Venmo for Business enterprise: Everything you want to know

7 min read

In the huge and usually sophisticated universe of digital payments, peer-to-peer (P2P) payments platforms have emerged as common, user-pleasant providers with promptly rising person bases. From PayPal’s Venmo to Square’s Dollars App, P2P payment apps provide individuals an easy way to deliver revenue to other people today promptly and commonly for free.

As the P2P space matures, the utility of these payment apps are increasing past break up checks and farther into the organization realm, as illustrated by PayPal’s Venmo for Organization portfolio.

With 70 million customers, Venmo is the darling of PayPal’s solution portfolio and the undisputed leader in the P2P payments area. The social payments platform processed $47 billion of the company’s full payment volume in PayPal’s fourth quarter, symbolizing a expansion of 60{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} 12 months about 12 months.

PayPal has gradually released additional organization functions in just Venmo, starting up with the skill for users to shell out choose corporations with Venmo by the Braintree system. In 2017, PayPal expanded this functionality and enabled Venmo payments at thousands and thousands of US merchants, giving people the capability to pick both PayPal or Venmo as a payment solution at checkout.

When a service provider enables Venmo as a checkout selection, Venmo customers can pay out for items or services working with their app harmony or connected playing cards and lender accounts wherever PayPal is recognized in the US by means of the cell world wide web and desktop. Much more than two million merchants, which include Lyft, Uber, StitchFix, and Pottery Barn, at present present customers the potential to pay out with Venmo at checkout.

Previous July, PayPal launched Business enterprise Profiles on Venmo as a pilot to give sole proprietors and informal sellers the means to take payments for merchandise and providers by means of the Venmo app. In February, PayPal expanded the tool’s availability to all small corporations, and additional than 150,000 companies are signed up already.

You will find a good deal to recognize about Venmo for Organization past the principles of P2P payments and payment acceptance. This is a breakdown of all the things you will need to know about Venmo for Business.

What is Venmo for Business?

The Venmo for Enterprise portfolio consists of both Small business Profiles on the Venmo application — geared toward smaller firms and relaxed sellers — and the capacity to spend with Venmo, a element aimed at modest to massive retailers.

With Company Profiles, Venmo is focusing on smaller sellers or people today with side hustles — these as pet dog walkers, landscapers, nearby artists, and crafters — who previously use Venmo in a personal potential to settle for payments. The Small business Profile lets these sellers individual their particular and company transactions for far better bookkeeping and tracking, but also offers them a house to share aspects like the deal with, cellphone quantity, email, and site associated with their organization.

Meanwhile, the Pay with Venmo working experience is in essence a provider for established merchants searching to offer Venmo as a payment choice at checkout.

1 of the crucial differences among Business enterprise Profiles and Pay out with Venmo is that the latter is made for payments produced online or in-application. To settle for Venmo on the web or in-app, merchants have to go through both PayPal or Braintree as their payment gateway. The Organization Profile services is finest suited for in-individual Venmo acceptance and does not have to have the added stage of the payments gateway.

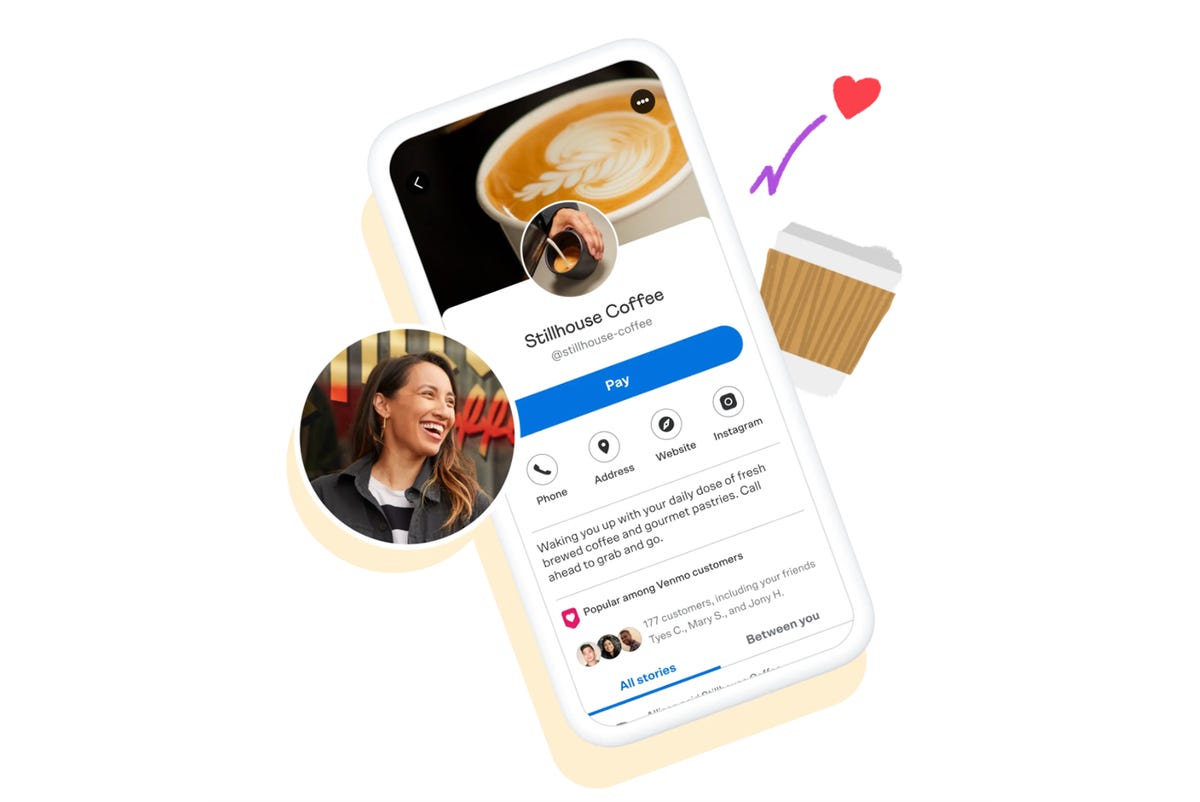

(Graphic: Venmo)

How does Venmo for Enterprise get the job done?

The Pay out with Venmo choice for merchants and sellers is tied to the PayPal Checkout provider. PayPal has said that the addition of Venmo to a merchant’s internet site does not require additional integration operate on the merchant’s section. Instead, the company explained it relies on its present platform architecture to help Venmo as a payment technique, mirroring the company’s strategy to expanding One Contact.

The initially move in having PayPal Checkout is to signal up for a PayPal Company account. Then, you can function with 1 of the e-commerce platform vendors that has PayPal Checkout built-in into its system, or function with a developer to combine PayPal Checkout into your web site or app. After enabled, cookied Venmo people will see Venmo as an possibility at checkout, and from there, they can just tap the Venmo button and comprehensive the payment.

The procedure to established up a Small business Profile is considerably simplified. Present Venmo account holders can search for the “Business Profile” choice in the Venmo app’s main menu to commence the course of action. Venmo will ask for important business enterprise facts, these as a distinctive identify and Venmo username for the small business, a description of the company, the business enterprise group, get hold of strategies, and organization handle.

For registered organizations, Venmo will also talk to for the lawful small business identify and deal with, the Employer Identification Number (EIN), registration variety, cell phone range, and small business contact’s handle. Once the company profile is posted, you can add and edit a enterprise photo and start off taking payments.

To settle for payments, sellers are assigned a small business-precise Venmo QR Code, which can be printed out and displayed at the point-of-sale for buyers to scan with their phone, or despatched right via email, text, or AirDrop (iOS only) to provide a immediate link to the Small business Profile.

The fee construction is similar for equally Pay out with Venmo and Organization Profiles. Fork out with Venmo has the standard PayPal cost of 2.9{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} additionally $.30 for each individual transaction. The Company Profiles cost is a little less, with sellers charged 1.9{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} plus $.10 of the payment.

Small business functions in Venmo for Enterprise

A single of PayPal’s biggest assets for the Venmo for Company portfolio is its own client foundation of a lot more than 377 million lively buyers and 29 million retailers close to the world, as well as its present infrastructure in around 200 marketplaces. The pitch is that retailers can increase their attain globally by tapping into the usefulness and ubiquity of PayPal’s payments infrastructure across the world wide web.

Mainly because Venmo is a social payments platform, sellers also have the chance to draw focus to their small business by means of Venmo’s social feed and research. Once a payment is entire, it appears on an overall feed and a customer’s particular person feed (based on one’s privateness configurations), growing publicity of your brand name or company among other Venmo people. PayPal claimed Venmo people tend to be extremely engaged and on normal verify the application two to three periods a 7 days.

What is more, the Enterprise Profiles give scaled-down sellers a way to do company devoid of setting up a official website existence, like a comprehensive-blown site, Facebook Webpage, or Google Enterprise listing. Venmo end users can locate a business profile by exploring for a precise business name or username, but sellers can also share the profile on social media and other platforms outside Venmo for much more visibility.

The takeaway

Whether or not it can be opting for the full PayPal Checkout expertise or enabling Venmo acceptance with a Small business Profile, the prevalent advantage is seriously about supplying prospects as quite a few selections to pay out as possible.

Organization Profiles are a fairly very simple way for casual sellers to settle for payments with out signing up for a formal payments processor or place-of-sale company.

Equally, presenting Venmo at checkout offers merchants the capacity to offer buyers a lot more choice and get to a larger sized demographic, significantly millennials and Gen Z. According to info launched by the Census Bureau past calendar year, a lot more than half of the nation’s overall populace are now members of the millennial technology or younger. When put together, the millennial and Gen Z populations overall around 166 million buyers. The Venmo brand name has witnessed the most traction among the these more youthful populations.

PayPal also did a review of Venmo consumers and located that nearly 50 {14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} (47{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3}) of clients are fascinated in employing Venmo as a payment method when checking out with retailers, and that 89{14cc2b5881a050199a960a1a3483042b446231310e72f0dc471a7a1eddd6b0c3} of clients desire to pay out with Venmo since they rely on the brand, it truly is easy to use and mainly because it allows them to split transactions.