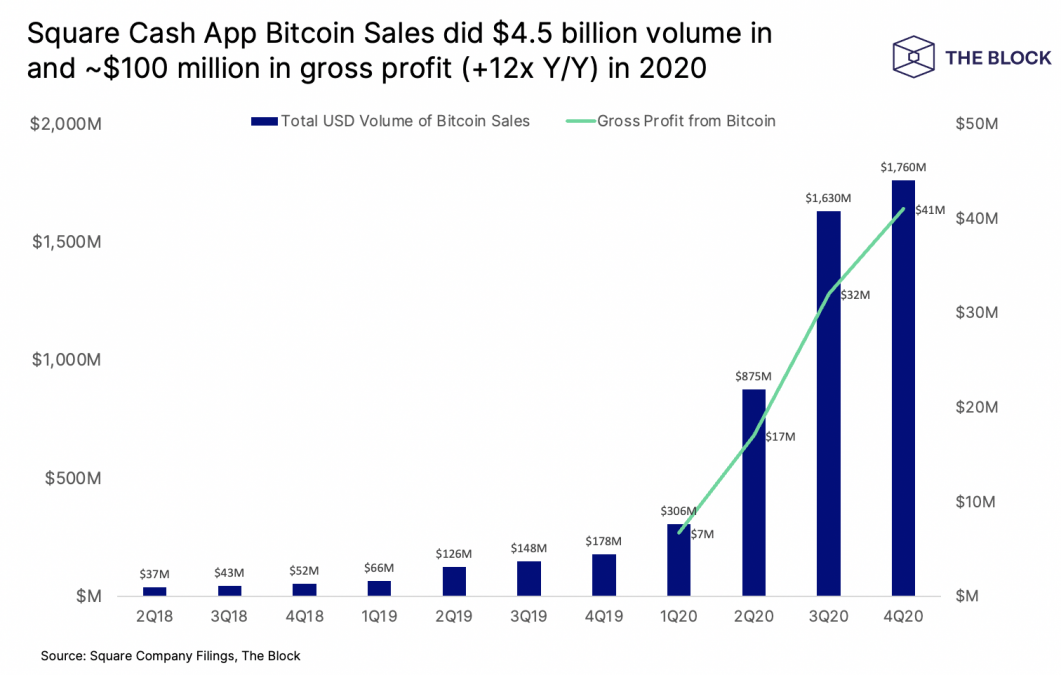

Sq. reviews $4.57 billion in bitcoin sales for 2020 by means of Cash App

3 min readSq. claimed Tuesday that it executed $1.76 billion in bitcoin profits during the fourth quarter of 2020, with $4.57 billion sold for the entirety of previous 12 months.

Accounting for the income invested to get the bitcoin it sold, Square reported in its report, as filed with the SEC, that it produced $97 million in gross profits during 2020 from its bitcoin revenue. Square reported fourth-quarter gross income were being $41 million.

“During the total 12 months 2020, we noticed major growth in bitcoin profits yr more than calendar year. Though bitcoin income was $4.57 billion in 2020, up close to 9x year above year, bitcoin gross profit was only $97 million, or close to 2{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of bitcoin revenue,” Sq. stated.

“Bitcoin profits and gross profit benefited from an boost in bitcoin actives and progress in purchaser need, as effectively as a significant 12 months-over-calendar year boost in the market place rate of bitcoin,” the company mentioned.

Square observed in its report that Dollars App’s lively person ranks have swelled simply because of its bitcoin supplying, accounting for some 3 million consumers who bought or offered bitcoin in 2020:

“In 2020, extra than 3 million clients acquired or marketed bitcoin on Hard cash Application, and, in January 2021, additional than 1 million shoppers acquired bitcoin for the to start with time. Additionally, in the fourth quarter of 2020, bitcoin volumes for every buyer were up a lot more than 2.5x 12 months more than year, principally pushed by shopping for exercise, as current clients ongoing to buy bitcoin and new adopters purchased even larger volumes of bitcoin. Bitcoin has served increase gross income per lively purchaser and engagement in our broader ecosystem as bitcoin actives use other products and solutions, these as Hard cash Card and direct deposit, far more regularly compared to the typical Funds Application shopper.”

Square also stated that it expanded its bitcoin holdings over and above the $50 million truly worth it purchased in October:

“Sq. also declared now that it has acquired close to 3,318 bitcoins at an aggregate invest in value of $170 million. Blended with Square’s previous invest in of $50 million in bitcoin, this represents around five percent of Square’s total funds, funds equivalents and marketable securities as of December 31, 2020.”

As shown in the chart higher than, Square’s bitcoin offering has come a prolonged way since its inception in early 2018 in conditions of quantity as perfectly as general public visibility. Over and above the Dollars App company, Square has devoted assets to bitcoin development.

CEO Jack Dorsey has turn out to be an advocate for bitcoin in the enterprise world, and most not long ago unveiled a bitcoin advancement fund, in partnership with hip-hop artist and producer Jay-Z, backed by 500 BTC.

Dorsey claimed all through Tuesday’s earnings simply call: “We’re also heading to double down on our dedication to Bitcoin and carry on to appear for new methods to connect our products strains within the Hard cash App.”

Nor is Sq. on your own in seeking to offer you consumer-dealing with crypto services through the regular payments realm.

Past 12 months, PayPal went community with its crypto giving in partnership with sector startup Paxos. PayPal has explained it is investing in a new unit centered on crypto and electronic currencies, with a extensive-horizon perspective to help central lender electronic currencies really should these get traction in the globe of payments.

For PayPal, the positive aspects are notably seen in the variety of user engagement, in accordance to one particular of its executives.

“Each individual working day we’re viewing an very wholesome influx of to start with-time customers. An greater engagement at the time they’ve produced their initial crypto purchases. Clients who have bought crypto have been logging into PayPal at around two times their log-in frequency prior to really having purchased crypto which is remarkable,” chief approach officer Jonathan Auerbach claimed not long ago.

Payments giants Visa and Mastercard have each highlighted their expanding crypto footprints as well. Earlier this month, Mastercard uncovered that it would help payments manufactured with stablecoins as element of a broader, three-pronged approach focused on cryptocurrencies, stablecoins and CBDCs.

Editor’s Note: This story has been current with extra details. The headline has also been up-to-date for clarity.

© 2021 The Block Crypto, Inc. All Rights Reserved. This article is supplied for informational uses only. It is not offered or supposed to be employed as lawful, tax, financial commitment, economic, or other information.