder, William Sean Creighton, entered into an NPA with the United States Attorney’s Office for the Eastern District of Pennsylvania (“E.D. Pa.”).[30] E.D. Pa. alleged that 5Dimes, which operated in Costa Rica, allowed American gamblers to place bets through its website, www.5Dimes.eu.[31] 5Dimes allegedly used third-party payment processors to process credit card transactions from American gamblers, hiding the nature of the transactions from credit card companies.[32] From 2011 to September 2018, 5Dimes allegedly hid more than $46.8 million in illegal gambling proceeds.[33] In September 2018, Mr. Creighton was kidnapped and murdered; subsequently, Ms. Varela assumed responsibility for 5Dimes’ assets but did not take operational control of the company.[34] E.D. Pa. began its investigation in 2016, and after Mr. Creighton’s death Ms. Varela sought to resolve the investigation and bring the operations of the company into compliance with U.S. law.[35]

Ms. Varela and 5Dimes “each have cooperated fully and actively” with the investigation, including by identifying criminal assets from 5Dimes, overseeing a new compliance program, reorganizing the corporate structure of the company, and bringing 5Dimes into compliance with U.S. law.[36] Ms. Varela’s and 5Dimes’ cooperation “did not include information about the identities of individual U.S.-based customers.”[37] Ms. Varela also temporarily suspended all of 5Dimes’ U.S. operations so that it could “emerge[]” from the NPA ready to lawfully operate in the United States.[38] E.D. Pa. considered the following conduct in choosing to pursue an NPA: 5Dimes’ “willingness to acknowledge and accept responsibility for its conduct”; Varela’s and 5Dimes’ “extraordinary cooperation”; 5Dimes’ “commitment to agree to the forfeiture of the proceeds”; Varela’s “lack of involvement in the criminal conduct or operations” of 5Dimes; “the changing legal climate of sports betting and its legality in many states in the U.S.”; and “5Dimes’ commitment—as directed by Varela—to becoming compliant with U.S. law.”[39]

5Dimes and Varela must pay $46,817,880.60, which includes forfeiting $3,376,189 in cash, gold, sports memorabilia, and other assets belonging to Creighton; forfeiting $26,441,691.60 in additional assets; forfeiting $2,000,000 that was seized in Costa Rica by Costa Rican law enforcement; and paying $15,000,000 in additional proceeds of the criminal conduct.[40] E.D. Pa. agreed—at Varela’s request—to “answer inquiries made by gaming regulators, potential investors, and/or financial institutions regarding her cooperation in [E.D. Pa.’s] investigation and lack of involvement in the operations” of 5Dimes.[41] The 5Dimes agreement does not include an express term of length, but most of 5Dimes’ obligations were required to be satisfied by the effective date of the agreement, which was September 30, 2020.

The Bank of Nova Scotia (DPA)

On August 19, 2020, The Bank of Nova Scotia (“Scotiabank”) and the DOJ Fraud Section, as well as the U.S. Attorney’s Office for the District of New Jersey, entered into a three-year DPA to resolve criminal charges of wire fraud and attempted price manipulation.[42] The DPA imposes an independent compliance monitor and requires payment of over $60.4 million, composed of a criminal penalty ($42 million), criminal disgorgement ($11.8 million), and victim compensation ($6.6 million).[43] A portion of the criminal penalty will be credited against payments made to the Commodity Futures Trading Commission (“CFTC”) under a separate agreement.[44]

The Scotiabank DPA resolved allegations that between approximately January 2008 and July 2016, four traders located in New York, London, and Hong Kong placed thousands of unlawful orders in the precious metals futures contracts markets.[45] One of the traders pleaded guilty to attempted price manipulation in July 2019, with sentencing scheduled for January 2021.[46]

Scotiabank received credit for its cooperation, including (1) voluntarily making an internationally based employee available for interview in the United States, (2) producing documents from foreign countries without implicating foreign data privacy laws, and (3) proactively identifying important documents and information, even when unfavorable.[47] The DPA also acknowledges Scotiabank’s remedial measures, including increasing the budget, headcount, expertise, and infrastructure of the compliance function.[48] As part of the DPA, the bank committed to continuing the enhancement of its compliance program and internal controls.[49] Scotiabank did not receive credit for self-reporting.[50]

This DPA illustrates the importance of compliance programs and the obligation of compliance personnel to address allegedly unlawful behavior. Although DOJ credited Scotiabank for remediation, the DPA emphasizes the alleged failure of the bank’s “compliance function, especially as it related to trade surveillance function . . . to detect and deter the four traders’ unlawful practices.”[51] Furthermore, the DPA alleges that for almost a three-year period, three compliance officers had “substantial information” regarding unlawful practices by one trader, yet “failed to stop that activity and thus contributed to the offense conduct.”[52] Based principally on these considerations, DOJ imposed a fine at the top of the applicable Sentencing Guidelines fine range in calculating the criminal penalty of $42 million,[53] and determined that an independent monitor was necessary.[54]

Contemporaneous with the DOJ resolution, Scotiabank entered into two settlements with the CFTC. First, Scotiabank consented to a CFTC order, which amended a prior 2018 resolution, resolving allegations of spoofing by the individual traders.[55] Under the terms of the resolution, Scotiabank agreed to pay approximately $60.4 million, including a civil monetary penalty of $42 million, as well as restitution and disgorgement.[56] Second, Scotiabank consented to a CFTC order related to false statements made by Scotiabank to the CFTC, Commodity Exchange Inc., and the National Futures Association.[57] Under the terms of the second resolution, Scotiabank agreed to pay a civil monetary penalty of approximately $17 million.[58]

Beam Suntory Inc. (DPA)

On October 23, 2020, Beam Suntory Inc. (“Beam”), a Chicago-based company that produces and sells distilled beverages, agreed to enter into a three-year DPA with the U.S. Attorney’s Office for the Northern District of Illinois and the DOJ Fraud Section for violating the Foreign Corrupt Practices Act (“FCPA”).[59] According to the DPA, Beam engaged in a scheme to pay a bribe to an Indian government official in exchange for approval of a license to bottle a line of products that Beam sought to market and sell in India.[60] Beam also allegedly violated the internal controls and books and records provisions of the FCPA.[61] For example, a former member of Beam’s legal department allegedly was willfully blind to information related to improper activities and practices by third parties engaged by Beam in India.[62]

Pursuant to the DPA, Beam agreed to pay a $19.5 million criminal fine.[63] Additionally, Beam agreed to enhance its compliance and ethics program and to review its internal accounting controls, policies, and procedures in connection with the FCPA and other applicable anti-corruption laws.[64] Beam has also agreed to submit annual reports to DOJ for the three-year term of the DPA regarding the remediation and implementation of these compliance measures.[65]

In a related matter with the SEC, Beam agreed in July 2018 to pay the SEC disgorgement and prejudgment interest totaling approximately $6 million and a civil monetary penalty of $2 million.[66] However, DOJ did not credit this SEC settlement towards the criminal penalty because, according to DOJ, Beam did not seek to coordinate a parallel resolution with DOJ.[67] This is noteworthy, as the FPCA Resource Guide advises DOJ and SEC to “strive to avoid imposing duplicative penalties, forfeiture, and disgorgement for the same conduct.”[68] This policy was articulated by former Deputy Attorney General Rod Rosenstein in May 2018, when he announced the policy against “piling on,” which instructs DOJ attorneys “when possible, to coordinate with other federal, state, local, and foreign enforcement authorities seeking to resolve a case with a company for the same misconduct.”[69] Nevertheless, the policy provides that DOJ should weigh all relevant factors when determining whether coordination between DOJ and other enforcement agencies is appropriate, including “the adequacy and timeliness of a company’s disclosures and its cooperation with the Department, separate from any such disclosures and cooperation with other relevant enforcement authorities.”[70] In this case, Beam received only “partial credit” from DOJ for its cooperation and remediation.[71] Accordingly, this may be a situation where DOJ’s view of Beam’s cooperativeness may have frustrated clean application of the “piling on” policy.

For a discussion of this and other FCPA resolutions in 2020, please refer to our 2020 Year-End FCPA Update.

Catholic Diocese of Jackson (DPA)

On July 15, 2020, the U.S. Attorney for the Northern District of Mississippi (“N.D. Miss.”) entered into a twelve-month DPA with the Catholic Diocese of Jackson, a Mississippi non-profit corporation.[72] The agreement resolved allegations that the Diocese committed misprision of a felony, stemming from the fraudulent fundraising activities of one of the Diocese’s former priests, Lenin Vargas, who subsequently fled the country to Mexico.[73] The DPA stated that the Diocese had cooperated with the N.D. Miss. investigation; identified all payments made to Vargas; begun refunding parishioners’ donations made in relation to Vargas’s fraudulent charitable solicitations; and had no prior criminal history.[74]

As part of the terms of the DPA, the Diocese was required to complete “prior remedial measures” including: (1) returning donations made by parishioners related to Vargas’s fraudulent solicitation of charitable donations; (2) undertaking staff changes in the Diocese’s Accounting and Chancery Offices; (3) undertaking improvements in accounting for donations in priest spending; (4) forming a new review board focusing on ethical conduct; (5) establishing a fraud prevention hotline; (6) revising collection practices; and (7) initiating a formal disciplinary process for Vargas, including revocation of his priest privileges by the Catholic Diocese of Jackson, notification regarding Vargas’s activities to his home diocese in Mexico, and initiation of Vargas’s laicization.[75] The Diocese agreed to cooperate fully with N.D. Miss. as “a material condition of the DPA” and agreed to implement an effective financial compliance program, including a compliance review board and designation of a compliance officer responsible for monitoring the effectiveness of the program.[76] Additional measures included, among others, an “open[ness] to monitoring/reporting on additional measures taken and the results of its changes to the parish and priest financial reporting,” reconciliation with those impacted by the priest’s conduct without retaliation for participation in N.D. Miss.’s investigation, and a commitment to undertake steps to remove the offending priest’s rights under Canonical law.[77]

Commonwealth Edison Company (DPA)

On July 17, 2020, Commonwealth Edison Company (“ComEd”), an electric utility provider, entered into a DPA with the United States Attorney’s Office for the Northern District of Illinois (“N.D. Ill.”).[78] N.D. Ill. alleged that ComEd arranged “jobs, vendor subcontracts, and monetary payments associated with those jobs and subcontracts” for associates of “Public Official A,” in exchange for passing favorable legislation.[79] Media outlets have reported that “Public Official A” is Michael Madigan, the Speaker of the Illinois House of Representatives and the Chairperson of the Democratic Party of Illinois.[80] ComEd allegedly paid associates of Mr. Madigan—who performed “little or no work” for ComEd—over $1.3 million between 2011 and 2019.[81] N.D. Ill. also alleged that Mr. Madigan arranged for ComEd to appoint his associate to its Board of Directors, retain a certain law firm, despite not having “enough appropriate legal work” to give to the firm, and award internships to students from Mr. Madigan’s ward in Chicago.[82] In return, N.D. Ill. alleged that Mr. Madigan supported two bills—the Energy and Infrastructure and Modernization Act of 2011 and the Future Energy Jobs Act of 2016—the “reasonably foreseeable anticipated benefits” of which to ComEd exceeded $150,000,000.[83]

N.D. Ill. acknowledged that ComEd “provided substantial cooperation,” including “conducting a thorough and expedited internal investigation” and “making regular factual presentations to” N.D. Ill. at which ComEd “shar[ed] information that would not have been otherwise available to the government.”[84] ComEd also created a new position—Executive Vice President for Compliance and Audit—which maintains “a direct reporting line to the Audit Committee of the Exelon [ComEd’s parent company] Board of Directors and Chief Executive Officer.”[85] Additionally, ComEd drafted and implemented new compliance policies, which require careful review of ComEd’s ongoing relationships with third-party lobbyists and political consultants.[86] ComEd did not receive voluntary self-disclosure credit.

The DPA has a three-year term, which may be extended up to one year if N.D. Ill. finds that ComEd breached the agreement.[87] ComEd must pay a criminal penalty of $200,000,000, which ComEd can make in two installments: $100,000,000 within 30 days of the filing of the DPA and the remaining $100,000,000 within 90 days of the filing of the DPA.[88] Over the course of the three years, ComEd must conduct and submit reports on compliance reviews at least annually.[89]

CSG Imports and KG Imports

On August 14, 2020, the U.S. Attorney’s Office for the District of New Jersey (“D.N.J.”) entered into DPAs with CSG Imports LLC and KG Imports LLC, both of Lakewood, New Jersey, to resolve violations of the Defense Production Act of 1950 for allegedly price-gouging consumers of personal protective equipment (“PPE”) during the COVID-19 pandemic.[90] The resolutions arise out of law enforcement’s April 22, 2020, seizure of over 11 million items of PPE—predominantly N-95 respirator face masks and three-ply disposable face masks—owned by CSG Imports and KG Imports from three warehouses in Lakewood.[91] Law enforcement seized the PPE after learning that the companies were offering for sale and selling scarce PPE at prices in excess of prevailing market prices for those items.[92]

CSG Imports entered into a one-year DPA with D.N.J., and KG Imports entered into a two-year DPA.[93] Under the terms of its DPA, CSG Imports has committed to selling the seized PPE at cost and compensating two entities that purchased PPE from CSG Imports in excess of prevailing market prices in the amount of $400,000.[94] The agreement provides that CSG Imports must pay a minimum of $200,000 to each entity directly (in amounts proportionate to CSG Imports’ profits), and that it may compensate the remaining portion of the $400,000 by transferring PPE to these entities at no cost.[95] Pursuant to its DPA, KG Imports also agreed to sell the seized PPE at cost.[96]

Additionally, CSG Imports agreed that it would cease, for the term of the DPA, obtaining PPE of any kind for the purpose of resale.[97] If CSG Imports does not comply with this requirement, the term of the agreement will be extended to two years.[98]

D.N.J. cited the following factors as relevant to both DPAs:

- Both CSG Imports and KG Imports accepted responsibility for the conduct described in their respective Statements of Facts;

- Each entity cooperated with D.N.J.’s investigation;

- Each entity agreed to the sale and disposition of PPE previously seized by the government at prices not to exceed reasonable costs; and

- Neither entity voluntarily self-disclosed the conduct at issue to D.N.J.[99]

In the case of CSG Imports, D.N.J. also cited its agreement to compensate particular entities $400,000 for their purchase of PPE during the relevant time period.[100]

Both entities are required to report to D.N.J. at six-month intervals regarding all transactions involving the sale of the seized PPE until the last of the seized PPE has been sold or otherwise transferred.[101]

Essentra FZE (DPA)

On July 16, 2020, Essentra FZE Company Limited (“Essentra FZE”), a global supplier of cigarette products incorporated in the United Arab Emirates (UAE), entered into a three-year DPA with the United States Attorney’s Office for the District of Columbia and the DOJ National Security Division for conspiring to violate the International Emergency Economic Powers Act (“IEEPA”) and defrauding the United States in connection with evading sanctions on North Korea.[102] According to the DPA, Essentra FZE conspired to violate the North Korea Sanctions Regulations by causing a U.S. financial institution, including its foreign branch, to export financial services to North Korea, in violation of 31 C.F.R. § 510.101 et seq.[103] In particular, Essentra FZE allegedly conspired with a front company to export cigarette products to North Korea by establishing false end-user information for shipments to North Korea and addressing commercial invoices to financial cutouts. The DPA alleges that this was done in an effort to conceal the North Korean nexus of these transactions and deceive U.S. financial institutions into processing Essentra FZE’s U.S. dollar transactions.[104] Notably, this is the first-ever DOJ corporate resolution for violations of the sanctions regulations placed on North Korea in March 2016.[105]

As part of the DPA, Essentra FZE agreed to pay a $665,112 fine, which represents twice the value of the transactions at issue in the DPA.[106] In addition, Essentra FZE has implemented and will continue to implement a sanctions compliance program, including global sanctions training covering the United States, the United Nations, United Kingdom, and European Union sanctions and trade control laws.[107] Finally, Essentra FZE is required to provide quarterly reports describing the status of the company’s continued improvements to its sanctions compliance program, as required by the DPA, in addition to other reporting requirements.[108]

Essentra FZE also entered into a settlement agreement with the Treasury Department’s Office of Foreign Assets Control (“OFAC”) in connection with these violations, and was assessed a $665,112 fine.[109] OFAC credited Essentra FZE’s DOJ penalty, and therefore its obligation to pay OFAC was deemed satisfied.[110]

Goldman Sachs Group, Inc. (DPA)

On October 22, 2020, the Goldman Sachs Group, Inc. (“Goldman Sachs”), the U.S. Attorney’s Office for the Eastern District of New York (“E.D.N.Y.”), and DOJ’s Criminal Division, Fraud Section and Money Laundering and Asset Recovery Sections (together, “the Offices”) entered into a DPA as part of a $2.9 billion global settlement for alleged conspiracy to violate the anti-bribery provisions of the FCPA related to three bond offerings the firm had structured and arranged for Malaysia’s state development fund 1MDB.[111] The DPA term is three years, with the option for an extension of one year if the Offices, in their sole discretion, determine Goldman Sachs has knowingly violated any provision of the DPA.[112] Additionally, a Malaysian subsidiary of Goldman Sachs pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA.[113]

The DPA states that the Offices reached this resolution with Goldman Sachs based on a number of factors, including Goldman Sachs’s remedial measures and commitment to enhancing its compliance controls. Relevant measures identified in the DPA included: (i) implementing heightened controls and additional procedures and policies relating to electronic surveillance and investigation, due diligence on proposed transactions or clients, and the use of third-party intermediaries across business units; and (ii) enhancing anti-corruption training for all management and relevant employees.[114] Goldman Sachs received partial credit for cooperation with the investigation and did not receive voluntary disclosure credit.

The company agreed to report to the Offices annually during the term of the DPA regarding its remediation and implementation of the compliance measures.

Herbalife Nutrition Ltd. (DPA)

On August 28, 2020, Herbalife Nutrition, Ltd. (“Herbalife”), a global nutrition company, agreed to enter into a three-year DPA with the DOJ Fraud Section and the U.S. Attorney’s Office for the Southern District of New York (“S.D.N.Y.”) for conspiring to violate the books and records provisions of the FCPA.[115] According to the DPA, from 2007 to 2016, Yangliang Li, an executive at one of Herbalife’s wholly owned subsidiaries based in China (Herbalife China), and other employees at Herbalife China, engaged in a scheme to falsify books and records and provide improper payments and benefits to Chinese government officials, for the purpose of obtaining, retaining, and increasing Herbalife’s business in China.[116] Li and others at Herbalife China, according to the DPA, maintained false account records that did not accurately reflect the transactions and dispositions of Herbalife’s assets by, for example, falsely recording certain payments and benefits as “travel and entertainment expenses.”[117]

As part of the DPA, Herbalife agreed to pay a criminal fine of over $55 million. In addition, Herbalife has implemented and will continue to implement a compliance and ethics program related to the FCPA and other applicable anti-corruption laws, as well as undertake a review of its internal accounting controls, policies, and procedures regarding compliance with the FCPA and other applicable anti-corruption laws.[118] Further, Herbalife will submit annual reports for the term of the DPA regarding the remediation and implementation of these compliance measures.[119]

In November 2019, DOJ unsealed related criminal charges against Li and another former Herbalife China executive involved in the criminal conduct.[120] Finally, in a related matter with the SEC, Herbalife agreed to pay disgorgement and prejudgment interest totaling over $67 million.[121]

Jia Yuan USA Co. (NPA)

On October 5, 2020, Jia Yuan USA Co., Inc., the subsidiary of China-based hotel group Shenzhen Hazens, entered into a three-year NPA with the U.S. Attorney’s Office for the Central District of California (“C.D. Cal.”) to resolve an investigation into the company’s conduct with Los Angeles municipal officials, including alleged bribery, honest services fraud, and foreign and conduit campaign contributions.[122] The company agreed to pay a criminal monetary penalty of $1,050,000 as part of the resolution.[123]

To advance the company’s efforts to operate and redevelop a Los Angeles hotel which it purchased in 2014 for more than $100 million, Jia Yuan admitted a series of acts including: providing concert tickets to a city councilman soon after that individual and the city’s deputy mayor for economic development intervened in a compliance issue on behalf of the hotel group; making campaign contributions to several U.S. political candidates despite being prohibited from doing so; providing several in-kind contributions to political candidates by hosting reduced-cost fundraising events at the hotel in question; and providing indirect bribe payments and a family trip to China for the city councilman.[124]

The company’s substantial cooperation appears to have contributed to DOJ’s decision to enter the NPA in lieu of prosecution. According to the NPA, relevant considerations included the company’s “extensive internal investigative actions in connection with the collection, analysis and organization of vast amounts of relevant data and evidence, including providing C.D. Cal. records located in China and in the personal possession of its Chairman.”[125] The company also timely accepted responsibility for its conduct and took several remedial measures, including the termination of an outside consultant involved in the alleged bribery (who separately pleaded guilty and will be sentenced in early 2021) and various enhancements to its ethics, compliance, and internal controls programs.[126] The NPA also specifically noted the company’s agreement to “continue to cooperate with the USAO and the FBI during the pendency of any prosecution the USAO has instituted and may institute” based on related conduct.[127]

JP Morgan Chase & Co. (DPA)

On September 29, 2020, JPMorgan Chase & Co. (“JPMorgan”) and the DOJ Fraud Section, as well as the U.S. Attorney’s Office for the District of Connecticut (“D. Conn.”), entered into a three-year DPA to resolve criminal charges of wire fraud.[128] Under the terms of the DPA, JPMorgan paid over $920 million in a criminal monetary penalty ($436.4 million), criminal disgorgement ($172 million), and victim compensation ($311.7 million).[129] The monetary penalty and disgorgement will be credited for separate agreements with the CFTC and SEC, respectively.[130]

The JPMorgan DPA resolved allegations related to two fraudulent schemes spanning eight years. First, from about March 2008 to August 2016, traders and sales personnel working in New York, London, and Singapore allegedly unlawfully traded in the markets for precious metals futures contracts.[131] Two individual traders located in New York pleaded guilty to related charges in 2018 and 2019; to date, neither has been sentenced.[132] DOJ also obtained a superseding indictment against three former traders and one former salesperson in the Northern District of Illinois in 2019; to date, the charges have not been resolved.[133] The second alleged scheme occurred from about April 2008 to January 2016.[134] Traders in New York and London allegedly unlawfully traded in the markets for U.S. Treasury futures contracts and in the secondary cash market for U.S. Treasury notes and bonds.[135]

As part of the DPA, JPMorgan and its subsidiaries, JPMorgan Chase Bank, N.A. (“JPMC”) and J.P. Morgan Securities LLC (“JPMS”), agreed to “cooperate fully” with the Fraud Section and D. Conn. in any matters relating to the conduct at issue in the DPA or other conduct under investigation.[136] JPMorgan and its subsidiaries also must report evidence or allegations of conduct that may constitute a violation of the wire fraud statute or other enumerated laws governing securities, commodities, and trading.[137] Furthermore, the entities agreed to enhance their compliance programs and report to the government regarding those enhancements.[138]

DOJ credited JPMorgan for its cooperation and remedial efforts.[139] The DPA highlights that JPMorgan suspended and ultimately terminated employees involved in the conduct and provided all relevant facts known to it, including information regarding individual participants.[140] The DPA also describes JPMorgan’s efforts to improve its compliance program and internal controls, including: (1) hiring hundreds of compliance officers and internal audit personnel, with significant increases in compliance and internal audit spending; (2) improving anti-fraud and manipulation training and policies; (3) revising its trade surveillance program, with continuing modifications to the parameters used to detect potential spoofing in response to lessons learned; (4) increasing its electronic communications surveillance program, with ongoing updates to the universe of monitored employees and regular updates to the lexicon used; (5) implementing tools to facilitate closer supervision of traders; (6) considering employees’ commitment to compliance in promotion and compensation decisions; and (7) implementing independent quality assurance testing of surveillance alerts.[141] Based on the remedial efforts, state of the compliance program, and reporting obligations, DOJ did not require an independent compliance monitor.[142]

DOJ also considered a number of other factors when determining the type and scope of the resolution, including the number of instances of unlawful trading (tens of thousands) and duration of the alleged misconduct (over nearly eight years),[143] as well as a guilty plea on May 20, 2015, for similar conduct.[144] The company did not receive credit for timely and voluntary self-disclosure.[145]

In a separate but parallel resolution with the CFTC, JPMorgan and its subsidiaries agreed to pay approximately $920 million, including a civil monetary penalty of approximately $436 million, as well as restitution and disgorgement, credited to any such payments made to DOJ.[146] Similarly, JPMS resolved an investigation by the SEC into trading activity in the secondary cash market.[147] JPMS agreed to pay $10 million in disgorgement and a civil monetary penalty of $25 million.[148]

Natural Advantage LLC (DPA)

On June 10, 2020, Natural Advantage LLC, a Louisiana-based chemical manufacturer, entered into a three-year DPA and agreed to forfeit $1,938,650 to resolve charges that it distributed and exported regulated List 1 chemicals (those which, in addition to legitimate uses, can be precursor chemicals for the production of methamphetamine and ecstasy) without proper registration.[149] Two executives were simultaneously charged in a criminal information with failure to appropriately report the manufacture of such chemicals under 21 U.S.C. § 843(a)(9).[150]

Natural Advantage allegedly distributed and exported 1,550 kilograms of List 1 chemicals domestically and internationally without obtaining the proper registration from the U.S. Drug Enforcement Administration.[151] The DEA had previously warned the company not to distribute these chemicals without authorization, and the charged executives allegedly concealed their conduct by failing to file annual manufacturing reports.[152] However, the DPA and information do not allege that the chemicals were diverted to narcotics traffickers.[153]

The company received credit for its acceptance of responsibility, cooperation with law enforcement, and commitment to enhance its regulatory compliance measures.[154] As part of the latter factor, the company agreed to retain an independent auditor to oversee compliance with List 1 chemical distribution and associated accounting requirements.[155] Relevant considerations also included the potential collateral consequences to employees and the absence of any prior criminal history.[156] However, the DPA also noted the seriousness of the misconduct that spanned multiple jurisdictions and was known by company management.[157]

Patterson Companies, Inc. (NPA)

On February 14, 2020, Patterson Companies, Inc. (“Patterson”) entered into an NPA in coordination with the simultaneous guilty plea of its corporate subsidiary, Animal Health International, Inc. (“AHI”), a Colorado veterinary and agricultural prescription distributor, for introducing misbranded drugs into interstate commerce.[158] The allegations centered on AHI’s distribution of veterinary drugs from unlicensed veterinarians and to individuals not authorized or licensed to receive such drugs.[159] AHI was required to pay $52 million in penalties as a result of its plea, and Patterson committed to enhance its compliance program.[160]

The NPA highlighted Patterson’s cooperation in the investigation in the decision not to prosecute the company.[161] This cooperation included proactively bringing information to the prosecutor’s attention, remediation of non-compliant activity and implementation of control enhancements (including as it related to licensing, dispensing, distribution, and related sales practices), and entering into tolling agreements.[162] Patterson also voluntarily disclosed additional non-compliant conduct at the company beyond that described in the information against AHI.[163] The NPA noted that the company “has since taken extensive proactive steps to enhance its regulatory function, capabilities and support to guide the business and other control functions on regulatory compliance matters.”[164]

Power Solutions International, Inc. (NPA)

On September 24, 2020, Power Solutions International, Inc. (“PSI”), an engine manufacturing company, entered into an NPA with N.D. Ill.[165] N.D. Ill. alleged that from 2014 through 2016, PSI over-reported its revenue figures by millions of dollars in representations to the SEC.[166] The same day, PSI also resolved a parallel SEC investigation through a settlement agreement in which PSI agreed to pay a $1.7 million civil fine and remedy deficiencies in its internal controls.[167] PSI senior executives, including the CEO, allegedly agreed to special terms—which included rights to “return products,” “exchange products,” “discounts,” and “extended and indefinite periods in which to pay”—for certain transactions but did not report the special terms to PSI’s Accounting Department, effectively inflating the recognized revenue for those transactions.[168] N.D. Ill. also alleged that PSI shipped products without customers’ knowledge and consent to further inflate its revenue and made misrepresentations to its auditor to conceal the inflated revenue.[169]

N.D. Ill. recognized that PSI promptly hired outside counsel and a forensic accounting firm to conduct an independent investigation after allegations of inflating revenue were raised to the company’s Board of Directors.[170] Upon learning of N.D. Ill.’s and the SEC’s investigations into the same allegations, PSI took several steps, including apprising N.D. Ill. of its internal investigation, removing employees involved in the conduct, and “implementing extensive remedial measures and operational improvements.”[171] N.D. Ill. gave PSI full credit for cooperating with its investigation, including “voluntarily waiving the attorney-client privilege and work product protection to provide additional information to [N.D. Ill.], including the results of its independent investigation.”[172] PSI’s remedial measures included “removing certain executives and employees” involved in the conduct; “retaining a new leadership team,” including a new CEO, CFO, Chairman of the Board, and others; compensating shareholder victims through an $8.5 million class action settlement; “full remediation of the deficiencies in its internal control over financial reporting”; the $1.7 million fine paid to the SEC; and “extensive operational improvements,” including creating the new position of Vice President of Internal Audit.[173] Given PSI’s cooperation, N.D. Ill. agreed to an NPA, although PSI did not receive voluntary self-disclosure credit.[174]

The NPA has a three-year term, which may be extended up to one year if N.D. Ill. finds that PSI breached the agreement.[175] N.D. Ill. did not impose a criminal monetary penalty, recognizing that given PSI’s “current financial condition,” “even with the use of a reasonable installment schedule,” it would be unable to pay a criminal monetary penalty on top of the $8.5 million civil class action settlement and $1.7 million civil fine to the SEC without “seriously jeopardizing the Company’s continued viability.”[176] N.D. Ill. also required PSI to conduct and submit reports on compliance reviews at least annually over the course of the three-year agreement.[177]

Progenity, Inc. (NPA)

On July 21, 2020, Progenity, Inc., a San Diego-based clinical laboratory, entered into a one-year NPA with the U.S. Attorney’s Office for the Southern District of California (“S.D. Cal.”) as part of a $49 million multi-jurisdictional settlement.[178] Concurrently with the NPA to resolve criminal allegations, Progenity entered into civil settlements with S.D. Cal. and S.D.N.Y., as well as multiple states.[179] Although the NPA carried no separate monetary penalty, Progenity agreed to pay a total of $49 million to resolve federal and state civil allegations that Progenity had fraudulently billed and submitted false claims to federal healthcare programs by using incorrect Current Procedural Terminology (“CPT”) codes for its noninvasive prenatal testing (“NIPT”) for pregnant women and provided kickbacks to physicians to induce to them to order Progenity tests for their patients.[180]

The criminal investigation, which was brought only by S.D. Cal., related to the company’s practices for billing its NIPT tests to government healthcare programs and were resolved via an NPA based on a number of factors, including: the company’s extensive remedial efforts, including termination of employees responsible for the payments, its compliance program, creating a Compliance Committee independent from the Board composed of senior personnel, instituting third-party review of Progenity’s CPT code selection, and conducting regular audits of claims to government payors; cooperation with S.D. Cal.’s investigation; and the payment of restitution to the relevant federal healthcare programs.[181] S.D. Cal. also noted the significant collateral consequences to healthcare beneficiaries and the public from further prosecution of Progenity.[182]

Under the terms of the NPA, S.D. Cal. may, upon notice to Progenity, extend the term of the NPA in six-month increments, for a maximum total term of two years (that is, the one-year NPA term plus two six-month extensions).[183]

Schneider Electric Buildings Americas, Inc. (NPA)

On December 16, 2020, Schneider Electric Buildings Americas, Inc. (“Schneider Electric”), an electricity services company, entered into an NPA with the United States Attorney’s Office for the District of Vermont (“D. Vt.”).[184] D. Vt. alleged that Schneider Electric made and submitted false claims and false statements material to false claims regarding eight “Energy Savings Performance Contracts” made with the Department of the Navy, the Department of Homeland Security, the General Services Administration, the Department of Agriculture, and the Department of Veterans Affairs.[185] According to D. Vt., these false claims included “hiding or burying” costs from one project in separate construction estimates, inflating line item construction cost estimates, and improperly allocating risk, which inflated the cost of the contracts.[186] D. Vt. also alleged that a former Schneider Electric Senior Project Manager solicited and received kickbacks for six of those contracts.[187]

Schneider Electric received partial cooperation credit for, among other things, voluntarily disclosing the findings of its internal investigation, voluntarily disclosing additional wrongdoing not previously known to the government, and producing 1.9 million pages of documents before they were fully reviewed by counsel.[188] Schneider Electric also “engaged in extensive remedial measures, including enhancing its compliance program and internal controls”; terminated two employees responsible for the alleged wrongdoing and “admonished” two more employees who were involved; voluntarily made employees available for interviews; and agreed to cooperate in the government’s ongoing investigation.[189] That said, D. Vt. did not give credit to Schneider Electric for timely accepting responsibility for its conduct (though it did ultimately admit responsibility for the actions of its direct and indirect agents), voluntary self-disclosure, identifying any individuals (with one exception) not previously known to the government, or calculating certain loss amounts.[190]

The NPA has a three-year term, which may be extended up to one year if D. Vt. finds that Schneider Electric breached the agreement.[191] The NPA provides for $1,630,700 in criminal forfeiture.[192] In addition, under a separate civil settlement agreement with the DOJ Civil Division and D. Vt. (on behalf of the Department of the Navy, the Department of Homeland Security, the General Services Administration, the Department of Agriculture, and the Department of Veterans Affairs), Schneider Electric agreed to pay a civil fine of $9,369,000, of which $4,625,546.44 (nearly half) is restitution and interest.[193] Schneider Electric must submit reports to the government of annual compliance reviews undertaken over the course of the three-year agreement.[194]

Select Energy Services, Inc. (NPA)

On September 28, 2020, Select Energy Services, Inc. (“SES”), a water management company, entered into an NPA with the United States Attorney’s Office for the Middle District of Pennsylvania (“M.D. Pa.”).[195] SES is the successor in interest to Rockwater Energy Solutions, Inc. (“Rockwater Energy”), which is the parent company of Rockwater Northeast LLC (“Rockwater Northeast”). Rockwater Northeast entered into a plea agreement with M.D. Pa.[196] As a condition of that plea agreement, SES agreed to entered into an NPA.[197] Six individuals also pleaded guilty, four of whom were Rockwater Northeast employees and two of whom were third-party contractors—DOJ has noted that the adequacy of prosecution of individuals is a factor when making charging decisions.

M.D. Pa. alleged that Rockwater Northeast and Rockwater Energy violated the Clean Air Act by installing “defeat devices” on 60 heavy-duty diesel trucks, which are designed to foil annual safety inspections by the Department of Transportation.[198]

The NPA has a three-year term, and SES must pay a monetary penalty of $2.3 million.[199] SES agreed to continue cooperating with M.D. Pa. and implement an environmental compliance program.[200] Over the course of the agreement, SES must conduct annual audits over the course of the three-year NPA to ensure compliance with the Clean Air Act.[201]

Taro Pharmaceuticals (DPA)

On July 23, 2020, Taro Pharmaceuticals U.S.A., Inc. (“Taro”) entered into a DPA to resolve allegations that the company participated in two criminal antitrust conspiracies to fix prices, allocate customers, and rig bids for generic drugs.[202] The company agreed to pay a $205,653,218 criminal penalty and admitted that its sales affected by the charged conspiracies exceeded $500 million.[203] Taro additionally agreed to cooperate fully with the Antitrust Division’s ongoing criminal investigation into the generic drug industry.[204]

Among the factors motivating the Antitrust Division to agree to a pre-trial resolution was that a conviction for Taro could result in severe collateral consequences in the form of mandatory exclusion from federal healthcare programs.[205] This consideration has been noted in other DPAs entered into by the Antitrust Division, discussed above.

Taro’s resolution with the Antitrust Division is the latest in a series of five DPAs entered into in connection with a common investigation into price fixing in the generic drug industry, which we began to cover in our 2019 Year-End Update and again in our 2020 Mid-Year Update. In addition to the five DPAs associated with this investigation, four executives have been charged for their roles in the alleged price fixing schemes, and three of those individuals have pleaded guilty. Former Taro U.S.A. executive Ara Aprahamian was indicted in February 2020 and is awaiting trial.[206]

The generic drug industry agreements reflect the Antitrust Division’s recent shift toward using DPAs to resolve charges, which is covered in further detail above.

Ticketmaster LLC (DPA)

On December 30, 2020, Ticketmaster LLC (“Ticketmaster”), an online event ticket retailer and distributor, entered into a three-year DPA with E.D.N.Y. and agreed to pay $10,000,000 to resolve Computer Fraud and Abuse Act, computer intrusion, and fraud charges stemming from its alleged repeated accessing of the computer systems of a competitor without authorization.[207] The former head of Ticketmaster’s Artist Services division pleaded guilty in a related case to conspiracy to commit computer intrusions and wire fraud in October 2019.[208]

The alleged scheme centered on Ticketmaster’s use of information derived from a former employee of the company’s competitor, which offered artists the ability to sell presale tickets in advance of the general tickets that Ticketmaster provided.[209] The employee shared with Ticketmaster employees unique URLs used by the competitor for drafting ticketing web pages. Ticketmaster used this information to retrieve information from these nonpublic websites to “benchmark” Ticketmaster’s prices against those of its competitor, thereby granting it a competitive advantage.[210]

Ticketmaster received only partial credit for cooperation, in part because it disclosed the conduct to the government only after it was identified in civil litigation.[211] Ticketmaster agreed to implement remedial measures, including those specific to the use and misuse of computer systems and passwords, along with enhancements to its compliance and internal controls programs.[212] Other relevant considerations to the form of agreement included the duration of the scheme, alleged repeated instances of misconduct by employees and executives, and the resulting benefits for the company from the misconduct.[213] The DPA further requires Ticketmaster to submit an annual report regarding remediation and implementation of the agreed-upon compliance measures, but does not require an independent compliance monitor in light of the company’s remediation and the effectiveness of its compliance program.[214]

Vitol Inc. (DPA)

On December 3, 2020, DOJ Fraud and E.D.N.Y. entered into a three-year DPA with Vitol Inc. (“Vitol”), the U.S. affiliate of one of the largest oil distributors and energy commodities traders in the world, for conspiring to violate the anti-bribery provisions of the FCPA between 2005 and 2020.[215] The DPA alleged that Vitol made improper payments to foreign officials at state-owned oil companies in Brazil, Ecuador, and Mexico.[216]

As part of the resolution, Vitol agreed to pay a total criminal penalty of $135 million, $45 million of which DOJ credited against the amount the company will pay to resolve a parallel investigation by the Brazilian Ministério Público Federal for the same conduct relating to Brazil.[217] Vitol also settled related charges via cease-and-desist proceedings brought by the CFTC, which included “attempted manipulation of S&P Global Platts physical oil benchmarks.”[218] This case was the first CFTC action involving foreign corruption, and, as part of the CFTC settlement, Vitol agreed to pay $12.7 million in disgorgement and a civil penalty of $16 million related to Vitol’s trading activity not covered by the DOJ settlement.[219]

Vitol and its parent company, Vitol S.A.,[220] received full credit for cooperation, which included: (1) making factual presentations to DOJ Fraud and E.D.N.Y.; (2) voluntarily facilitating an interview in the U.S. of a former foreign-based employee; (3) promptly producing relevant documents, including documents outside of the United States and translations of documents; and (4) timely accepting responsibility for the conduct and reaching a prompt resolution.[221] Vitol and Vitol S.A. also provided DOJ with “all relevant facts known to them, including information about the individuals involved” in the alleged misconduct.[222] The DPA further acknowledged that Vitol, Vitol S.A., and their affiliates engaged in remedial measures, including enhancing their compliance programs and internal controls, making personnel changes, conducting internal investigations and risk assessments, and enhancing their training and internal reporting programs.[223] Vitol did not receive voluntary self-disclosure credit.[224]

The DPA did not impose a corporate monitor due to Vitol and Vitol S.A.’s remediation efforts and annual reporting requirements during the term of the DPA.[225]

International DPA Developments

We continue to track the global trend of countries adopting and developing DPA regimes. As prior Mid-Year and Year-End Updates have discussed (see, e.g., our 2020 Mid-Year Update), Canada, France, Singapore, and the United Kingdom currently allow for DPA or DPA-like agreements, although prosecutors in Canada and Singapore have yet to enter into such an agreement since both countries passed legislation authorizing the practice in 2018.[226] Additional countries, including Australia,[227] Ireland,[228] Poland,[229] and Switzerland,[230] have also considered adopting DPAs or similar agreements, but little progress has been made on the proposals in all four countries since 2018. France and the United Kingdom therefore continue to be the frontrunners in developing DPA-like regimes in the international landscape, as the United Kingdom has allowed DPAs since 2013, France has allowed DPA-like agreements since 2016, and both announced agreements and issued related guidance in 2020.

The United Kingdom led the international DPA scene in terms of number of agreements in 2020, with the Serious Fraud Office (“SFO”) entering into three new DPAs. As discussed in our 2020 Mid-Year Update, the SFO entered into DPAs with Airbus SE[231] and G4S Care and Justice Services (UK) Ltd[232] in the first half of the year. In October, the SFO also entered into a third DPA with Airline Services Limited and released comprehensive guidance on the office’s approach to DPAs, both discussed below. France’s Ministry of Justice entered into two Conventions Judiciaire d’Intérêt Public or Judicial Public Interest Agreements (“CJIPs”)—and released a circular concerning CJIPs in 2020, discussed in our 2020 Mid-Year Update.

Airline Services Limited (United Kingdom)

On October 22, 2020, the SFO announced that it reached a DPA with Airline Services Limited (“ASL”),[233] and the DPA was approved by the Southwark Crown Court a week later.[234] The DPA resolved allegations that ASL, an airlines services company based in the United Kingdom, failed to prevent bribery by an associated person in violation of the U.K. Bribery Act.[235] ASL, as described in the agreement, engaged an agent to assist in procuring contracts from airlines that was at the same time engaged by Deutsche Lufthansa AG as a project manager responsible for assessing bids received. Between 2011 and 2013, the agent assisted ASL in submitting three winning bids to Lufthansa by sharing confidential information with ASL about the bidding process. ASL self-reported the conduct to the SFO in July 2015, but the SFO did not announce its investigation until the DPA was reached in October 2020.[236]

Pursuant to the DPA, ASL agreed to pay disgorgement in the amount of £990,971.45.[237] ASL also agreed to pay a financial penalty of £1,238,714.31, which included a 50{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} discount to reflect ASL’s early self-report and cooperation with the SFO, and a contribution to the SFO’s costs of £750,000.[238]

SFO Guidance on DPAs

In October 2020, the SFO also updated the SFO Operational Handbook to include a chapter on DPAs.[239] The Director of the SFO described the chapter as “comprehensive guidance” on how the SFO approaches DPAs, as well as how the office engages with companies where a DPA is a prospective outcome.[240] The guidance echoes much of the same content as the DPA Code of Practice that has been in place since 2014,[241] and the Code of Practice is cited frequently throughout the guidance. The guidance provides an overview of the two tests that must be applied by a prosecutor in considering a DPA: the evidential test, which assesses whether there is sufficient evidence to provide a realistic prospect of conviction, and the public interest test, which asks whether the public interest would be properly met by entering into a DPA rather than proceeding with prosecution.[242] The guidance also outlines many of the key factors that the SFO will consider when deciding whether to enter into a DPA, including cooperation and voluntary self-reporting. Similar to DOJ policy in the United States, the guidance also encourages prosecutors to consider parallel investigations by other agencies, either overseas or in the U.K.[243] Although the guidance is consistent with SFO’s Code of Practice, it provides greater clarity on the mechanics of negotiating a DPA with the SFO. For additional information on the SFO guidance, please refer to our October 2020 client alert.

____________________

The chart below summarizes the agreements concluded by DOJ in 2020. The SEC has not entered into any NPAs or DPAs in 2020. The complete text of each publicly available agreement is hyperlinked in the chart.

The figures for “Monetary Recoveries” may include amounts not strictly limited to an NPA or a DPA, such as fines, penalties, forfeitures, and restitution requirements imposed by other regulators and enforcement agencies, as well as amounts from related settlement agreements, all of which may be part of a global resolution in connection with the NPA or DPA, paid by the named entity and/or subsidiaries. The term “Monitoring & Reporting” includes traditional compliance monitors, self-reporting arrangements, and other monitorship arrangements found in settlement agreements.

|

U.S. Deferred and Non-Prosecution Agreements in 2020 |

||||||

|

Company |

Agency |

Alleged Violation |

Type |

Monetary Recoveries |

Monitoring & Reporting |

Term of DPA/NPA (months) |

|

5D Holdings Ltd. |

E.D. Pa. |

Illegal gambling / wire fraud |

NPA |

$46,817,881 |

No |

Not specified(a) |

|

Airbus SE |

DOJ Fraud; DOJ NSD; D.D.C. |

FCPA; AECA; ITAR |

DPA |

$582,628,702 |

Yes |

36 |

|

Alcon Pte Ltd |

DOJ Fraud; D.N.J. |

FCPA |

DPA |

$8,925,000 |

Yes |

36 |

|

Alutiiq International Solutions, LLC |

DOJ Fraud |

Major fraud against the United States |

NPA |

$1,259,444 |

Yes |

36 |

|

Apotex Corporation |

DOJ Antitrust |

Antitrust |

DPA |

$24,100,000 |

No |

36 |

|

Bank Hapoalim B.M. |

DOJ Tax; S.D.N.Y. |

Tax |

DPA |

$874,270,533 |

Yes |

36 |

|

Bank Hapoalim B.M. and Hapoalim (Switzerland) Ltd. |

DOJ MLARS; E.D.N.Y. |

AML |

NPA |

$30,063,317 |

Yes |

36 |

|

Bank of Nova Scotia |

DOJ Fraud; D.N.J.; CFTC |

Wire fraud; price manipulation |

DPA |

$77,451,102 |

Yes |

36 |

|

Beam Suntory Inc. |

N.D. Ill.; DOJ Fraud |

FCPA |

DPA |

$19,572,885 |

Yes |

36 |

|

Bradken Inc. |

W.D. Wash.; DOJ Civil |

Major fraud against the United States |

DPA |

$10,896,924 |

No |

36 |

|

CSG Imports LLC |

D.N.J. |

Defense Production Act |

DPA |

$400,000 |

Yes |

12 |

|

Catholic Diocese of Jackson, Miss. |

N.D. Miss. |

Fraud |

DPA |

$0 |

Yes |

12 |

|

Chipotle Mexican Grill Inc. |

C.D. Cal.; DOJ CPB |

FDCA |

DPA |

$25,000,000 |

Yes |

36 |

|

Commonwealth Edison Company (ComEd) |

N.D. Ill. |

Bribery of a Public Official |

DPA |

$200,000,000 |

Yes |

36 |

|

Essentra FZE |

DOJ NSD; D.D.C. |

Sanctions |

DPA |

$666,544 |

Yes |

36 |

|

Florida Cancer Specialists & Research Institute LLC |

DOJ Antitrust |

Antitrust |

DPA |

$100,000,000 |

No |

44 |

|

Goldman Sachs |

E.D.N.Y.; DOJ Fraud; DOJ MLARS |

FCPA |

DPA |

$1,967,088,000 |

Yes |

36 |

|

Herbalife Nutrition Ltd. |

DOJ Fraud; S.D.N.Y. |

FCPA |

DPA |

$123,056,591 |

Yes |

36 |

|

Industrial Bank of Korea |

S.D.N.Y. |

BSA |

DPA |

$86,000,000 |

Yes |

24 |

|

Jia Yuan USA Co., Inc. |

C.D. Cal. |

Federal program bribery |

NPA |

$1,050,000 |

No |

36 |

|

JPMorgan Chase & Co. |

DOJ Fraud; D. Conn. |

Wire Fraud |

DPA |

$920,203,609 |

Yes |

36 |

|

KG Imports LLC |

D.N.J. |

Defense Production Act |

DPA |

$0 |

Yes |

24 |

|

Natural Advantage LLC |

M.D. Pa. |

Unlicensed chemical distribution and exportation |

DPA |

$1,938,650 |

Yes |

36 |

|

NiSource, Inc. / Columbia Gas of Massachusetts |

D. Mass. |

Natural Gas Pipeline Safety Act |

DPA |

$53,030,116 |

No |

36 |

|

Novartis Hellas S.A.C.I. |

DOJ Fraud; D.N.J. |

FCPA |

DPA |

$337,800,000 |

Yes |

36 |

|

Patterson Companies |

W.D. Va. |

FDCA |

NPA |

$52,802,203 |

Yes |

42 |

|

Pentax of America, Inc. |

D.N.J.; DOJ CPB |

FDCA |

DPA |

$43,000,000 |

Yes |

36 |

|

Power Solutions International |

N.D. Ill. |

Securities fraud |

NPA |

$1,700,000 |

Yes |

36 |

|

Practice Fusion Inc. |

D. Vt.; DOJ Civil |

AKS |

DPA |

$145,000,000 |

Yes |

36 |

|

Progenity, Inc. |

S.D. Cal.; S.D.N.Y. |

Healthcare fraud |

NPA |

$49,000,000(b) |

Yes |

12 |

|

Propex Derivatives Pty Ltd |

DOJ Fraud |

Commodities violations (7 U.S.C. §§ 6c and 13) |

DPA |

$1,000,000 |

Yes |

36 |

|

Sandoz Inc |

DOJ Antitrust; E.D. Pa. |

Antitrust |

DPA |

$195,000,000 |

No |

36 |

|

Schneider Electric Buildings America, Inc. |

D. Vt.; DOJ Civil |

Anti-Kickback Act; wire fraud |

NPA |

$10,999,700 |

Yes |

36 |

|

Select Energy Services, Inc. |

M.D. Pa. |

Clean Air Act |

NPA |

$2,300,000 |

No |

36 |

|

Taro Pharmaceuticals |

DOJ Antitrust; E.D. Pa. |

Antitrust |

DPA |

$205,653,218 |

No |

36 |

|

Ticketmaster LLC |

E.D.N.Y. |

Computer Fraud and Abuse Act; wire fraud |

DPA |

$10,000,000 |

Yes |

36 |

|

Union Bancaire Privée, UBP SA |

DOJ Tax |

Tax |

NPA addendum |

$14,000,000 |

No |

48 (in original NPA) |

|

Vitol S.A. |

DOJ Fraud; E.D.N.Y.; CFTC |

FCPA |

DPA |

$163,791,000 |

Yes |

36 |

|

Wells Fargo & Company / Wells Fargo Bank, N.A. |

C.D. Cal; W.D.N.C. |

Falsification of bank records; identity theft |

DPA |

$3,000,000,000 |

No |

36 |

|

(a) The effective date of the 5D Holdings Ltd. agreement, by which most of 5Dimes’ obligations were required to have been satisfied, was September 30, 2020. (b) The amount paid by Progenity was attributable entirely to the parallel civil resolutions; the NPA itself imposed no penalties. |

||||||

____________________